IBM 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

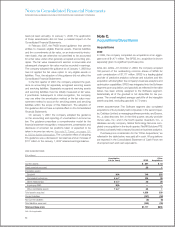

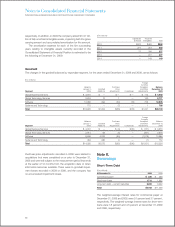

The acquisitions were accounted for as business combina-

tions, and accordingly, the assets and liabilities of the acquired

entities were recorded at their estimated fair values at the date of

acquisition. The primary items that generated the goodwill are the

value of the synergies between the acquired companies and IBM

and the acquired assembled workforce, neither of which qualify

as an amortizable intangible asset. For the “Other Acquisitions”,

the overall weighted-average life of the identified amortizable

intangible assets acquired is 6.5 years. With the exception of

goodwill, these identified intangible assets will be amortized on

a straight-line basis over their useful lives. Goodwill of $255 mil-

lion has been assigned to the Software ($246 million) and Global

Technology Services ($10 million) segments. Substantially all of

the goodwill is not deductible for tax purposes.

On October 5, 2009, the company announced that it had

signed an agreement with Bank of America Corporation to

acquire the core operating assets of Wilshire Credit Corporation,

including the Wilshire mortgage servicing platform. This acquisi-

tion continues the company’s strategic focus on the mortgage

services industry and strengthens its commitment to deliver

mortgage business process outsourcing solutions. The agree-

ment is subject to customary closing conditions and is not

expected to close until the first quarter of 2010.

2008

In 2008, the company completed 15 acquisitions at an aggre-

gate cost of $6,796 million. The Cognos, Inc. and Telelogic, AB

acquisitions are shown separately given their significant pur-

chase prices.

COGNOS, INC. (COGNOS)—On January 31, 2008, the company

ac quired 100 percent of the outstanding common shares

of Cognos for consideration of $5,021 million consisting of

$4,998 million of cash and $24 million of equity instruments.

Through this acquisition, IBM and Cognos will become a lead-

ing provider of technology and services for business intelligence

and performance management, delivering the industry’s most

complete, open standards-based platform with the broadest

range of expertise to help companies expand the value of their

information, optimize their business processes and maximize

performance across their enterprises. The company acquired

Cognos to accelerate its Information on Demand strategy, a

cross-company initiative that combines the company’s strength

in information integration, content and data management and

business consulting services to unlock the business value of

information. Cognos was integrated into the Software segment

upon acquisition, and goodwill, as reflected in the table on

page 84, has been entirely assigned to the Software segment.

Approximately 25

–

30 percent of the goodwill was deductible

for tax purposes. The overall weighted-average useful life of

the intangible assets acquired, excluding goodwill, is 6.5 years.

TELELOGIC, AB (TELELOGIC)—On April 3, 2008, IBM acquired 100

percent of the outstanding common shares of Telelogic for cash

consideration of $885 million. Telelogic is a leading global pro-

vider of solutions that enable organizations to align the develop-

ment of products, complex systems and software with business

objectives and customer needs. This results in improved quality

and predictability, while reducing time-to-market and overall

costs. Clients will benefit from the combined technologies and

services of both companies, providing them a wider range of

software and system development capabilities used to build

complex systems. Telelogic was integrated into the Software

segment upon acquisition, and goodwill, as reflected in the table

on page 84 has been entirely assigned to the Software segment.

Substantially all of the goodwill is not deductible for tax pur-

poses. The overall weighted-average useful life of the intangible

assets acquired, excluding goodwill, is 7.0 years.

OTHER ACQUISITIONS—The company acquired 13 additional

companies at an aggregate cost of $889 million that are pre-

sented in the table on page 84 as “Other Acquisitions.”

The Software segment completed eight other acquisitions,

seven of which were privately held companies: in the first quarter;

AptSoft Corporation, Solid Information Technology, Net Integration

Tech nologies Inc., and Encentuate, Inc; in the second quarter;

Infodyne, Beijing Super Info and FilesX. In the fourth quarter,

ILOG S.A. (ILOG), a publicly held company, was acquired for

$295 million. ILOG adds significant capability across the com-

pany’s entire software platform and bolsters its existing rules

management offerings.

Global Technology Services completed one acquisition in the

first quarter: Arsenal Digital Solutions, a privately held company.

Arsenal provides global clients with security rich information

protection services designed to handle increasing data retention

requirements.

Global Business Services completed one acquisition in the first

quarter: u9consult, a privately held company. u9consult comple-

ments the company’s existing capabilities in value chain consulting.

Systems and Technology completed three acquisitions:

in the second quarter; Diligent Technologies Corporation and

Platform Solutions, Inc (PSI), both privately held companies.

Diligent will be an important component of IBM’s New Enterprise

Data Center model, which helps clients improve IT efficiency

and facilitates the rapid deployment of new IT services for

future business growth. PSI’s technologies and skills, along

with its intellectual capital, will be integrated into the company’s

mainframe product engineering cycles and future product

plans. In the second quarter, $24 million of the purchase price

of PSI was attributed to the settlement of a preexisting lawsuit

83