Kodak 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

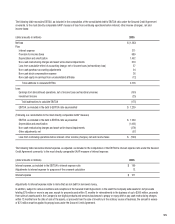

The following table reconciles EBITDA, as included in the computation of the consolidated debt to EBITDA ratio under the Secured Credit Agreement

covenants, to the most directly comparable GAAP measure of loss from continuing operations before interest, other income (charges), net and

income taxes:

(dollar amounts in millions) 2005

Net loss $ (1,362)

Plus:

Interest expense 211

Provision for income taxes 689

Depreciation and amortization 1,402

Non-cash restructuring charges and asset write-downs/impairments 379

Loss from cumulative effect of accounting change, net of income taxes (extraordinary loss) 57

Non-cash purchase accounting adjustments 24

Non-cash stock compensation expense 26

Non-cash equity in earnings from unconsolidated affi liates (12)

Total additions to calculate EBITDA 2,776

Less:

Earnings from discontinued operations, net of income taxes (extraordinary income) (150)

Investment income (25)

Total subtractions to calculate EBITDA (175)

EBITDA, as included in the debt to EBITDA ratio as presented $ 1,239

(Following is a reconciliation to the most directly comparable GAAP measure)

EBITDA, as included in the debt to EBITDA ratio as presented $ 1,239

Depreciation and amortization (1,402)

Non-cash restructuring charges and asset write-downs/impairments (379)

Other adjustments, net (57)

Loss from continuing operations before interest, other income (charges), net and income taxes $ (599)

The following table reconciles interest expense, as adjusted, as included in the computation of the EBITDA to interest expense ratio under the Secured

Credit Agreement covenants, to the most directly comparable GAAP measure of interest expense:

(dollar amounts in millions) 2005

Interest expense, as included in the EBITDA to interest expense ratio $ 199

Adjustments to interest expense for purposes of the covenant calculation 12

Interest expense $ 211

Adjustments to interest expense relate to items that are not debt for borrowed money.

In addition, subject to various conditions and exceptions in the Secured Credit Agreement, in the event the Company sells assets for net proceeds

totaling $75 million or more in any year, except for proceeds used within 12 months for reinvestments in the business of up to $300 million, proceeds

from sales of assets used in the Company’s non-digital products and services businesses to prepay or repay debt or pay cash restructuring charges

within 12 months from the date of sale of the assets, or proceeds from the sale of inventory in the ordinary course of business, the amount in excess

of $75 million must be applied to prepay loans under the Secured Credit Agreement.