Kodak 2005 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

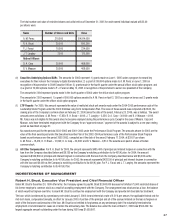

Robert H. Brust

Mr. Brust has announced his intention to retire from the Company effective February 1, 2007. The Company employed Mr. Brust under an offer

letter dated December 20, 1999, that was most recently amended on March 7, 2005. In addition to the information provided elsewhere in this

Proxy Statement, the amended offer letter provides Mr. Brust a special severance benefi t. If the Company terminates Mr. Brust’s employment

without cause prior to January 3, 2007, he will: 1) receive severance pay equal to two times his base salary plus target annual bonus; 2) receive the

supplemental retirement benefi t described on page 37, calculated based on 14 years of deemed service in addition to his actual years of service; and

3) be permitted to keep his stock options.

On March 7, 2005, the Company and Mr. Brust entered into a retention agreement to induce Mr. Brust to remain employed by the Company through

January 3, 2007. Pursuant to the terms of the retention agreement, Mr. Brust will receive a monthly cash retention benefi t of $15,000 for each full

month of continuous and active employment with the Company during 2006, subject to proration in certain limited circumstances. In addition, on

May 12, 2005, Mr. Brust received 27,000 shares of restricted stock under the terms of the 2005 Omnibus Long-Term Compensation Plan. Pursuant to

the terms of the award, upon Mr. Brust’s termination of employment for other than “cause” on or after January 3, 2007, all remaining restrictions on

the shares will lapse and he will not forfeit any of the restricted stock subject to the grant.

Philip J. Faraci

The Company employed Mr. Faraci under an offer letter dated November 3, 2004. In addition to the information provided elsewhere in this Proxy

Statement, the offer letter provides Mr. Faraci with a signing bonus consisting of $50,000 cash, a grant of stock options for 32,800 shares and 10,000

shares of restricted stock. The offer letter also provides Mr. Faraci with an enhanced pension benefi t, as described on page 38. If the Company

terminates Mr. Faraci’s employment for reasons other than cause or disability prior to the fi fth anniversary of his hire date, he will be eligible to receive

under the offer letter: 1) severance pay equal to one times his then-current base salary plus target annual bonus; and 2) a prorated portion of the

deemed service under the terms of his supplemental retirement benefi t described on page 38.

James T. Langley

The Company employed Mr. Langley under an offer letter dated August 12, 2003. In addition to the information provided elsewhere in this Proxy

Statement, the offer letter provides Mr. Langley a hiring bonus of 15,000 shares of restricted stock, a cash sign-on bonus, eligibility for an individual

long-term bonus, additional relocation and severance benefi ts and the ability to keep his stock options upon his termination of employment for certain

circumstances.

Under the terms of the cash sign-on bonus, Mr. Langley is eligible for a $100,000 payment, payable in four equal installments of $25,000. The fi rst

installment was paid upon his employment, the second was paid on the fi rst anniversary of the commencement of his employment, the third was paid

on the second anniversary of the commencement of his employment and the remaining installment will be paid on the third anniversary of the date of

his commencement of employment provided he is employed with the Company as of such date.

To incent achievement of certain pre-established goals in the Graphic Communications Group, the offer letter establishes a three-year individual

long-term bonus plan for Mr. Langley, which provides for a target aggregate award of $1,000,000. The plan is totally performance based; if the plan’s

goals are not achieved, no payments can be made under the plan. Under the plan, a separate “target performance goal” is established for each of the

plan’s three years. To receive the entire amount of the target award for a particular year, Mr. Langley must achieve 100% of the established “target

performance goal” for that year. If Mr. Langley does not achieve the “target performance goal” for a particular year, he may nevertheless receive a

portion of the target award for that year if he achieves at least the plan’s “minimum performance goal” for that year. The target award for each year

of the plan is as follows: 2004 – $200,000; 2005 – $300,000; 2006 – $500,000. As described in the footnotes to the Summary Compensation Table

on page 25, Mr. Langley achieved the plan’s goals for 2004 and 2005 and, therefore, earned the payments of $200,000 and $300,000, respectively,

which amounts were deferred. Except in limited circumstances, Mr. Langley must be employed on the last day of the year in order to be eligible for any

award payable for that year.

The offer letter states that upon any of the following circumstances, Mr. Langley’s relocation to his prior primary residence will be covered under the

terms of the Company’s relocation program if he so chooses: 1) termination without cause; 2) termination for good reason; or 3) voluntary termination

following the third anniversary of Mr. Langley’s commencement of employment. Under the same three situations, Mr. Langley is permitted to retain all

his stock options following his termination of employment, and under the fi rst two situations, he is entitled to retain a prorated portion of the restricted

shares and the restrictions will lapse.

If the Company terminates Mr. Langley’s employment without cause or if he terminates his employment in certain other limited circumstances,

Mr. Langley is eligible to receive under the offer letter: 1) severance pay up to one times his base salary plus target annual bonus; and 2) the then

current balance in the phantom cash balance account described on page 38 plus a prorated portion of the $100,000 contribution for the year of his

termination of employment.