Kodak 2005 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

The Company has determined the pro forma (loss) earnings from continuing operations, net (loss) earnings, and corresponding per share information

as if the provisions of FIN 47 had been adopted prior to January 1, 2003. The pro forma information is as follows:

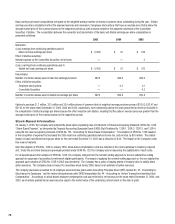

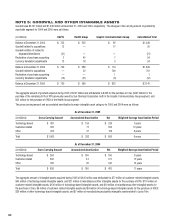

(in millions, except per share data) 2005 2004 2003

(Loss) earnings from continuing operations

As reported $ (1,455) $ 81 $ 189

Pro forma $ (1,462) $ 76 $ 185

(Loss) earnings from continuing operations, per basic and diluted share

As reported $ (5.05) $ .28 $ .66

Pro forma $ (5.08) $ .26 $ .65

Net (loss) earnings

As reported $ (1,362) $ 556 $ 253

Pro forma $ (1,312) $ 551 $ 249

Net (loss) earnings, per basic and diluted share

As reported $ (4.73) $ 1.94 $ .88

Pro forma $ (4.56) $ 1.92 $ .87

Number of shares used in earnings per share

Basic 287.9 286.6 286.5

Diluted 287.9 286.8 290.8

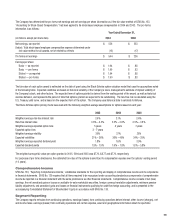

The liability for asset retirement obligations as of the dates noted below would have been as follows if FIN 47 had been implemented prior to

January 1, 2003:

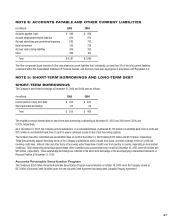

(dollar amounts in millions)

December 31, 2004 $ 71

December 31, 2003 $ 65

A reconciliation of the beginning and ending aggregate carrying amount of all asset retirement obligations (including those recorded under SFAS

No. 143, FSP 143-1 and FIN 47) for the year ended December 31, 2005 follows:

(dollar amounts in millions)

Asset retirement obligations as of January 1 $ 7

Liabilities incurred in the current period (including the adoption of FIN 47) 66

Accretion expense 2

Asset retirement obligations as of December 31 $ 75

Reconciliations for the years ended December 31, 2004 and December 31, 2003 are not shown due to immateriality.

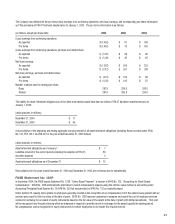

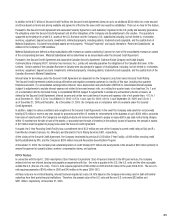

FASB Statement No. 123R

In December 2004, the FASB issued Statement No. 123R, “Share-Based Payment,” a revision to SFAS No. 123, “Accounting for Stock-Based

Compensation.” SFAS No. 123R eliminates the alternative to record compensation expense using the intrinsic value method of accounting under

Accounting Principles Board Opinion No. 25 (APB No. 25) that was provided in SFAS No. 123 as originally issued.

Under Opinion 25, issuing stock options to employees generally resulted in the recognition of no compensation cost if the options were granted with an

exercise price equal to their fair value at the date of grant. SFAS No. 123R requires companies to measure and record the cost of employee services

received in exchange for an award of equity instruments based on the fair value of the award at the date of grant (with limited exceptions). That cost

will be recognized over the period during which an employee is required to provide service in exchange for the award (usually the vesting period).

No compensation cost is recognized for equity instruments for which employees do not render the requisite service.