IBM 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

basis (at least annually), to January 1, 2009. The application

of these amendments did not have a material impact on the

Consolidated Financial Statements.

In February 2007, the FASB issued guidance that permits

entities to measure eligible financial assets, financial liabilities

and firm commitments at fair value, on an instrument-by-instru-

ment basis, that are otherwise not permitted to be accounted

for at fair value under other generally accepted accounting prin-

ciples. The fair value measurement election is irrevocable and

subsequent changes in fair value must be recorded in earnings.

The company adopted this guidance as of January 1, 2008 but

has not applied the fair value option to any eligible assets or

liabilities. Thus, the adoption of this guidance did not affect the

Consolidated Financial Statements.

In the first quarter of 2007, the company adopted the guid-

ance on accounting for separately recognized servicing assets

and servicing liabilities. Separately recognized servicing assets

and servicing liabilities must be initially measured at fair value,

if practicable. Subsequent to initial recognition, the company

may use either the amortization method or the fair value mea-

surement method to account for servicing assets and servicing

liabilities within the scope of this Statement. The adoption of

this guidance did not have a material effect on the Consolidated

Financial Statements.

On January 1, 2007, the company adopted the guidance

on the accounting and reporting of uncertainties in income tax

law. The guidance prescribes a comprehensive model for the

financial statement recognition, measurement, presentation and

disclosure of uncertain tax positions taken or expected to be

taken in income tax returns. See note P, “Taxes”, on pages 101

to 103 for further information. The cumulative effect of adopting

this guidance was a decrease in tax reserves and an increase of

$117 million to the January 1, 2007 retained earnings balance.

Note C.

Acquisitions/Divestitures

Acquisitions

2009

In 2009, the company completed six acquisitions at an aggre-

gate cost of $1,471 million. The SPSS, Inc. acquisition is shown

separately given its significant purchase price.

SPSS, INC. (SPSS)—On October 2, 2009, the company acquired

100 percent of the outstanding common shares of SPSS for

cash consideration of $1,177 million. SPSS is a leading global

provider of predictive analytics software and solutions and this

acquisition will strengthen the company’s business analytics and

optimization capabilities. SPSS was integrated into the Software

segment upon acquisition, and goodwill, as reflected in the table

below, has been entirely assigned to the Software segment.

Substantially all of the goodwill is not deductible for tax pur-

poses. The overall weighted average useful life of the intangible

assets acquired, excluding goodwill, is 7.0 years.

OTHER ACQUISITIONS—The Software segment also completed

acquisitions of four privately held companies: in the second quar-

ter, Outblaze Limited, a messaging software provider, and Exeros,

Inc., a data discovery firm; in the third quarter, security provider

Ounce Labs, Inc.; and in the fourth quarter, Guardium, Inc., a

database security company. Global Technology Services com-

pleted one acquisition in the fourth quarter: RedPill Solutions PTE

Limited, a privately held company focused on business analytics.

Purchase price consideration for the “Other Acquisitions,” as

reflected in the table below, was paid all in cash. All acquisitions

are reported in the Consolidated Statement of Cash Flows net

of acquired cash and cash equivalents.

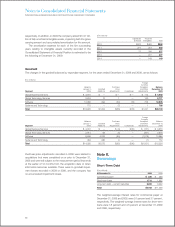

2009 ACQUISITIONS

($ in millions)

Amortization Other

Life (in Years) SPSS Acquisitions

Current assets $ 397 $ 13

Fixed assets/noncurrent 20 1

Intangible assets:

Goodwill N/A 748 255

Completed technology 4 to 7 105 39

Client relationships 5 to 7 30 20

In-process R&D N/A — —

Other identifiable assets 1 to 7 36 1

Total assets acquired 1,336 330

Current liabilities (157) (34)

Noncurrent liabilities (2) (0)

Total liabilities assumed (160) (35)

Total purchase price $1,177 $295

N/A—Not applicable

82