IBM 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

financing arrangements are for terms ranging generally from two

to seven years. Each financing contract is priced independently at

competitive market rates. The company has a history of enforcing

the terms of these separate financing agreements.

The company utilizes certain of its financing receivables as

collateral for non-recourse borrowings. Financing receivables

pledged as collateral for borrowings were $271 million and $373

million at December 31, 2009 and 2008, respectively. These bor-

rowings are included in note K, “Borrowings,” on pages 90 to 92.

The company did not have any financing receivables held for

sale as of December 31, 2009 and 2008.

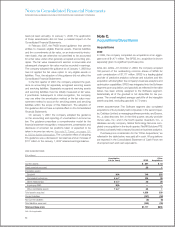

Note H.

Plant, Rental Machines and

Other Property

($ in millions)

At December 31: 2009 2008

Land and land improvements $ 737 $ 729

Buildings and building improvements 9,314 8,819

Plant, laboratory and office equipment 25,888 24,950

35,940 34,499

Less: Accumulated depreciation 23,485 22,178

Plant and other property — net 12,455 12,321

Rental machines 3,656 3,946

Less: Accumulated depreciation 1,946 1,962

Rental machines — net 1,710 1,984

Total— net $14,165 $14,305

Note I.

Investments and Sundry Assets

($ in millions)

At December 31: 2009 2008*

Deferred transition and setup costs

and other deferred arrangements** $1,772 $1,548

Derivatives — noncurrent

+ 565 1,117

Alliance investments:

Equity method 115 167

Non-equity method 477 285

Prepaid software 312 370

Long-term deposits 310 277

Other receivables 617 238

Employee benefit-related 427 372

Other assets 783 685

Total $5,379 $5,058

* Reclassified to conform with 2009 presentation.

** Deferred transition and setup costs and other deferred arrangements are related

to Global Services client arrangements. Also see note A, “Significant Accounting

Policies,” on pages 70 to 79 for additional information.

+ See note L, “Derivatives and Hedging Transactions,” on pages 92 through 96

for the fair value of all derivatives reported in the Consolidated Statement of

Financial Position.

Note J.

Intangible Assets Including Goodwill

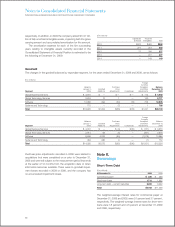

Intangible Assets

The following table details the company’s intangible asset bal-

ances by major asset class.

($ in millions)

At December 31, 2009

Gross Net

Carrying Accumulated Carrying

Intangible Asset Class Amount Amortization Amount

Capitalized software $1,765 $ (846) $ 919

Client-related 1,367 (677) 690

Completed technology 1,222 (452) 770

Patents/trademarks 174 (59) 115

Other* 94 (75) 19

Total $4,622 $(2,109) $2,513

* Other intangibles are primarily acquired proprietary and nonproprietary business

processes, methodologies and systems, and impacts from currency translation.

($ in millions)

At December 31, 2008

Gross Net

Carrying Accumulated Carrying

Intangible Asset Class Amount Amortization Amount

Capitalized software $1,861 $ (839) $1,022

Client-related 1,532 (663) 869

Completed technology 1,167 (327) 840

Patents/trademarks 188 (76) 112

Other* 154 (121) 35

Total $4,901 $(2,023) $2,878

* Other intangibles are primarily acquired proprietary and nonproprietary business

processes, methodologies and systems, and impacts from currency translation.

The net carrying amount of intangible assets decreased $365

million for the year ended December 31, 2009, primarily due to

amortization of acquired intangibles. No impairment of intangible

assets was recorded in any of the periods presented.

Total amortization was $1,221 million and $1,310 million for

the years ended December 31, 2009 and 2008, respectively.

The aggregate intangible amortization expense for acquired

intangibles (excluding capitalized software) was $489 million and

$520 million for the years ended December 31, 2009 and 2008,

89