IBM 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

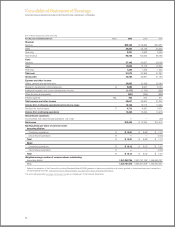

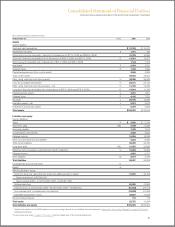

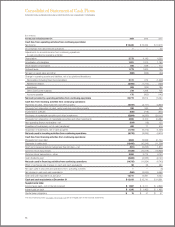

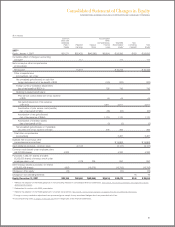

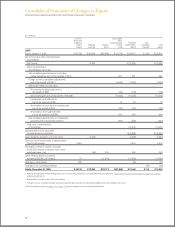

Consolidated Statement of Changes in Equity

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

($ in millions)

Common Accumulated

Stock and Other

Additional Comprehensive Total IBM Non-

Paid-in Retained Treasury Income/ Stockholders’ controlling Total

Capital Earnings Stock (Loss) Equity* Interests* Equity*

2007**

Equity, January 1, 2007 $31,271 $52,432 $(46,296) $(8,901) $ 28,506 $129 $ 28,635

Cumulative effect of change in accounting

principle+ 117 117 117

Net income plus other comprehensive

income/(loss):

Net income 10,418 $ 10,418 $ 10,418

Other comprehensive

income/(loss), net of tax:

Net unrealized gains/(losses) on cash flow

hedge derivatives (net of tax benefit of $32) (123) (123) (123)

Foreign currency translation adjustments

(net of tax benefit of $553++) 726 726 726

Retirement-related benefit plans:

Prior service costs/(credits) (net of tax expense

of $31) 44 44 44

Net gains/(losses) (net of tax expense

of $1,913) 3,611 3,611 3,611

Amortization of prior service costs/(credits)

(net of tax benefit of $50) (85) (85) (85)

Amortization of net gains/(losses)

(net of tax expense of $654) 1,110 1,110 1,110

Amortization of transition assets

(net of tax benefit of $1) (2) (2) (2)

Net unrealized gains/(losses) on marketable

securities (net of tax expense of $132) 206 206 206

Total other comprehensive

income/(loss) 5,487 5,487

Subtotal: Net income plus other

comprehensive income/(loss) $ 15,905 $ 15,905

Cash dividends declared—common stock (2,147) (2,147) (2,147)

Common stock issued under employee plans

(49,137,038 shares) 4,332 4,332 4,332

Purchases (1,282,131 shares) and sales

(9,282,055 shares) of treasury stock under

employee plans — net (179) 729 550 550

Other treasury shares purchased, not retired

(178,385,436 shares) (405) (18,378) (18,783) (18,783)

Changes in other equity (10) (10) (10)

Changes in noncontrolling interests 16 16

Equity, December 31, 2007 $35,188 $60,640 $(63,945) $(3,414) $ 28,470 $145 $ 28,615

* Reflects the adoption of the FASB guidance on noncontrolling interests in consolidated financial statements. See note B, “Accounting Changes,” on pages 79 to 82 for

additional information.

** Reclassified to conform with 2009 presentation.

+ Reflects the adoption of the FASB guidance for uncertain tax positions. See note B, “Accounting Changes,” on pages 79 to 82 for additional information.

++Foreign currency translation adjustments are presented gross except for any associated hedges which are presented net of tax.

The accompanying notes on pages 70 through 126 are an integral part of the financial statements.

67