Kodak 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

2004-2007 Restructuring Program

The Company announced on January 22, 2004 that it planned to develop and execute a comprehensive cost reduction program throughout the 2004

to 2006 timeframe. The objective of these actions was to achieve a business model appropriate for the Company’s traditional businesses, and to

sharpen the Company’s competitiveness in digital markets.

The Program was expected to result in total charges of $1.3 billion to $1.7 billion over the three-year period, of which $700 million to $900 million

related to severance, with the remainder relating to the disposal of buildings and equipment. Overall, Kodak’s worldwide facility square footage was

expected to be reduced by approximately one-third. Approximately 12,000 to 15,000 positions worldwide were expected to be eliminated through

these actions primarily in global manufacturing, selected traditional businesses and corporate administration.

On July 20, 2005, the Company announced that it would extend the restructuring activity, originally announced in January 2004, as part of its efforts

to accelerate its digital transformation and to respond to a faster-than-expected decline in consumer fi lm sales. The Company now plans to increase

the total employment reduction to a range of 22,500 to 25,000 positions, and to reduce its traditional manufacturing infrastructure to approximately

$1 billion, compared with $2.9 billion as of December 31, 2004. When largely completed by the middle of 2007, these activities will result in a

business model consistent with what is necessary to compete profi tably in digital markets. As a result of this announcement, this program has been

renamed the “2004-2007 Restructuring Program.”

The Company implemented certain actions under this program during 2005. As a result of these actions, the Company recorded charges of

$742 million in 2005, which were composed of severance, long-lived asset impairments, exit costs and inventory write-downs of $497 million,

$124 million, $84 million and $37 million, respectively. The severance costs related to the elimination of approximately 8,125 positions, including

approximately 1,000 photofi nishing, 4,375 manufacturing, 575 research and development and 2,175 administrative positions. The geographic

composition of the positions to be eliminated includes approximately 4,150 in the United States and Canada and 3,975 throughout the rest of the

world. The reduction of the 8,125 positions and the $581 million charges for severance and exit costs are refl ected in the 2004-2007 Restructuring

Program table below. The $124 million charge for long-lived asset impairments was included in restructuring costs and other in the accompanying

Consolidated Statement of Operations for the year ended December 31, 2005. The charges taken for inventory write-downs of $37 million were

reported in cost of goods sold in the accompanying Consolidated Statement of Operations for the year ended December 31, 2005.

Under this Program, on a life-to-date basis as of December 31, 2005, the Company has recorded charges of $1,416 million, which were composed

of severance, long-lived asset impairments, exit costs and inventory write-downs of $915 million, $262 million, $183 million and $56 million,

respectively. The severance costs related to the elimination of approximately 17,750 positions, including approximately 5,700 photofi nishing,

7,950 manufacturing, 1,000 research and development and 3,100 administrative positions.

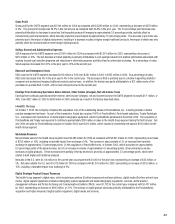

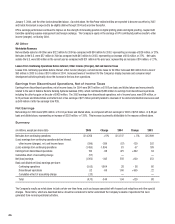

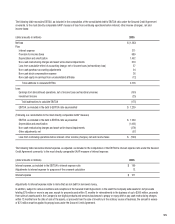

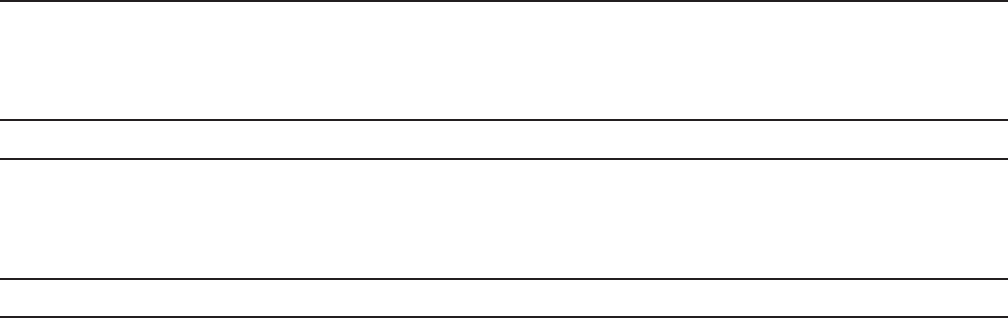

The following table summarizes the activity with respect to the charges recorded in connection with the focused cost reduction actions that the

Company has committed to under the 2004-2007 Restructuring Program and the remaining balances in the related reserves at December 31, 2005:

Long-lived Asset

Exit Impairments

Number of Severance Costs and Inventory Accelerated

(dollars in millions) Employees Reserve Reserve Total Write-downs Depreciation

2004 charges 9,625 $ 418 $ 99 $ 517 $ 157 $ 152

2004 reversals — (6) (1) (7) — —

2004 utilization (5,175) (169) (47) (216) (157) (152)

2004 other adj. & reclasses — 24 (15) 9 — —

Balance at 12/31/04 4,450 267 36 303 — —

2005 charges 8,125 497 84 581 161 391

2005 reversals — (3) (6) (9) — —

2005 utilization (10,225) (377) (95) (472) (161) (391)

2005 other adj. & reclasses — (113) 4 (109) — —

Balance at 12/31/05 2,350 $ 271 $ 23 $ 294 $ — $ —

The severance charges of $497 million and the exit costs of $84 million were reported in restructuring costs and other in the accompanying