IBM 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

cost, but is both intelligent and secure. The systems product

line will be significantly refreshed in 2010 with the release of the

next generation System z mainframe in the second half and the

next generation POWER systems in System p beginning in the

first quarter of 2010.

In 2010, Global Financing will continue to focus on expand-

ing its core business by accelerating growth in the participation

rates for IBM products and services transactions. In addition,

the business will drive increased operational efficiency and

sales productivity through the deployment of its single operating

model initiative. This global initiative is focused on simplifying

processes, standardizing operations and optimizing business

performance.

The company expects 2010 pre-tax retirement-related plan

cost to be approximately $1.5 billion, an increase of approximately

$100 million compared to 2009. This estimate reflects current

pension plan assumptions and the impacts of recent non-U.S.

pension plan redesign efforts. See note U, “Retirement-Related

Benefits,” on pages 109 through 121 for additional information.

The company expects in the normal course of business that

its effective tax rate in 2010 will be approximately 26.0–26.5

percent. The rate will change year to year based on non-recur-

ring events, such as the settlement of income tax audits and

changes in tax laws, as well as recurring factors including the

geographic mix of income before taxes, the timing and amount

of foreign dividend repatriation, state and local taxes and the

effects of various global income tax strategies.

Effective January 1, 2010, the company will implement sev-

eral new accounting standards that have been issued by

the Financial Accounting Standards Board. These standards

include: amended guidance for revenue recognition for arrange-

ments with multiple deliverables; guidance that revises the scope

of existing software revenue recognition accounting; amend-

ments to the accounting rules for variable interest entities and

transfers of financial assets; and, additional disclosure require-

ments for fair value measurements. The company has evaluated

the new guidance and does not expect a material impact on the

Consolidated Financial Statements. See note B, “Accounting

Changes”, on pages 79 to 82 for additional information.

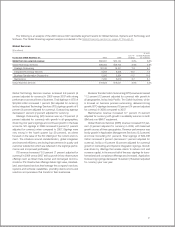

Liquidity and Capital Resources

The company has consistently generated strong cash flow

from operations, improving results year to year and providing

a source of funds ranging between $14.9 billion and $20.8 bil-

lion per year over the past five years. The company provides

for additional liquidity through several sources: maintaining an

adequate cash balance, access to global funding sources,

a committed global credit facility and other committed and

uncommitted lines of credit worldwide. At December 31, 2009,

the company had total unused lines of credit of $17,314 million.

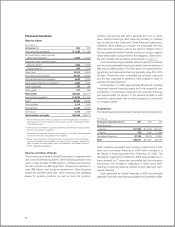

The following table provides a summary of the major sources of

liquidity for the years ended December 31, 2005 through 2009.

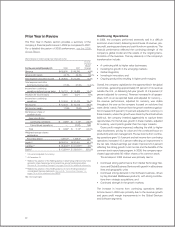

Cash Flow and Liquidity Trends

($ in billions)

2009 2008 2007 2006 2005

Net cash from

operating activities $20.8 $18.8 $16.1 $15.0 $14.9

Cash and short-term

marketable securities $14.0 $12.9 $16.1 $10.7 $13.7

Committed global credit

facilities $10.0 $10.0 $10.0 $10.0 $10.0

Trade receivables

securitization facility $ — $ — $ — $ — $ 0.5

The major rating agencies’ ratings on the company’s debt

securities at December 31, 2009 appear in the table below and

remain unchanged from December 31, 2008. The company’s

debt securities do not contain any acceleration clauses which

could change the scheduled maturities of the obligation. In addi-

tion, the company does not have “ratings trigger” provisions in

its debt covenants or documentation, which would allow the

holders to declare an event of default and seek to accelerate

payments thereunder in the event of a change in credit rating.

The company’s contractual agreements governing derivative

instruments contain standard market clauses which can trigger

the termination of the agreement if the company’s credit rating

were to fall below investment grade. At December 31, 2009, the

fair value of those instruments that were in a liability position was

$1,555 million, before any applicable netting, and this position

is subject to fluctuations in fair value period to period based on

the level of the company’s outstanding instruments and market

conditions. The company has no other contractual arrange-

ments that, in the event of a change in credit rating, would result

in a material adverse effect on its financial position or liquidity.

Moody’s

Standard Investors Fitch

& Poor’s Service Ratings

Senior long-term debt A+ A1 A+

Commercial paper A-1 Prime-1 F1

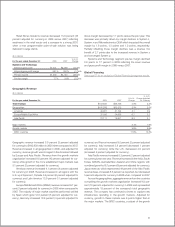

The company prepares its Consolidated Statement of Cash

Flows in accordance with applicable accounting standards for

cash flow presentation on page 66 and highlights causes and

events underlying sources and uses of cash in that format on

pages 35 and 36. For purposes of running its business, the

company manages, monitors and analyzes cash flows in a dif-

ferent format.

Management uses a free cash flow measure to evaluate the

company’s operating results, plan share repurchase levels, evalu-

ate strategic investments and assess the company’s ability and

need to incur and service debt. Free cash flow is not a defined

term under U.S. GAAP and it should not be inferred that the entire

free cash flow amount is available for discretionary expenditures.

The company defines free cash flow as net cash from operating

activities less the change in Global Financing receivables and net

49