Kodak 2005 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

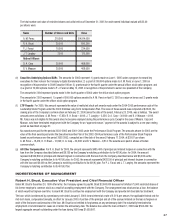

BASE SALARY

Base salary is the only fi xed portion of an executive’s compensation. Each executive’s base salary is reviewed annually based on the executive’s

relative responsibility and market comparisons.

SHORT-TERM VARIABLE PAY PLAN

Three key principles underlie the Executive Compensation for Excellence and Leadership Plan (EXCEL), the Company’s short-term variable pay plan for

its executives: alignment, simplicity and discretion. Alignment to Company objectives is achieved through the two performance metrics used to fund

the Plan: digital revenue and investable cash fl ow. Simplicity is accomplished through ease of plan administration; each participant has only three to

four key performance goals. Discretion, the third key principle, may be used to adjust the size of the Plan’s funding pool, modify the funding pool’s

allocation to the Company’s units and determine the performance and rewards of the Plan’s participants.

Participants in EXCEL are assigned target awards for the year based on a percentage of their base salaries as of the end of that year. This percentage

is determined by the participant’s wage grade. For 2005, target awards ranged from 25% of base salary for lower-level executives to 155% of base

salary for the CEO.

In the fi rst 90 days of each year, the Compensation Committee establishes a performance matrix for the year based on the Plan’s two performance

metrics. This matrix determines the percentage of the Plan’s target corporate funding pool that will be earned for the year based on the Company’s

actual performance against these two metrics. The target corporate funding pool is the aggregate of all participants’ target awards for the year. Under

the performance matrix, the corporate funding pool will fund at 100% if target performance for each performance metric is met.

The Compensation Committee may use its discretion to increase or decrease the amount of the corporate funding pool for any year. The

Committee considers a number of baseline metrics before applying this discretion. In 2005, these baseline metrics included earnings from operations

in the traditional business, performance against supply chain and inventory goals, performance against cost reduction goals regarding selling, general,

administrative and advertising costs and execution against the Company’s new business model. In addition, the Compensation Committee may choose

to exercise discretion to recognize such things as unanticipated economic or market changes, extreme currency exchange effects and management of

signifi cant workforce issues.

The CEO allocates the corporate funding pool among the Company’s business units. Each business unit has its own targets for operational

performance for the year. Senior management of each staff, region, function and business unit allocates the unit’s funds to its participants based on

each participant’s individual performance. This assessment includes performance against pre-established individual goals, leadership and support of

the Company’s diversity and inclusion strategy.

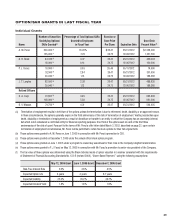

STOCK OPTION PROGRAM

Since the Fall of 2003, only the Company’s offi cers are eligible for an annual stock option grant. This change was made in large part in recognition of

the signifi cant potential dilutive impact of these types of awards. The Company’s offi cers, including its named executive offi cers, continue to receive

stock options since they remain an effective incentive compensation vehicle for those who are most responsible for infl uencing shareholder value.

Currently, all options are granted for a term of no more than seven years and are priced at 100% of the fair market value of the Company’s common

stock on the date of grant. In addition, in those limited situations where participants are permitted to retain their stock options upon termination of

employment, the options generally expire three years thereafter, rather than upon expiration of their normal term.

The Company bases target grant ranges on the median survey values of the companies it polls. Grants to individual offi cers are then adjusted based

in large part on the offi cer’s relative leadership assessment. Finally, the Compensation Committee ultimately determines the size of the stock option

awards to the executive offi cers using the recommendations made by management as a starting point. The 2005 stock option awards granted by the

Compensation Committee to the named executive offi cers are listed in the following table.

Daniel A. Carp, Retired Chairman and Chief Executive Offi cer

In March 2001, the Company loaned Mr. Carp $1,000,000 for the purchase of a home. The loan was unsecured and bore interest at 5.07% per year,

the applicable federal rate for mid-term loans, compounded annually, in effect for March 2001. The entire amount of the loan and all accrued interest

was paid by Mr. Carp upon his retirement from the Company. The largest aggregate amount outstanding under the loan during 2005 was $508,347.