Kodak 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

Intellectual Property Donation

During 2003, the Company recorded a tax benefi t of $13 million related to the donation of intellectual property in the form of technology patents to a

tax-qualifi ed organization.

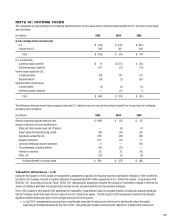

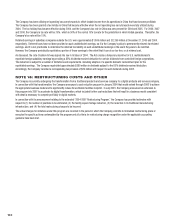

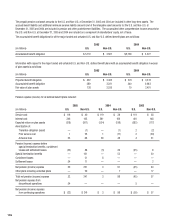

The signifi cant components of deferred tax assets and liabilities were as follows:

(in millions) 2005 2004

Deferred tax assets

Pension and postretirement obligations $ 1,132 $ 835

Restructuring programs 91 145

Foreign tax credit 447 189

Investment tax credits 148 148

Employee deferred compensation 105 214

Inventories 4 84

Tax loss carryforwards 220 234

Other 426 384

Total deferred tax assets 2,573 2,233

Deferred tax liabilities

Depreciation 534 584

Leasing 78 101

Other 119 298

Total deferred tax liabilities 731 983

Valuation allowance 1,406 284

Net deferred tax assets $ 436 $ 966

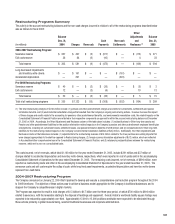

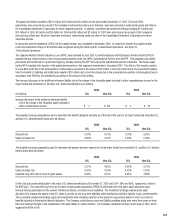

Deferred tax assets (liabilities) are reported in the following components within the Consolidated Statement of Financial Position:

(in millions) 2005 2004

Deferred income taxes (current) $ 100 $ 556

Other long-term assets 450 521

Accrued income taxes (81) (44)

Other long-term liabilities (33) (67)

Net deferred tax assets $ 436 $ 966

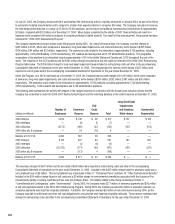

At December 31, 2005, the Company had available net operating loss carryforwards both inside and outside of the U.S. of approximately $584 million

for income tax purposes, of which approximately $373 million has an indefi nite carryforward period. The remaining $211 million expires between the

years 2006 and 2025. Utilization of these net operating losses may be subject to limitations in the event of signifi cant changes in stock ownership of

the Company. The Company also has $447 million of unused foreign tax credits at December 31, 2005, with various expiration dates through 2015.

The valuation allowance as of December 31, 2005 of $1,406 million is attributable to $177 million of net foreign deferred tax assets, including certain

net operating loss and capital loss carryforwards and $1,229 million of U.S. net deferred tax assets, including current year losses and credits, which

the Company is unable to benefi t. The valuation allowance as of December 31, 2004 of $284 million is attributable to certain net operating loss and

capital loss carryforwards outside the U.S. and to other tax credits in the U.S.

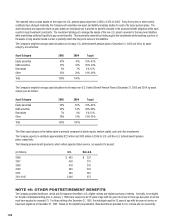

The Company has recognized the balance of its deferred tax assets on the belief that it is more likely than not that they will be realized. This belief

is based on an assessment of all available evidence, including an evaluation of scheduled reversals of deferred tax assets and liabilities, estimates of

projected future taxable income, carryback potential and tax planning strategies.