Kodak 2005 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

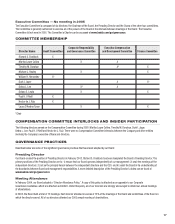

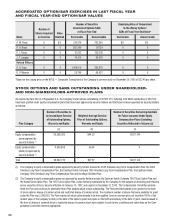

27

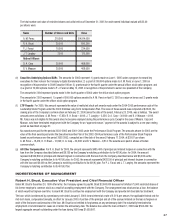

The total number and value of restricted shares and units held as of December 31, 2005 for each named individual (valued at $23.40

per share) were:

Name Number of Shares and Units Value

A. M. Perez 210,000 $4,914,000

R. H. Brust 29,500 690,300

P. J. Faraci 10,000 234,000

J. T. Langley 7,500 175,500

Retired Offi cers

D. A. Carp 20,000 468,000

B. V. Masson 20,000 468,000

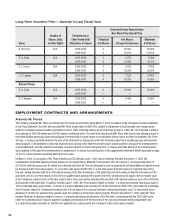

(e) Securities Underlying Options/SARs The amounts for 2005 represent: 1) grants made on June 1, 2005 under a program to reward key

executives for their roles in the Company’s digital transformation; 2) a grant of 300,000 options made to A. M. Perez on June 1, 2005 in

recognition of his promotion to Chief Executive Offi cer; 3) grants made in the fourth quarter under the annual offi cer stock option program; and

4) a grant of 10,000 options made to P. J. Faraci on May 12, 2005 in recognition of his promotion to senior vice president of the Company.

The amounts for 2004 represent grants made in the fourth quarter of 2004 under the offi cer stock option program.

The amounts for 2003 represent: 1) a grant of 500,000 options awarded to A. M. Perez on April 2, 2003 as a sign-on bonus and 2) grants made

in the fourth quarter under the offi cer stock option program.

(f) LTIP Payouts For 2005, this amount represents the value of restricted stock unit awards made under the 2004-2005 performance cycle of the

Leadership Stock Program under the 2000 Omnibus Long-Term Compensation Plan. The value of these awards was computed at $26.00, the

closing price of the Company’s common stock on February 21, 2006 (since the date of the award, February 20, 2006, was a holiday). The award

amounts were as follows: A. M. Perez – 17,850; R. H. Brust – 4,106; J. T. Langley – 3,356; D. A. Carp – 30,600; and B. V. Masson – 4,106.

Mr. Faraci was not eligible for this award since he became employed during the performance cycle. Except in the case of Messrs. Carp and

Masson, who have terminated employment with the Company for an “approved reason,” payment of the awards is subject to a one-year vesting

period as described on page 31.

No awards were paid for the periods 2003–2005 and 2001–2003 under the Performance Stock Program. The amounts shown for 2003 are the

value of the fi nal awards paid under the Executive Incentive Plan of the 2002–2004 performance cycle of the Performance Stock Program

based on performance over the period 2002-2003, computed as of the date of the award, February 17, 2004, at $29.07 per share:

A. M. Perez – 16,474; R. H. Brust – 12,693; D. A. Carp – 30,398; and B. V. Masson – 8,614. The awards were paid in shares of Kodak

common stock.

(g) All Other Compensation For R. H. Brust for 2005, the amount represents $485,400 of principal and interest forgiven in connection with the

loan from the Company described below and $6,150 as the Company’s matching contribution to its 401(K) plan; for 2004, the amount

represents $509,800 of principal and interest forgiven in connection with the loan from the Company described below and $6,000 as the

Company’s matching contribution to its 401(K) plan; for 2003, the amount represents $428,100 of principal and interest forgiven in connection

with the loan and $6,000 as the Company’s matching contribution to its 401(K) plan. For P. J. Faraci and J. T. Langley, the amounts represent the

Company’s matching contribution to its 401(K) Plan.

INDEBTEDNESS OF MANAGEMENT

Robert H. Brust, Executive Vice President and Chief Financial Offi cer

Under Mr. Brust’s December 20, 1999 offer letter, the Company agreed to pay Mr. Brust $3,000,000 because he forfeited 75,000 restricted shares of

his former employer’s common stock as a result of accepting employment with the Company. The arrangement was structured as a loan, the balance

of which would be forgiven over time, to incent Mr. Brust to continue his employment with the Company and provide him favorable tax treatment.

The loan, which is evidenced by a promissory note dated January 6, 2000, bears interest at a rate of 6.21% per annum, the applicable federal rate for

mid-term loans, compounded annually, in effect for January 2000. A portion of the principal and all of the accrued interest on the loan is forgiven on

each of the fi rst seven anniversaries of the loan. Mr. Brust is not entitled to forgiveness on any anniversary date if he voluntarily terminates his

employment or is terminated for cause on or before the anniversary date. The balance due under the loan on March 1, 2006 was $504,429; the

largest aggregate amount outstanding under the loan during 2005 was $1,059,997.