IBM 2009 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Year in Review

Segment Details

The following is an analysis of the 2009 versus 2008 reportable segment results. The analysis of 2008 versus 2007 reportable segment

results is on pages 40 to 45.

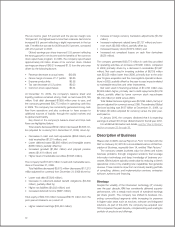

The following table presents each reportable segment’s external revenue and gross margin results.

($ in millions)

Yr.-to-Yr. Yr.-to-Yr.

Percent/ Change

Margin Adjusted

For the year ended December 31: 2009 2008 Change for Currency

Revenue:

Global Technology Services $37,347 $ 39,264 (4.9)% (2.0)%

Gross margin 35.0% 32.6% 2.4 pts.

Global Business Services 17,653 19,628 (10.1)% (8.1)%

Gross margin 28.2% 26.7% 1.5 pts.

Software 21,396 22,089 (3.1)% (0.8)%

Gross margin 86.0% 85.4% 0.6 pts.

Systems and Technology 16,190 19,287 (16.1)% (14.9)%

Gross margin 37.8% 38.1% (0.2) pts.

Global Financing 2,302 2,559 (10.0)% (7.3)%

Gross margin 47.5% 51.3% (3.8) pts.

Other 869 803 8.3% 11.7%

Gross margin 11.6% 13.4% (1.8) pts.

Total revenue $95,758 $103,630 (7.6)% (5.3)%

Gross profit $43,785 $ 45,661 (4.1)%

Gross margin 45.7% 44.1% 1.7 pts.

In addition to producing world-class systems, software and

technology products, IBM innovations are also a major differen-

tiator in providing solutions for the company’s clients through its

services businesses. The company’s investments in R&D also

result in intellectual property (IP) income of approximately $1

billion annually. Some of IBM’s technological breakthroughs are

used exclusively in IBM products, while others are licensed and

may be used in either/both IBM products and/or the products

of the licensee. While the company’s various proprietary intel-

lectual property rights are important to its success, IBM believes

its business as a whole is not materially dependent on any

particular patent or license, or any particular group of patents or

licenses. IBM owns or is licensed under a number of patents,

which vary in duration, relating to its products. Licenses under

patents owned by IBM have been and are being granted to oth-

ers under reasonable terms and conditions.

Integrated Supply Chain

Consistent with the company’s work with clients to transform

their supply chains for greater efficiency and responsiveness to

global market conditions, the company continues to derive busi-

ness value from its own globally integrated supply chain, thereby

providing a strategic advantage for the company to create value

for clients. IBM leverages its supply-chain expertise for clients

through its supply-chain business transformation outsourcing

service to optimize and help operate clients’ end-to-end supply-

chain processes, from procurement to logistics.

IBM spends approximately $35 billion annually through its

supply chain, procuring materials and services globally. The

supply, manufacturing and logistics and customer fulfillment

operations are integrated in one operating unit that has opti-

mized inventories over time, improved response to marketplace

opportunities and external risks and converted fixed costs to

variable costs. Simplifying and streamlining internal processes

has improved operations, sales force productivity and processes.

25