Kodak 2005 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.103

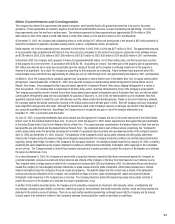

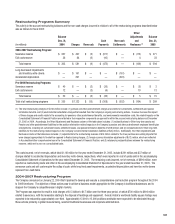

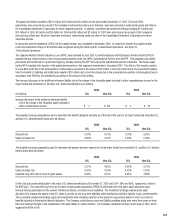

The total severance charges of $497 million include pension and other postretirement charges and credits for curtailments, settlements and special

termination benefi ts. However, because the impact of these charges and credits relate to the accounting for pensions and other postretirement

benefi ts, the related impacts on the Consolidated Statement of Financial Position are refl ected in their respective components as opposed to within

the accrued restructuring balances at December 31, 2005 or 2004. Accordingly, other adjustments of $(113) million to the severance reserve in

2005 included reclassifi cations to Other long-term assets and Pension and other postretirement liabilities for the position elimination-related impacts

on the Company’s pension and other postretirement employee benefi t plan arrangements, including net curtailment losses, settlement losses, and

special termination benefi ts of $(96) million, which are disclosed in Note 17 “Retirement Plans” and Note 18, “Other Postretirement Benefi ts”.

Additionally, the other adjustments of $(113) million to the severance reserve in 2005 include: (1) adjustments to the severance reserve of $7 million

related to the Creo purchase accounting impacts that were charged appropriately to Goodwill as opposed to Restructuring charges, (2) foreign

currency translation adjustments of $(12) million, and (3) rebalancing reclassifi cations to other restructuring reserves of ($12) million, which net to

zero on a consolidated basis.

Other adjustments of $4 million to the exit cost reserve in 2005 included: (1) reclassifi cations to Other long-term liabilities for the restructuring-related

impacts on the Company’s environmental remediation liabilities of $(8) million, which are disclosed in Note 11, “Commitments and Contingencies”

under “Environmental”, (2) adjustments to the exit cost reserve of $7 million related to the Creo purchase accounting impacts that were charged

appropriately to Goodwill as opposed to Restructuring charges, and (3) rebalancing reclassifi cations to other restructuring reserves of $5 million,

which net to zero on a consolidated basis.

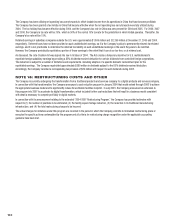

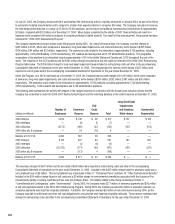

As a result of the initiatives already implemented under the 2004-2007 Restructuring Program, severance payments will be paid during periods

through 2007 since, in many instances, the employees whose positions were eliminated can elect or are required to receive their payments over an

extended period of time. Most exit costs were paid during 2005. However, certain costs, such as long-term lease payments, will be paid over periods

after 2005.

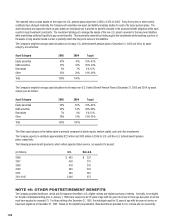

As a result of initiatives implemented under the 2004-2007 Restructuring Program, the Company recorded $391 million of accelerated depreciation

on long-lived assets in cost of goods sold in the accompanying Consolidated Statement of Operations for the year ended December 31, 2005. The

accelerated depreciation relates to long-lived assets accounted for under the held and used model of SFAS No. 144. The year-to-date amount of

$391 million relates to $37 million of photofi nishing facilities and equipment, $349 million of manufacturing facilities and equipment, and $5 million

of administrative facilities and equipment that will be used until their abandonment. The Company will record approximately $200 million of additional

accelerated depreciation in 2006 related to the initiatives implemented in 2005. Additional amounts of accelerated depreciation may be recorded in

2006 and 2007 as the Company continues to execute its 2004-2007 Restructuring Program.

The charges of $1,133 million recorded in 2005, excluding reversals, included $222 million applicable to the D&FIS segment, $23 million applicable

to the Health Group segment, and $30 million applicable to the Graphic Communications Group segment, and $3 million applicable to All Other.

The balance of $855 million was applicable to manufacturing, research and development, and administrative functions, which are shared across

all segments.

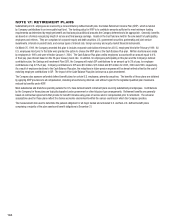

Pre-2004 Restructuring Programs

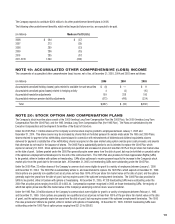

At December 31, 2005, the Company had remaining severance and exit costs reserves of $2 million and $13 million, respectively, relating to

restructuring plans committed to or executed prior to 2004. During 2005, reversals of $3 million were made to reduce the severance reserve balance,

as severance payments were less than originally estimated. During 2005, reversals of $3 million were made to reduce the exit costs reserve balance,

as the Company was able to settle lease and other exit cost obligations for amounts that were less than originally estimated.

The remaining severance payments relate to initiatives already implemented under the Pre-2004 Restructuring Programs and will be paid out during

2006 since, in many instances, the employees whose positions were eliminated can elect or are required to receive their severance payments over an

extended period of time. Most of the remaining exit costs reserves represent long-term lease payments, which will continue to be paid over periods

throughout and after 2006.