Kodak 2005 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

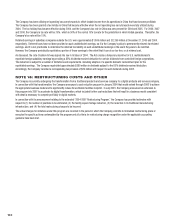

The special termination benefi ts of $101 million, $52 million and $30 million for the years ended December 31, 2005, 2004 and 2003,

respectively, were incurred as a result of the Company’s restructuring actions and, therefore, have been included in restructuring costs and other in

the Consolidated Statement of Operations for those respective periods. In addition, curtailment and settlement charges totaling $21 million and

$11 million for 2005, $8 million and $0 million for 2004 and $0 million and $2 million for 2003 were also incurred as a result of the Company’s

restructuring actions and, therefore, have been included in restructuring costs and other in the Consolidated Statement of Operations for those

respective periods.

In connection with the divestiture of RSS, the fi nal asset transfer was completed in November 2005. In connection with the fi nal asset transfer,

a one-time settlement charge of $54 million was recognized during the fourth quarter in discontinued operations. See Note 22,

“Discontinued Operations.”

The Japanese Welfare Pension Insurance Law (JWPIL) was amended in June 2001 to permit employers with Employees’ Pension Funds (EPFs) to

separate the pay related portion of the old-age pension benefi ts under the JWPIL (Substitutional Portion) from the EPF. This obligation and related

plan assets are transferred to a government agency, thereby relieving the EPF from paying the substitutional portion of benefi ts. The Kodak Japan

Limited EPF completed the transfer of the substitutional portion to the Japanese Government in December 2004. The effect of the transfer resulted

in a one-time credit due to the derecognition of future salary increases in the amount of $3 million, a one-time credit due to the government subsidy

from the transfer of liabilities and related plan assets of $25 million and a one-time charge due to the accelerated recognition of unrecognized loss in

accordance with SFAS No. 88 settlement accounting in the amount of $20 million.

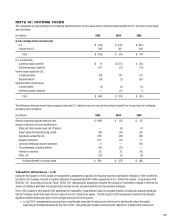

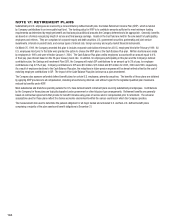

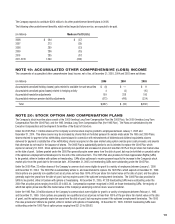

The increase (decrease) in the additional minimum liability (net of the change in the intangible asset) included in other comprehensive income for the

major funded and unfunded U.S. and Non-U.S. defi ned benefi t plans is as follows:

2005 2004

(in millions) U.S. Non-U.S. U.S. Non-U.S.

Increase (decrease) in the additional minimum liability

(net of the change in the intangible asset) included in

other comprehensive income $ 2 $ 154 $ 5 $ 56

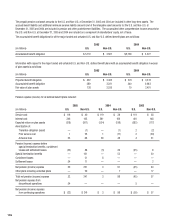

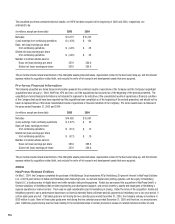

The weighted-average assumptions used to determine the benefi t obligation amounts as of the end of the year for all major funded and unfunded U.S.

and Non-U.S. defi ned benefi t plans were as follows:

2005 2004

U.S. Non-U.S. U.S. Non-U.S.

Discount rate 5.51% 4.51% 5.75% 5.02%

Salary increase rate 4.58% 3.67% 4.25% 3.29%

The weighted-average assumptions used to determine net pension (income) expense for all the major funded and unfunded U.S. and Non-U.S. defi ned

benefi t plans were as follows:

2005 2004

U.S. Non-U.S. U.S. Non-U.S.

Discount rate 5.57% 4.85% 5.95% 5.27%

Salary increase rate 4.33% 3.29% 4.25% 3.20%

Expected long-term rate of return on plan assets 9.00% 8.12% 9.00% 7.86%

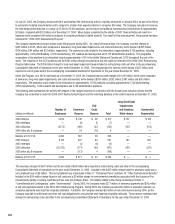

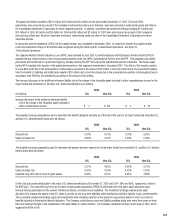

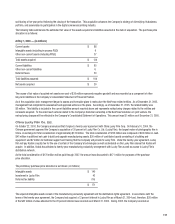

Of the total plan assets attributable to the major U.S. defi ned benefi t plans at December 31, 2005 and 2004, 98% and 98%, respectively, relate to

the KRIP plan. The expected long-term rate of return on plan assets assumption (EROA) is determined from the plan’s asset allocation using

forward-looking assumptions in the context of historical returns, correlations and volatilities. The investment strategy underlying the asset

allocation is to manage the assets of the U.S. plans to provide for the long-term liabilities while maintaining suffi cient liquidity to pay current benefi ts.

This is primarily achieved by holding equity-like investments while investing a portion of the assets in long duration bonds in order to provide for

benefi ts included in the projected benefi t obligation. The Company undertakes an asset and liability modeling study once every three years or when

there are material changes in the composition of the plan liability or capital markets. The Company completed its most recent study in 2005, which

supports the EROA of 9%.