Kodak 2005 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

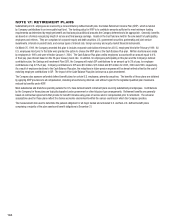

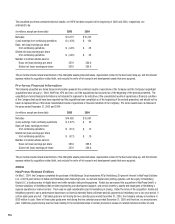

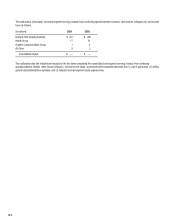

weighted-average exercise price of options. The total intrinsic value of options exercised during years ended December 31, 2005, 2004 and 2003 was

(in thousands) $1,238, $417, and $3,153, respectively.

As of December 31, 2005, there was $8.7 million of total unrecognized compensation cost related to unvested options. The cost is expected to be

recognized over a weighted-average period of 2.14 years.

The total fair value of shares vested during the years ended December 31, 2005, 2004 and 2003 was $16 million, $15 million and $20 million,

respectively.

Cash received for option exercises for the years ended December 31, 2005, 2004 and 2003 was $12 million, $5 million and $12 million, respectively.

The actual tax benefi t realized for the tax deductions from option exercises was not material for 2005, 2004 or 2003.

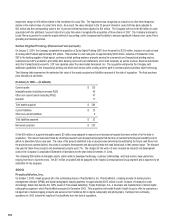

NOTE 21: ACQUISITIONS

2005

Creo Inc.

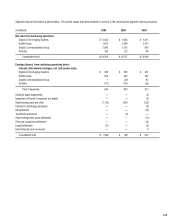

On June 15, 2005, the Company completed the acquisition of Creo Inc. (Creo), a premier supplier of prepress and workfl ow systems used by

commercial printers around the world. The acquisition of Creo uniquely positions the Company to be the preferred partner for its customers, helping

them improve effi ciency, expand their offerings and grow their businesses. The Company paid $954 million (excluding approximately $13 million in

transaction related costs), or $16.50 per share, for all of the outstanding shares of Creo. The Company used its bank lines to initially fund the

acquisition, which has been refi nanced through the Company’s Secured Credit Facilities. Creo’s extensive solutions portfolio is now part of the

Company’s Graphic Communications Group segment.

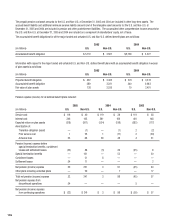

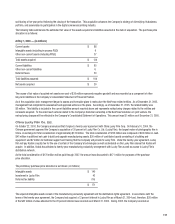

The following represents the total purchase price of the acquisition (in millions):

Cash paid at closing $ 954

Estimated transaction costs 13

Total purchase price $ 967

Upon closing of an acquisition, the Company estimates the fair values of assets and liabilities acquired in order to consolidate the acquired balance

sheet. Given the time it takes to obtain pertinent information to fi nalize the acquired balance sheet, it is not uncommon for initial estimates to be

revised in subsequent quarters. The Company is currently in the process of fi nalizing the purchase price allocation with respect to the acquisition

of Creo and must complete (1) the fi nal review of the independent third party valuation prepared, and (2) the allocation of the purchase price to the

proper tax jurisdictions, which will allow the Company to complete the fi nal valuation of the deferred tax liability associated with the acquisition. The

purchase price allocation, including the allocation to the proper tax jurisdictions, will be completed in the second quarter of 2006. A preliminary

estimate of the deferred tax liability has been calculated and is included in the preliminary purchase price allocation, which is as follows:

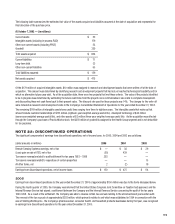

At June 15, 2005 — (in millions):

Current assets $ 358

Intangible assets (including in-process R&D) 292

Other non-current assets (including PP&E) 191

Goodwill 462

Total assets acquired $ 1,303

Current liabilities $ 249

Non-current liabilities 87

Total liabilities assumed $ 336

Net assets acquired $ 967