Kodak 2005 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

87

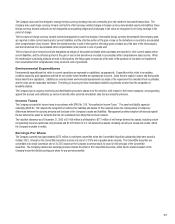

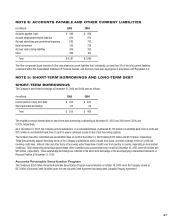

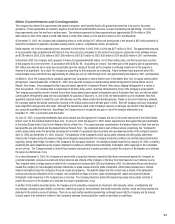

NOTE 8: ACCOUNTS PAYABLE AND OTHER CURRENT LIABILITIES

(in millions) 2005 2004

Accounts payable, trade $ 996 $ 868

Accrued employment-related liabilities 950 872

Accrued advertising and promotional expenses 683 762

Deferred revenue 350 226

Accrued restructuring liabilities 309 355

Other 899 813

Total $ 4,187 $ 3,896

The other component above consists of other miscellaneous current liabilities that, individually, are less than 5% of the total current liabilities

component within the Consolidated Statement of Financial Position, and therefore, have been aggregated in accordance with Regulation S-X.

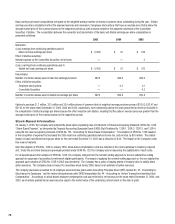

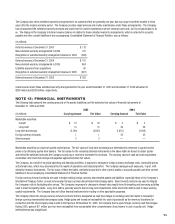

NOTE 9: SHORT-TERM BORROWINGS AND LONG-TERM DEBT

SHORT-TERM BORROWINGS

The Company’s short-term borrowings at December 31, 2005 and 2004 were as follows:

(in millions) 2005 2004

Current portion of long-term debt $ 706 $ 400

Short-term bank borrowings 113 69

Total $ 819 $ 469

The weighted-average interest rates for short-term bank borrowings outstanding at December 31, 2005 and 2004 were 5.82% and

5.02%, respectively.

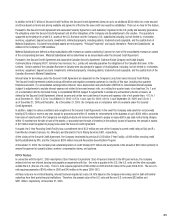

As of December 31, 2005, the Company and its subsidiaries, on a consolidated basis, maintained $1,132 million in committed bank lines of credit and

$773 million in uncommitted bank lines of credit to ensure continued access to short-term borrowing capacity.

The Company has other committed and uncommitted lines of credit at December 31, 2005 totaling $132 million and $773 million, respectively.

These lines primarily support borrowing needs of the Company’s subsidiaries, which include term loans, overdraft coverage, letters of credit and

revolving credit lines. Interest rates and other terms of borrowing under these lines of credit vary from country to country, depending on local market

conditions. Total outstanding borrowings against these other committed and uncommitted lines of credit at December 31, 2005 were $34 million and

$65 million, respectively. These outstanding borrowings are refl ected in the short-term borrowings in the accompanying Consolidated Statement of

Financial Position at December 31, 2005.

Accounts Receivable Securitization Program

The Company’s $200 million Accounts Receivable Securitization Program was terminated on October 18, 2005 when the Company closed on

$2.7 billion of Secured Credit Facilities under the new Secured Credit Agreement and associated Canadian Security Agreement.