Kodak 2005 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

by the Company’s performance against specifi c fi nancial measures for two-year overlapping cycles established by the Committee in the fi rst 90 days

of each year. While the performance measure for the 2005-2006 performance cycle of this program originally was set by the Committee as

operational earnings per share, in light of the Company’s announcement in July 2005 that it will no longer report operational earnings per share and

that digital earnings growth is one of the three key metrics by which the Company is being managed, the Committee revised the measure for this

cycle to be digital earnings from operations for 2005 and 2006. The performance measure for the 2004-2005 performance cycle of the Leadership

Stock Program was determined by the Committee to remain operational earnings per share during this two-year period, since the cycle was nearing

completion at the time of the Company’s announcement. The Committee determined that based on the Company’s operational earnings per share

performance for the two-year period from January 1, 2004 through December 31, 2005, the payout under the 2004-2005 performance cycle of the

Leadership Stock Program will be equal to 51% of target allocations for all participants. A description of the Leadership Stock Program is set forth

on page 31.

In addition to Leadership Stock, the Company’s offi cers are eligible for an annual grant of stock options. A description of the Company’s stock option

program is set forth on page 28. The target Leadership Stock awards for the Company’s offi cers are reduced to refl ect their continuing participation in

the stock option program.

The Company also is continuing its practice of periodically awarding grants of restricted stock or stock options to selected executives. These awards

generally are made to either: 1) attract new executives or support retention objectives; or 2) recognize exceptional performance.

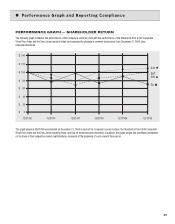

The Leadership Stock Program has replaced the Performance Stock Program, which measured performance over a three-year period based on the

Company’s total shareholder return relative to those companies within the Standard & Poor’s 500 Composite Price Index. Based on the Company’s

performance over the fi nal three-year performance cycle ending in 2005, no awards were paid for this cycle.

Share Ownership Program

The Company and the Committee believe that the interests of the Company’s executives should be inseparable from those of its shareholders. The

Company aims to link these interests by encouraging stock ownership on the part of its executives.

One program designed to meet this objective is the Company’s share ownership program. All executive offi cers are required to retain a specifi ed

percentage of the shares attributable to stock option exercises or the vesting or earn-out of full value shares (such as restricted shares or Leadership

Stock) until they attain specifi ed ownership levels, which are expressed below as a multiple of base salary.

The share ownership requirements operate as follows:

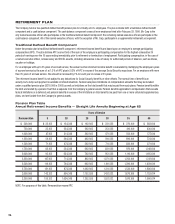

Level Salary Multiple Retention Ratio

CEO 5x 100%

COO/President 4x 100%

Executive VPs 3x 75%

Senior VPs 2x 75%

Other Executive Offi cers 1x 50%

Chief Executive Offi cer Compensation

On May 10, 2005, the Board of Directors accepted Mr. Daniel A. Carp’s resignation as Chief Executive Offi cer, effective June 1, 2005, and as

Chairman of the Board, effective December 31, 2005, in connection with Mr. Carp’s planned retirement from the Company on January 1, 2006.

On that same day, the Board elected Mr. Antonio M. Perez as Chief Executive Offi cer, effective June 1, 2005, and as Chairman of the Board, effective

December 31, 2005.

Compensation Arrangements for Antonio M. Perez in Connection with Election as

CEO and Chairman

The compensation arrangements for Mr. Perez in connection with his election as CEO and Chairman were approved by the Committee on

May 10, 2005, after extensive discussions spanning two meetings which included the Committee’s independent external compensation consultant and

certain members of the Company’s management team (excluding Messrs. Perez and Carp). Effective June 1, 2005, when Mr. Perez became CEO, he

received: 1) an annual base salary of $1,100,000 (with the excess over $1 million to be deferred until after Mr. Perez’s retirement in order to preserve

the full deductibility for federal income tax purposes of Mr. Perez’s base salary); 2) a one-time cash award of $150,000; 3) a one-time award of

60,000 shares of restricted stock with a fi ve-year vesting schedule with 50% of the shares vesting on the third anniversary of the grant date and 50%

of the shares vesting on the fi fth anniversary of the grant date; and 4) a one-time award of 300,000 non-qualifi ed stock options with a