Kodak 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

January 5, 2004, and the other factors described above. As noted above, the NexPress-related entities are expected to become accretive by 2007,

and Kodak Versamark is expected to be slightly dilutive through 2004 and accretive thereafter.

KPG’s earnings performance continued to improve on the strength of its leading position in digital printing plates and digital proofi ng, coupled with

favorable operating expense management and foreign exchange. The Company’s equity in the earnings of KPG contributed positive results to other

income (charges), net during 2004.

All Other

Worldwide Revenues

Net worldwide sales for All Other were $122 million for 2004 as compared with $96 million for 2003, representing an increase of $26 million, or 27%.

Net sales in the U.S. were $57 million in 2004 as compared with $45 million for 2003, representing an increase of $12 million, or 27%. Net sales

outside the U.S. were $65 million in the current year as compared with $51 million in the prior year, representing an increase of $14 million, or 27%.

Losses From Continuing Operations Before Interest, Other Income (Charges), Net and Income Taxes

Losses from continuing operations before interest, other income (charges), net and income taxes for All Other increased $98 million from a loss of

$93 million in 2003 to a loss of $191 million in 2004. Increased levels of investment for the Company’s display business and consumer inkjet

development activities primarily drove the increase in the loss from operations.

Earnings from Discontinued Operations, Net of Income Taxes

Earnings from discontinued operations, net of income taxes, for 2004 were $475 million, or $1.66 per basic and diluted share and were primarily

related to the sale of Kodak’s Remote Sensing Systems business (RSS), which contributed $466 million to earnings from discontinued operations,

including the after-tax gain on the sale of $439 million. The 2003 earnings from discontinued operations, net of income taxes, were $64 million, or

$.22 per basic and diluted share and refl ects net of tax earnings of $27 million primarily related to reversals of tax and environmental reserves as well

as $40 million of after-tax earnings from RSS.

Net Earnings

Net earnings for 2004 were $556 million, or $1.94 per basic and diluted share, as compared with net earnings for 2003 of $253 million, or $.88 per

basic and diluted share, representing an increase of $303 million, or 120%. This increase is primarily attributable to the reasons outlined above.

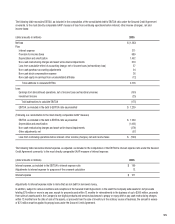

Summary

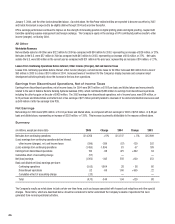

(in millions, except per share data) 2005 Change 2004 Change 2003

Net sales from continuing operations $ 14,268 + 6% $ 13,517 + 5% $ 12,909

(Loss) earnings from continuing operations before interest,

other income (charges), net, and income taxes (599) -589 (87) -129 302

(Loss) earnings from continuing operations (1,455) -1,896 81 -57 189

Earnings from discontinued operations 150 -68 475 +642 64

Cumulative effect of accounting change (57) — —

Net (loss) earnings (1,362) -345 556 +120 253

Basic and diluted net (loss) earnings per share:

Continuing operations (5.05) -1,904 .28 - 58 .66

Discontinued operations .52 -69 1.66 +655 .22

Cumulative effect of accounting change (.20) — —

Total (4.73) -344 1.94 +120 .88

The Company’s results as noted above include certain one-time items, such as charges associated with focused cost reductions and other special

charges. These items, which are described below, should be considered to better understand the Company’s results of operations that were

generated from normal operational activities.