Kodak 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

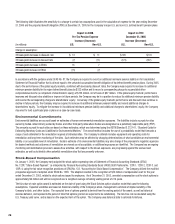

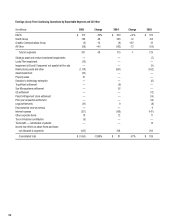

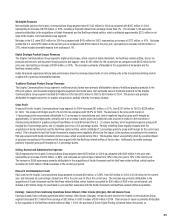

Earnings From Continuing Operations Before Interest, Other Income (Charges), Net and Income Taxes

Earnings from continuing operations before interest, other income (charges), net and income taxes for the Health Group segment decreased

$98 million, or 22%, from $452 million for the prior year to $354 million for 2005 due to the reasons described above.

Graphic Communications Group

On May 1, 2004, Kodak completed the acquisition of the NexPress-related entities, which develop high quality on-demand digital color printing

systems and manufacture digital black and white printing systems. There was no consideration paid to Heidelberg at closing. Under the terms of the

acquisition, Kodak and Heidelberg agreed to use a performance-based earn-out formula whereby Kodak will make periodic payments to Heidelberg

over a two-year period, if certain sales goals are met. If all sales goals were met during the two calendar years ended December 31, 2005, the

Company would have paid a maximum of $150 million in cash. For both the fi rst calendar year (2004) and for the second calendar year (2005),

there were no amounts paid to Heidelberg. Additional payments may also be made relating to the incremental sales of certain products in excess of a

stated minimum number of units sold during a fi ve-year period following the closing of the transaction.

On April 1, 2005, the Company became the sole owner of KPG through the redemption of Sun Chemical Corporation’s 50 percent interest in the KPG

joint venture. This transaction further established the Company as a leader in the graphic communications industry and complements the Company’s

existing business in this market. Under the terms of the transaction, the Company redeemed all of Sun Chemical’s shares in KPG by providing

$317 million in cash (excluding $7 million in transaction costs) at closing and by entering into two notes payable arrangements, one that will be

payable within the U.S. (the U.S. note) and one that will be payable outside of the U.S. (the non-U.S. note), that will require principal and interest

payments of $200 million in the third quarter of 2006, and $50 million annually from 2008 through 2013. The total payments due under the U.S. note

and the non-U.S. note are $100 million and $400 million, respectively. The aggregate fair value of these note payable arrangements of approximately

$395 million as of the acquisition date was recorded as long-term debt in the Company’s Consolidated Statement of Financial Position.

On June 15, 2005, the Company completed the acquisition of Creo Inc. (Creo), a premier supplier of prepress and workfl ow systems used by

commercial printers around the world. The acquisition of Creo uniquely positions the Company to be the preferred partner for its customers, helping

them improve effi ciency, expand their offerings and grow their businesses. The Company paid $954 million (excluding approximately $13 million

in transaction related costs), or $16.50 per share, for all of the outstanding shares of Creo. The Company used its bank lines to initially fund the

acquisition, which has been refi nanced through a 7-Year Term Loan under the Company’s new Secured Credit Facilities completed on

October 18, 2005.

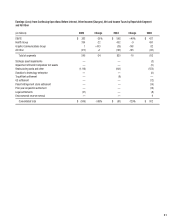

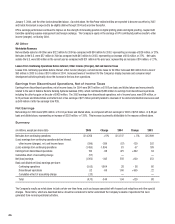

Worldwide Revenues

Net worldwide sales for the Graphic Communications Group segment were $2,990 million for 2005 as compared with $1,343 million for the prior year

period, representing an increase of $1,647 million, or 123%, which includes a favorable impact from exchange of less than 1%. The increase in net

sales was primarily due to the KPG, Creo and NexPress acquisitions, which contributed $1,561 million in sales.

Net sales in the U.S. were $1,079 million for the current year as compared with $587 million for the prior year, representing an increase of

$492 million, or 84%. Net sales outside the U.S. were $1,911 million in 2005 as compared with $756 million for the prior year period, representing

an increase of $1,155 million, or 153% as reported, which includes a favorable impact from exchange of approximately 1%.

Digital Strategic Product Groups’ Revenues

The Graphic Communications Group segment’s digital product sales consist of KPG digital revenues; Creo, a supplier of prepress systems; NexPress

Solutions, a producer of digital color and black and white printing solutions; Kodak Versamark, a leader in continuous inkjet technology; document

scanners; Encad, Inc., a maker of wide-format inkjet printers; and service and support.

Digital product sales for the Graphic Communications Group segment were $2,461 million for 2005 as compared with $1,065 million for the prior

year, representing an increase of $1,396 million, or 131%. The increase in digital product sales was primarily attributable to the KPG, Creo and

NexPress acquisitions.

Traditional Strategic Product Groups’ Revenues

The Graphic Communications Group segment’s traditional product sales are primarily comprised of sales of traditional graphics products, KPG’s analog

plates and other fi lms, and microfi lm products. These sales were $529 million for the current year compared with $278 million for the prior year,

representing an increase of $251 million, or 90%. This increase is primarily attributable to the acquisition of KPG.

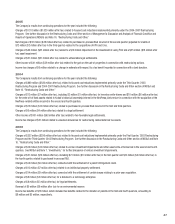

Gross Profi t

Gross profi t for the Graphic Communications Group segment was $805 million for 2005 as compared with $338 million in the prior year, representing

an increase of $467 million, or 138%. The gross profi t margin was 26.9% in the current year as compared with 25.2% in the prior year. The increase