IBM 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

Stock-Based Compensation

Stock-based compensation represents the cost related to stock-

based awards granted to employees. The company measures

stock-based compensation cost at grant date, based on the

estimated fair value of the award and recognizes the cost on a

straight-line basis (net of estimated forfeitures) over the employee

requisite service period. The company estimates the fair value of

stock options using a Black-Scholes valuation model. The cost

is recorded in cost, SG&A, and RD&E in the Consolidated State-

ment of Earnings based on the employees’ respective function.

The company records deferred tax assets for awards that

result in deductions on the company’s income tax returns, based

on the amount of compensation cost recognized and the statu-

tory tax rate in the jurisdiction in which it will receive a deduction.

Differences between the deferred tax assets recognized for finan-

cial reporting purposes and the actual tax deduction reported on

the income tax return are recorded in additional paid-in capital

(if the tax deduction exceeds the deferred tax asset) or in the

Consolidated Statement of Earnings (if the deferred tax asset

exceeds the tax deduction and no additional paid-in capital

exists from previous awards).

See note T, “Stock-Based Compensation,” on pages 105 to

109 for additional information.

Income Taxes

Income tax expense is based on reported income before income

taxes. Deferred income taxes reflect the tax effect of temporary

differences between asset and liability amounts that are rec-

ognized for financial reporting purposes and the amounts that

are recognized for income tax purposes. These deferred taxes

are measured by applying currently enacted tax laws. Valuation

allowances are recognized to reduce deferred tax assets to the

amount that will more likely than not be realized. In assessing

the need for a valuation allowance, management considers all

available evidence for each jurisdiction including past operating

results, estimates of future taxable income and the feasibility of

ongoing tax planning strategies. When the company changes

its determination as to the amount of deferred tax assets that

can be realized, the valuation allowance is adjusted with a cor-

responding impact to income tax expense in the period in which

such determination is made.

The company recognizes tax liabilities when, despite the

company’s belief that its tax return positions are supportable,

the company believes that certain positions may not be fully

sustained upon review by tax authorities. Benefits from tax

positions are measured at the largest amount of benefit that is

greater than 50 percent likely of being realized upon settlement.

The current portion of tax liabilities is included in taxes and the

noncurrent portion of tax liabilities is included in other liabilities in

the Consolidated Statement of Financial Position. To the extent

that new information becomes available which causes the com-

pany to change its judgment regarding the adequacy of existing

tax liabilities, such changes to tax liabilities will impact income

tax expense in the period in which such determination is made.

Interest and penalties, if any, related to accrued liabilities for

potential tax assessments are included in income tax expense.

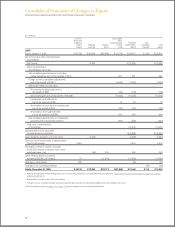

Translation of Non-U.S. Currency Amounts

Assets and liabilities of non-U.S. subsidiaries that have a local

functional currency are translated to United States (U.S.) dol-

lars at year-end exchange rates. Translation adjustments are

recorded in accumulated other comprehensive income/(loss)

in the Consolidated Statement of Changes in Equity. Income

and expense items are translated at weighted-average rates of

exchange prevailing during the year.

Inventories, plant, rental machines and other property—net

and other non-monetary assets and liabilities of non-U.S. subsid-

iaries and branches that operate in U.S. dollars are translated at

the approximate exchange rates prevailing when the company

acquired the assets or liabilities. All other assets and liabilities

denominated in a currency other than U.S. dollars are trans-

lated at year-end exchange rates with the transaction gain or

loss recognized in other (income) and expense. Cost of sales

and depreciation are translated at historical exchange rates. All

other income and expense items are translated at the weighted-

average rates of exchange prevailing during the year. These

translation gains and losses are included in net income for the

period in which exchange rates change.

Derivatives

All derivatives are recognized in the Consolidated Statement

of Finan cial Position at fair value and are reported in prepaid

expenses and other current assets, investments and sundry

assets, other accrued expenses and liabilities or other liabilities.

Classification of each derivative as current or noncurrent is based

upon whether the maturity of the instrument is less than or greater

than 12 months. To qualify for hedge accounting, the company

requires that the instruments be effective in reducing the risk

exposure that they are designated to hedge. For instruments that

hedge cash flows, hedge effectiveness criteria also require that it

be probable that the underlying transaction will occur. Instruments

that meet established accounting criteria are formally designated

as hedges. These criteria demonstrate that the derivative is

expected to be highly effective at offsetting changes in fair value

or cash flows of the underlying exposure both at inception of the

hedging relationship and on an ongoing basis. The method of

assessing hedge effectiveness and measuring hedge ineffective-

ness is formally documented at hedge inception. The company

assesses hedge effectiveness and measures hedge ineffective-

ness at least quarterly throughout the designated hedge period.

Where the company applies hedge accounting, the company

designates each derivative as a hedge of: (1) the fair value of a

recognized financial asset or liability or of an unrecognized firm

commitment (fair value hedge); (2) the variability of anticipated

cash flows of a forecasted transaction or the cash flows to be

received or paid related to a recognized financial asset or liability

(cash flow hedge); or (3) a hedge of a long-term investment

76