Kodak 2005 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.27

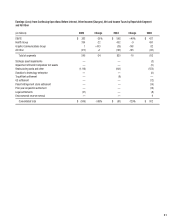

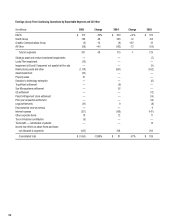

(ii) the amount of income and expense included in the Company’s Consolidated Statement of Operations for the years ended December 31, 2005,

2004 and 2003, (iii) the Company’s contributions and estimated future funding requirements and (iv) the amount of unrecognized losses at

December 31, 2005 and 2004.

Kodak’s defi ned benefi t pension and other postretirement benefi t costs and obligations are dependent on the Company’s assumptions used by

actuaries in calculating such amounts. These assumptions, which are reviewed annually by the Company, include the discount rate, long-term

expected rate of return on plan assets (EROA), salary growth, healthcare cost trend rate and other economic and demographic factors. Actual results

that differ from our assumptions are recorded as unrecognized gains and losses and are amortized to earnings over the estimated future service

period of the plan participants to the extent such total net unrecognized gains and losses exceed 10% of the greater of the plan’s projected benefi t

obligation or the market-related value of assets. Signifi cant differences in actual experience or signifi cant changes in future assumptions would affect

the Company’s pension and other postretirement benefi t costs and obligations.

Generally, the Company bases the discount rate assumption for its signifi cant plans on high quality corporate long-term bond yields in the respective

countries as of the measurement date. Specifi cally, for its U.S. and Canada plans, the Company determines a discount rate using a cash fl ow model to

incorporate the expected timing of benefi t payments and a AA-rated high quality corporate bond yield curve. For the Company’s other non-U.S. plans,

the discount rates are determined by comparison to published local long-term high quality bond indices.

The EROA assumption is based on a combination of formal asset and liability studies, historical results of the portfolio, and management’s expectation

as to future returns that are expected to be realized over the estimated remaining life of the plan liabilities that will be funded with the plan assets.

The salary growth assumptions are determined based on the Company’s long-term actual experience and future and near-term outlook. The

healthcare cost trend rate assumptions are based on historical cost and payment data, the near-term outlook and an assessment of the likely

long-term trends.

The Company reviews its EROA assumption annually for the Kodak Retirement Income Plan (KRIP). To facilitate this review, every three years, or

when market conditions change materially, the Company undertakes a new asset and liability study to reaffi rm the current asset allocation and the

related EROA assumption. In March 2005, a new asset and liability modeling study was completed and the KRIP EROA assumption for 2005 remained

at 9.0%. The KRIP EROA assumption is expected to remain at 9.0% for 2006 as well. Given the decrease in the discount rate of 25 basis points

from 5.75% for 2005 to 5.50% for 2006, an increase in expected return on plan assets due to asset performance in 2005, changes in demographic

assumptions resulting from the completion of assumption studies in 2005, and a decrease in amortization expense relating to unrecognized actuarial

losses in accordance with SFAS No. 87, total pension income from continuing operations before special termination benefi ts, curtailment losses and

settlement losses for the major funded and unfunded defi ned benefi t plans in the U.S. is expected to increase from $22 million in 2005 to $79 million

in 2006. Pension expense from continuing operations before special benefi ts, curtailment losses and settlement losses in the Company’s major

funded and unfunded non-U.S. defi ned benefi t plans is projected to increase from $88 million in 2005 to $113 million in 2006, which is primarily

attributable to an increase in amortization expense relating to the unrecognized actuarial losses. Additionally, due in part to the decrease in the

discount rate from 5.75% for 2005 to 5.50% for 2006 and a decrease in amortization expense relating to the unrecognized actuarial losses, the

Company expects the cost, before curtailment and settlement gains and losses, of its most signifi cant postretirement benefi t plan, the U.S. plan, to

approximate $180 million in 2006, as compared with $192 million for 2005. These estimates have been incorporated into the Company’s earnings

outlook for 2006.