Kodak 2005 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

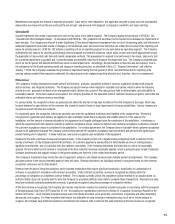

segments. Reportable segments are components of the Company for which separate fi nancial information is available that is evaluated regularly by

the chief operating decision maker in deciding how to allocate resources and in assessing performance. In September 2005, the Company announced

an organizational realignment that will change the current reportable segment structure. See Note 23, “Segment Information,” for a discussion of

this change.

Recently Issued Accounting Standards

FASB Staff Position No. 143-1

In June 2005, the Financial Accounting Standards Board (FASB) issued Staff Position No. 143-1, “Accounting for Electronic Equipment Waste

Obligations” (FSP 143-1). FSP 143-1 addresses the accounting for obligations associated with Directive 2002/96/EC on Waste Electrical and

Electronic Equipment (the “Directive”) adopted by the European Union, and requires application of the provisions of SFAS No. 143 and FIN 47 as those

standards relate to the Directive. This FSP is effective the later of the fi rst reporting period ending after June 8, 2005, or the date of adoption of the

Directive by the individual EU-member countries. There have been no material impacts on the Company’s consolidated fi nancial statements resulting

from the adoption of this FSP in those countries for which the Directive has been adopted, and there are no material impacts expected in the future

from the adoption of the Directive in the remaining EU-member countries.

FASB Interpretation No. 47

In March 2005, the FASB issued FASB Interpretation No. 47, “Accounting for Conditional Asset Retirement Obligations” (FIN 47). FIN 47 clarifi es

that the term “conditional asset retirement obligation” as used in FASB No. 143, “Accounting for Asset Retirement Obligations,” refers to a legal

obligation to perform an asset retirement activity in which the timing and/or method of settlement are conditional on a future event that may or may

not be within the control of the Company. In addition, FIN 47 clarifi es when a company would have suffi cient information to reasonably estimate the

fair value of an asset retirement obligation.

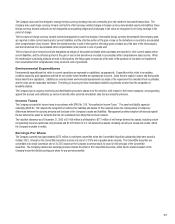

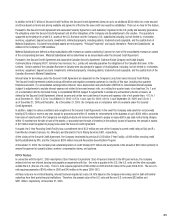

The Company adopted FIN 47 during the fourth quarter of 2005. FIN 47 requires that conditional asset retirement obligations, legal obligations to

perform an asset retirement activity in which the timing and/(or) method of settlement are conditional on a future event, be reported, along with

associated capitalized asset retirement costs, at their fair values. Upon initial application, FIN 47 requires recognition of (1) a liability, adjusted for

cumulative accretion from the date the obligation was incurred until the date of adoption of FIN 47, for existing asset retirement obligations; (2) an

asset retirement cost capitalized as an increase to the carrying amount of the associated long-lived asset; and (3) accumulated depreciation on the

capitalized asset retirement cost. Accordingly, the Company has recognized the following amounts in its Statement of Financial Position at

December 31, 2005 and Statement of Operations for the year ended December 31, 2005:

(dollar amounts in millions)

Additions to property, plant and equipment, gross $ 33

Additions to accumulated depreciation $ (33)

Additions to property, plant and equipment, net $ —

Asset retirement obligations $ 66

Cumulative effect of change in accounting principle, gross $ 66

Cumulative effect of change in accounting principle, net of tax $ 57

The adoption of FIN 47 reduced 2005 net earnings by $57 million, or $.20 per share.

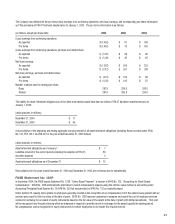

The Company’s conditional asset retirement obligations primarily relate to asbestos contained in buildings that Kodak owns. Environmental regulations

exist in many of the countries that Kodak operates in that require Kodak to handle and dispose of asbestos in a special manner if a building undergoes

major renovations or is demolished. Otherwise, Kodak is not required to remove the asbestos from its buildings. Kodak records a liability equal to

the estimated fair value of its obligation to perform asset retirement activities related to the asbestos, computed using an expected present value

technique, when suffi cient information exists to calculate the fair value. Kodak does not have a liability recorded related to each building that contains

asbestos because Kodak cannot estimate the fair value of its obligation for certain buildings due to a lack of suffi cient information about the range of

time over which the obligation may be settled through demolition, renovation or sale of the building.