Kodak 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

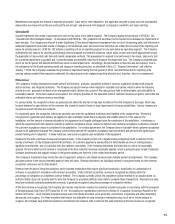

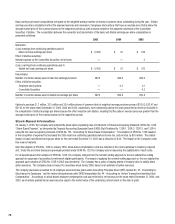

Basic earnings-per-share computations are based on the weighted-average number of shares of common stock outstanding during the year. Diluted

earnings-per-share calculations refl ect the assumed exercise and conversion of employee stock options that have an exercise price that is below the

average market price of the common shares for the respective periods as well as shares related to the assumed conversion of the Convertible

Securities, if dilutive. The reconciliation between the numerator and denominator of the basic and diluted earnings-per-share computations is

presented as follows:

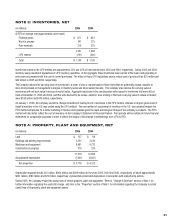

2005 2004 2003

Numerator:

(Loss) earnings from continuing operations used in

basic net (loss) earnings per share $ (1,455) $ 81 $ 189

Effect of dilutive securities:

Interest expense on the Convertible Securities, net of taxes — — 3

(Loss ) earnings from continuing operations used in

diluted net (loss) earnings per share $ (1,455) $ 81 $ 192

Denominator:

Number of common shares used in basic net earnings per share 287.9 286.6 286.5

Effect of dilutive securities:

Employee stock options — 0.2 0.1

Convertible Securities — — 4.2

Number of common shares used in diluted net earnings per share 287.9 286.8 290.8

Options to purchase 31.2 million, 32.5 million and 35.9 million shares of common stock at weighted-average per share prices of $52.03, $52.47 and

$51.63 for the years ended December 31, 2005, 2004 and 2003, respectively, were outstanding during the years presented but were not included in

the computation of diluted earnings per share because the effect would be anti-dilutive, meaning that the options’ exercise price was greater than the

average market price of the common shares for the respective periods.

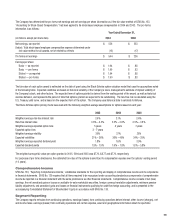

Stock-Based Information

On January 1, 2005, the Company early adopted the stock option expensing rules of Statement of Financial Accounting Standards (SFAS) No. 123R,

“Share-Based Payment,” as interpreted by Financial Accounting Standards Board (FASB) Staff Positions No. 123R-1, 123R-2, 123R-3, and 123R-4,

using the fair value recognition provisions of SFAS No. 123, “Accounting for Stock-Based Compensation.” The adoption of SFAS No. 123R resulted

in the recognition of expense that increased the 2005 loss from continuing operations before income tax, and net loss, by $16 million. The related

impact on basic and diluted earnings per share for the year ended December 31, 2005 was a reduction of $.06. The impact on the Company’s cash

fl ow was not material.

Upon the adoption of SFAS No. 123R in January 2005, stock-based compensation costs are included in the costs capitalized in inventory at period

end. Under the pro forma disclosures previously provided under SFAS No. 123, the Company was not assuming the capitalization of such costs.

For all awards issued after adoption of SFAS No. 123R, the Company changed from the nominal vesting approach to the non-substantive vesting

approach for purposes of accounting for retirement eligible participants. The impact of applying the nominal vesting approach vs. the non-substantive

approach upon adoption of SFAS No. 123R in 2005 was immaterial. The Company has a policy of issuing shares of treasury stock to satisfy share

option exercises. The Company does not expect to repurchase stock during 2006, based on an estimate of option exercises.

The Company previously accounted for its employee stock incentive plans under Accounting Principles Board (APB) Opinion No. 25, “Accounting for

Stock Issued to Employees,” and the related interpretations under FASB Interpretation No. 44, “Accounting for Certain Transactions Involving Stock

Compensation.” Accordingly, no stock-based employee compensation cost was refl ected in net earnings for the years ended December 31, 2004, and

2003, as all options granted had an exercise price equal to the market value of the underlying common stock on the date of grant.