IBM 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

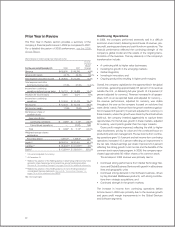

Software gross profit increased 2.4 percent with a flat mar-

gin year to year. The Software segment delivered pre-tax profit

of $3,058 million, an increase of 9.6 percent. The pre-tax margin

of 41.5 percent increased 2.4 points compared to fourth-quar-

ter 2008.

Systems and Technology revenue of $5,190 million decreased

4.3 percent (9 percent adjusted for currency). The rate of year-

to-year decline improved sequentially for the second consecutive

quarter. System z revenue decreased 26.8 percent (31 percent

adjusted for currency). System z MIPS shipments decreased

19 percent year to year. Volume performance was consistent

with expectations for this point in the product cycle. Converged

System p revenue declined 13.8 percent (18 percent adjusted

for currency). Although revenue has declined, the brand has

continued to gain market share, up 4 points in the quarter. In

the fourth quarter, sales generated by UNIX competitive dis-

placements was approximately $200 million. System x revenue

increased 36.8 percent (30 percent adjusted for currency),

with share gains in server (3 points) and blades (6 points). The

improved sales model and enhanced product offerings were the

key contributors to the fourth quarter performance. Systems

Storage revenue increased 1.4 percent (decreased 4 percent

adjusted for currency). Total disk revenue increased 6.1 percent

(1 percent adjusted for currency) driven by strong growth in

midrange and XIV. Tape revenue declined 9.8 percent (15 per-

cent adjusted for currency) versus the fourth quarter of 2008.

Microelectronics OEM revenue increased 1.9 percent in the

fourth quarter. The company’s 300 millimeter fabrication facility is

nearing full utilization and the 45 nanometer process output was

sold out again this quarter.

Systems and Technology gross margin of 42.5 percent,

increased 2.6 points versus the fourth quarter of 2008 with

margin improvement in all brands. This was the highest gross

profit margin since the fourth quarter of 2007 and was driven by

improvements in System x server and converged System p. The

Systems and Technology segment pre-tax profit increased 15.3

percent to $832 million. Pre-tax margin increased 2.6 points to

15.4 percent compared to the fourth quarter of 2008.

Global Financing external revenue of $621 million decreased

5.9 percent (12 percent adjusted for currency), driven by decreased

financing revenue. The Global Financing segment delivered 2.0

points of external gross margin improvement and 5.5 points of

total pre-tax margin expansion in the fourth quarter of 2009.

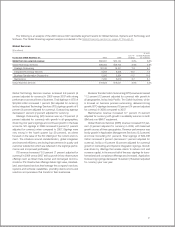

Geographic revenue increased 0.7 percent (decreased 6

percent adjusted for currency) with declines in all geographies,

adjusted for currency. Revenue in the major markets decreased

2.2 percent (7 percent adjusted for currency) and was 1 point

weaker than third quarter performance, adjusted for currency.

The U.K. had solid growth and revenue performance improved

sequentially in Canada and Japan (adjusted for currency).

Revenue in the growth markets increased 14.3 percent (2

percent adjusted for currency), 9 points higher than the major

markets, adjusted for currency. The growth markets contributed

20 percent of the geographic revenue in the fourth quarter. The

BRIC countries were up 18.4 percent (7 percent adjusted for

currency) driven by India, Brazil and China. Americas revenue

was $11,106 million, a decrease of 3.0 percent (6 percent

adjusted for currency). Adjusted for currency, revenue increased

2 percent in Latin America, while the U.S. declined 8 percent

and Canada declined 1 percent. EMEA revenue increased 2.4

percent (decreased 7 percent adjusted for currency) to $9,694

million. In the major market countries, when adjusted for cur-

rency, revenue in Germany declined 8 percent, France declined

12 percent, Italy declined 11 percent and Spain declined 11

percent while the U.K. was up 4 percent. Asia Pacific revenue

increased 5.7 percent (decreased 3 percent adjusted for cur-

rency) to $5,782 million, with the growth markets up 14.3

percent (3 percent adjusted for currency) and Japan down 2.8

percent (9 percent adjusted for currency).

Total expense and other income decreased 5.1 percent

compared to the fourth quarter of 2008 and the expense-to-

revenue-ratio improved 1.5 points. The decrease was driven by

lower operational expenses (approximately 15 points), partially

offset by 9 points due to the impact of currency and 1 point due

to the impact of acquisitions. The company continues to execute

its operational plan to increase efficiency and drive productiv-

ity by leveraging its scale and global presence. Initiatives such

as globalization of support functions and services delivery and

workforce balancing have yielded significant expense and cost

savings. Within selling, general and administrative expense,

workforce reduction charges decreased approximately $340 mil-

lion in the fourth quarter.

The company’s effective tax rate in the fourth-quarter 2009

was 24.6 percent compared with 23.8 percent in the fourth

quarter of 2008. The higher rate was primarily driven by higher

utilization of tax credits in the prior year.

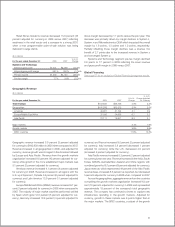

Share repurchases totaled $3,128 million in the fourth quar-

ter. The weighted-average number of diluted common shares

outstanding in the fourth quarter of 2009 was 1,340.7 million

compared with 1,353.7 million in the fourth quarter of 2008.

The company ended the quarter with $12,183 million of cash

and cash equivalents and generated $6,448 million in cash flow

provided by operating activities driven primarily by net income.

Net cash from investing activities was a use of cash of $2,495

million in fourth quarter of 2009 and Net cash from financing

activities was a use of cash of $1,206 million.

39