Kodak 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

In April 2005, the Securities and Exchange Commission voted to change the effective date of SFAS No. 123R to fi scal years starting after

June 15, 2005; however, early application is encouraged. The Company adopted the modifi ed version of the prospective application of SFAS No. 123R

as of January 1, 2005 under which the Company is required to recognize compensation expense, over the applicable vesting period, based on the

fair value of (1) any unvested awards subject to SFAS No. 123R existing as of January 1, 2005, and (2) any new awards granted subsequent to the

adoption date. Refer to the “Stock-Based Compensation” section under Note 1 above for the effect of adoption on the Company’s consolidated

fi nancial statements.

FASB Statement No. 151

In December 2004, the FASB issued SFAS No. 151, “Inventory Costs” that amends the guidance in Accounting Research Bulletin No. 43, Chapter 4,

“Inventory Pricing,” (ARB No. 43) to clarify the accounting for abnormal idle facility expense, freight, handling costs and wasted material (spoilage).

In addition, this Statement requires that an allocation of fi xed production overhead to the costs of conversion be based on the normal capacity

of the production facilities. SFAS No. 151 is effective for inventory costs incurred for fi scal years beginning after June 15, 2005 (year ending

December 31, 2006 for the Company). The Company does not expect the implementation of SFAS No. 151 to have a material impact on its

fi nancial statements.

FASB Staff Position No. 109-2

In December 2004, FASB issued FSP No. 109-2, “Accounting and Disclosure Guidance for the Foreign Earnings Repatriation Provision within the

American Jobs Creation Act of 2004 (the “Act”).” The Act was signed into law in October of 2004. The Act creates a temporary incentive for U.S.

multinationals to repatriate foreign subsidiary earnings by providing an 85% dividends received deduction for certain dividends from controlled foreign

corporations. The deduction is subject to a number of limitations and requirements, including adoption of a specifi c domestic reinvestment plan for

the repatriated earnings. Accordingly, the FSP provides guidance on accounting for income taxes that relate to the accounting treatment for

unremitted earnings in a foreign investment (a consolidated subsidiary or corporate joint venture that is essentially permanent in nature). Further,

the FSP permits a company time beyond the fi nancial reporting period of enactment to evaluate the effect of the Act on its plan for reinvestment or

repatriation of foreign earnings for purposes of applying FASB Statement No. 109, “Accounting for Income Taxes.” Accordingly, an enterprise that has

not yet completed its evaluation of the repatriation provision for purposes of applying Statement 109 is required to disclose certain information, for

each period for which fi nancial statements covering periods affected by the Act are presented. Subsequently, the total effect on income tax expense

(or benefi t) for amounts that have been recognized under the repatriation provision must be provided in a company’s fi nancial statements for the

period in which it completes its evaluation of the repatriation provision. The provisions of FSP 109-2 were effective in the fourth quarter of 2004.

In 2005, the Company completed its evaluation of the repatriation provision and repatriated approximately $580 million of gross qualifying dividends

subject to the 85% dividends received deduction. Accordingly, the Company recorded a corresponding tax provision of approximately $29 million in

2005 with respect to such dividends. See Note 15, “Income Taxes,” for further disclosure.

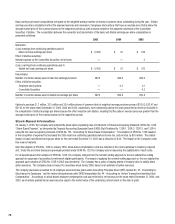

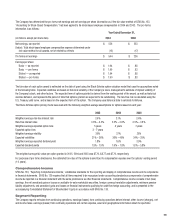

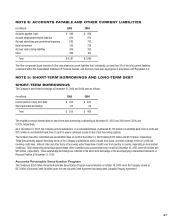

NOTE 2: RECEIVABLES, NET

(in millions) 2005 2004

Trade receivables $ 2,447 $ 2,137

Miscellaneous receivables 313 407

Total (net of allowances of $162 and $127 as of December 31, 2005 and 2004, respectively) $ 2,760 $ 2,544

Of the total trade receivable amounts of $2,447 million and $2,137 million as of December 31, 2005 and 2004, respectively, approximately $374

million and $492 million, respectively, are expected to be settled through customer deductions in lieu of cash payments. Such deductions represent

rebates owed to the customer and are included in accounts payable and other current liabilities in the accompanying Consolidated Statement of

Financial Position at each respective balance sheet date.