Kodak 2005 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

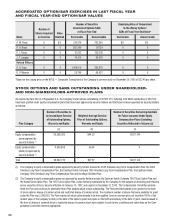

31

LONG-TERM INCENTIVE PLAN

Leadership Stock Program

Effective January 1, 2004, the Compensation Committee allocated performance stock units for the fi rst time under the Leadership Stock Program to

the Company’s executives, including the named executive offi cers. The Leadership Stock Program was established in the Fall of 2003 to:

• improve the linkage between controllable performance factors and executive compensation;

• enhance the focus of the Company’s executives on long-term operating goals;

• de-emphasize stock options by granting annual option awards only to those who are most responsible for infl uencing shareholder value; and

• reduce the Company’s share usage.

The program runs in two-year cycles with a new cycle beginning each January. All of the Company’s executives (approximately 800 employees) are

eligible to participate in the program. Awards are granted in the form of performance stock units which, if earned, are paid in the form of shares of

Kodak stock. The program’s awards are performance-based, not merely time-based. Individual award determinations are based on an executive’s level

of responsibility and leadership assessment.

For the 2004-2005 performance cycle, the program’s sole performance metric was Company operational earnings per share (EPS) performance over

the two-year period. EPS was used because it was an operational metric that each executive could directly infl uence. For the 2005-2006 performance

cycle, the program’s sole performance metric originally was EPS, but in October 2005 was changed to digital earnings from operations (DEFO). This

change in metric was a result of the Company’s announcement in July 2005 that it will no longer report operational earnings per share and that digital

earnings growth is one of the three key metrics by which the Company is being managed. Like EPS, DEFO is a metric that each executive can directly

infl uence. With respect to the 2005-2006 performance cycle, the target DEFO amounts that underlie the original EPS goals were used in order to

determine the appropriate revised performance goal for the performance cycle so as to provide a consistent methodology for the performance goal

and minimum performance goal. In setting the target for each two-year period contained in the 2004-2005 and 2005-2006 performance cycles of

the program, the Compensation Committee evaluated the Company’s implied return on invested capital to ensure that an acceptable level of return to

shareholders is achieved at target performance levels. For the 2006-2007 performance cycle, the program’s sole performance metric is DEFO.

The payment of any stock units earned under the program for any performance cycle is delayed for one year contingent on the executive’s continuous

employment with the Company, except in certain limited termination of employment circumstances, such as retirement, death, disability or an

approved reason, where the one-year vesting period does not apply. During this one-year vesting period, dividend equivalents are paid on the stock

units, but they too are subject to this one-year vesting period. At the end of this one-year period, the stock units, and all of the dividend equivalents

earned on these stock units, are paid to the executive in the form of shares of the Company’s stock.

For most executives, the Leadership Stock Program replaces the Company’s historical practice of granting an annual stock option award. Only the

Company’s offi cers continue to be eligible for an annual award of stock options. The target Leadership Stock allocations for the Company’s offi cers are

reduced to refl ect their continuing participation in the stock option program.

The Leadership Stock Program also replaced the Company’s Performance Stock Program. This was a program for the Company’s top executives that

measured performance over a three-year period based on the Company’s relative shareholder return. The Compensation Committee decided to

replace the program to improve the linkage between controllable performance and executive compensation, and to enhance the focus on the

Company’s long-term operating goals. The fi nal cycle of the Performance Stock Program ended December 31, 2005. The target awards under the

Leadership Stock Program for those participants who were formerly eligible for the Performance Stock Program were increased to refl ect their former

participation in this program.

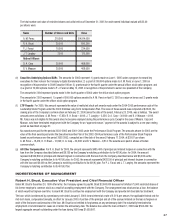

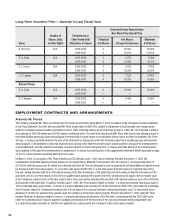

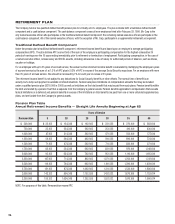

Because the amount of an executive’s earned award under the Leadership Stock Program is dependent upon the Company’s DEFO performance

and the executive’s continued employment, the amount of payout (if any) to an executive under the program for the 2005-2006 and 2006-2007

performance cycles cannot be determined at this time. The following table describes the award allocations that would be payable to a named executive

offi cer under the program for the 2005-2006 and 2006-2007 cycles, assuming threshold, target and maximum DEFO performance is achieved and

the named executive offi cer satisfi es the cycle’s one-year vesting period, where applicable. The awards payable to a named executive offi cer under

the program for the 2004-2005 cycle, assuming satisfaction of the one-year vesting period where applicable, are listed in the Summary Compensation

Table on page 25.

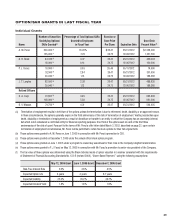

The Kodak Stock Option Plan, an “all employee stock option plan” which the Company formerly maintained, became effective on March 13, 1998,

and terminated on March 12, 2003. The Plan was used in 1998 to grant an award of 100 non-qualifi ed stock options or, in those countries

where the grant of stock options was not possible, 100 freestanding stock appreciation rights, to almost all full-time and part-time empolyees of

the Company and many of its domestic and foreign subsidiaries. In March of 2000, the Company made essentially an identical grant under the

Plan to generally the same category of employees. The Compensation Committee administered the Plan and continues to administer those Plan awards

which remain outstanding. A total of 16,600,000 shares were available for grant under the Plan. All awards granted under the Plan generally

contained the following features: 1) a grant price equal to the fair market value of the Company’s common stock on the date of grant; 2) a two-year

vesting period; and 3) a term of 10 years.