IBM 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

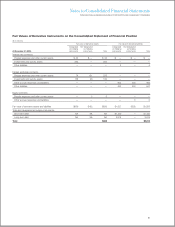

The Effect of Derivative Instruments on the Consolidated Statement of Earnings

($ in millions)

For the year ended December 31, 2009:

Gain (loss) recognized in earnings

Derivative instruments in Consolidated Statement of Recognized on Attributable to risk

fair value hedges Earnings line item derivatives(2) being hedged(3)

Interest rate contracts Cost of financing $(172) $344

Interest expense (97) 193

Total $(269) $537

Gain (loss) recognized in earnings and other comprehensive income

Effective portion Ineffectiveness and

Derivative instruments in Effective portion Consolidated Statement reclassified from amounts excluded from

cash flow hedges recognized in AOCI of Earnings line item AOCI to earnings effectiveness testing(4)

Interest rate contracts $ (0) Interest income $ (13) $—

Foreign exchange contracts (718) Other (income)

and expense 143 (3)

Cost of sales (49)

SG&A expense 14

Total $(718) $ 94 $(3)

Gain (loss) recognized in earnings and other comprehensive income

Effective portion Ineffectiveness and

Derivative instruments in Effective portion Consolidated Statement reclassified from amounts excluded from

net investment hedges recognized in AOCI of Earnings line item AOCI to earnings effectiveness testing(5)

Foreign exchange contracts $234 Interest income $— $ 1

Other (income)

and expense $— $—

Derivative instruments not Consolidated Statement Gain (loss) recognized

designated as hedging instruments(1) of Earnings line item in earnings

Foreign exchange contracts Other (income)

and expense $(128)

Equity contracts SG&A expense 177

Total $ 50

Note: AOCI represents Accumulated other comprehensive income/(loss) in Consolidated Statement of Changes in Equity.

(1)

See pages 76 and 77 for additional information on the purpose for entering into derivatives not designated as hedging instruments.

(2) Includes changes in clean fair values of the derivative instruments in fair value hedging relationships and the periodic accrual for coupon payments required under these

derivative contracts.

(3) Includes basis adjustments to the carrying value of the hedged item recorded during the period and amortization of basis adjustments recorded on de-designated

hedging relationships during the period.

(4) Amount of gain (loss) recognized in income represents ineffectiveness on hedge relationships.

(5) Amount of gain (loss) recognized in income represents amounts excluded from effectiveness assessment.

At December 31, 2009, in connection with cash flow hedges

of anticipated royalties and cost transactions, the company

recorded net losses of $718 million (before taxes), in accumu-

lated other comprehensive income/(loss); $427 million of losses

are expected to be reclassified to net income within the next 12

months, providing an offsetting economic impact against the

underlying anticipated transactions. At December 31, 2009, net

losses of approximately $18 million (before taxes), were recorded

in accumulated other comprehensive income/(loss) in connec-

tion with cash flow hedges of the company’s borrowings; $10

million of losses are expected to be reclassified to net income

within the next 12 months, providing an offsetting economic

impact against the underlying transactions.

For the 12 months ending December 31, 2009, there were

no significant gains or losses recognized in earnings represent-

ing hedge ineffectiveness or excluded from the assessment of

hedge effectiveness (for fair value hedges), or associated with an

underlying exposure that did not or was not expected to occur

(for cash flow hedges); nor are there any anticipated in the nor-

mal course of business.

Refer to note A, “Significant Accounting Policies”, on pages

76 and 77 for additional information.

96