Kodak 2005 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

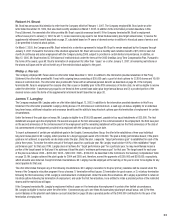

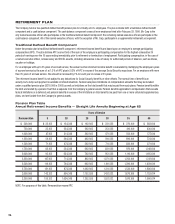

annuity, be treated as if he is eligible for traditional defi ned benefi t component of the pension plan. For this purpose, Mr. Brust will be credited with

14 years of extra service in addition to his actual service. If Mr. Brust remains employed until January 3, 2007, he will be credited with 18 years of

extra service in addition to his actual service for purposes of the traditional defi ned benefi t component of the pension plan. In any case, Mr. Brust’s

supplemental benefi t will be offset by his cash balance benefi t.

Mr. Brust’s total estimated annual benefi t payable upon retirement at normal retirement age (i.e., age 65) under his supplemental unfunded pension

arrangement, prior to offset for any cash balance benefi t, is $630,900. This estimate is based on the following assumptions: 1) that Mr. Brust will

remain an employee of the Company until age 65; 2) that his compensation will increase 3.75% per year; 3) that the terms of the pension plan will

remain unchanged; and 4) the following additional assumptions for purposes of converting his cash balance benefi t into an annuity: the cash balance

account accrues interest at 5% per year; a discount rate of 5%; and life expectancy using the 1994 Group Annuity Reserving Table for males and

females projected to 2002 at scale AA. Mr. Brust has, however, announced his intention to retire from the Company effective February 1, 2007,

approximately a year and a half prior to his normal retirement age.

Philip J. Faraci

In addition to the benefi t Mr. Faraci may be eligible for under the cash balance component of the pension plan, he is eligible for a supplemental

unfunded retirement benefi t under the terms of his November 3, 2004 offer letter. Under this arrangement, if Mr. Faraci remains employed for fi ve

years, he will be treated as if eligible for the traditional defi ned benefi t component of the pension plan, and will be considered to have completed

12.5 years of service with the Company. If, instead, he remains employed for 12 years, he will be considered to have completed 30 years total of

service with the Company. Mr. Faraci’s supplemental pension benefi t will be offset by his cash balance benefi t and any retirement benefi ts provided

to him under the retirement plan of any former employer.

Mr. Faraci’s total estimated annual benefi t payable upon retirement at normal retirement age (i.e., age 65) under his supplemental unfunded

pension arrangement, prior to offset for any cash balance benefi t and any retirement benefi ts provided to him under the retirement plan of any former

employer, is $462,204. This estimate is based on the following assumptions: 1) that Mr. Faraci will remain an employee of the Company until age 65;

2) that his compensation will increase 3.75% per year; 3) that the terms of the pension plan will remain unchanged; and 4) the following additional

assumptions for purposes of converting his cash balance benefi t into an annuity: the cash balance account accrues interest at 5% per year; a discount

rate of 5%; and life expectancy using the 1994 Group Annuity Reserving Table for males and females projected to 2002 at scale AA.

James T. Langley

In addition to the benefi t Mr. Langley may be eligible for under the cash balance component of the pension plan, he is eligible for a supplemental

unfunded retirement benefi t under the terms of his August 12, 2003 offer letter. Under this arrangement, the Company established a phantom cash

balance account on behalf of Mr. Langley. For each full year of service he remains employed (up to a maximum of six years), the Company will credit

the account with $100,000. The maximum the Company is obligated to credit to the account is $600,000. Any amounts credited to the account earn

interest at the same rate that amounts accrue interest under the cash balance component of the pension plan. In order to receive any of the amounts

credited to this account, Mr. Langley must remain continuously employed for at least three years unless his employment terminates for certain

specifi ed reasons.

Mr. Langley’s total estimated annual benefi t payable upon retirement at normal retirement age (i.e., age 65) under his supplemental unfunded

retirement arrangement and the cash balance component of the pension plan is $129,024. This estimate is based on the following assumptions: that

Mr. Langley will remain an employee until age 65, that interest accrues on his cash balance benefi t at 5% per year, and the terms of the pension plan

remain unchanged.

Bernard V. Masson

In addition to the benefi ts described above, Mr. Masson is covered under a supplemental unfunded retirement benefi t under the terms of his amended

letter agreement dated May 5, 2005. Under this arrangement, the Company established a phantom cash balance account on behalf of Mr. Masson.

The Company agreed to credit the account by $200,000 each year for up to fi ve years, beginning June 1, 2005. Any amounts credited to this account

earn interest at the same interest rate that amounts accrue interest under the cash balance benefi t. In order to receive any of the amounts credited

to this account, Mr. Masson had to have been continuously employed for at least fi ve years unless his employment terminates for a reason other than

cause, or for certain other specifi ed reasons. Pursuant to Mr. Masson’s September 30, 2005 letter agreement in connection with his termination of

employment effective January 2, 2006, Mr. Masson will receive the current balance in his phantom cash balance account, in an amount equal to

$200,000, plus accrued interest.