IBM 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Asia Pacific revenue decreased 1.9 percent (4 percent adjus-

ted for currency) year over year. Revenue in the Asia Pacific

growth markets decreased 2.4 percent (increased 3 percent

adjusted for currency), led by growth in China and India. China

revenue increased 10 percent, adjusted for currency, as the

company leveraged its broad portfolio to provide comprehensive

solutions to clients. India revenue increased 6 percent, adjusted

for currency. Japan revenue decreased 1.4 percent (10 percent

adjusted for currency).

The company continues to see growing opportunity glob-

ally—much of which is outside the traditional IT opportunity—to

help its clients drive efficiency in their physical infrastructures.

OEM revenue of $2,281 million in 2009 declined 15.2

percent (15 percent adjusted for currency) compared to 2008

driven by reduced demand year over year in the technology

OEM business. Year-to-year revenue performance improved in

this business across the second half of 2009.

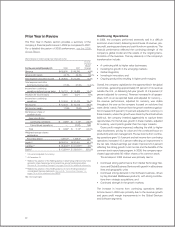

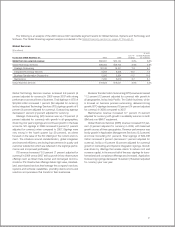

Total Expense and Other Income

($ in millions)

Yr.-to-Yr.

For the year ended December 31: 2009 2008 Change

Total expense and other income $25,647 $28,945 (11.4)%

Expense to Revenue 26.8% 27.9% (1.1) pts.

The key drivers year to year in total expense and other income

were approximately:

• Operational expense, (9) points

• Currency, (4) points

• Acquisitions, 1 point

In 2009, the company continued to execute its operational plan

to increase process efficiency and productivity; leveraging the

company’s scale and global presence. The company’s efforts

have been focused on all areas of the business—from sales

efficiency, supply chain management and service delivery to

the global support functions. The company’s cost and expense

base (approximately $80 billion) provides ample opportunity for

savings and the company yielded approximately $3.7 billion in

cost and expense savings in 2009. The company’s initiatives

have contributed to an improved operational balance point and

the improvements in margins and profit. As a result, the com-

pany is able to continue to invest in capabilities that will differen-

tiate the company in the future and accelerate the development

of new market opportunities.

For additional information regarding total expense and other

income, see the following analyses by category.

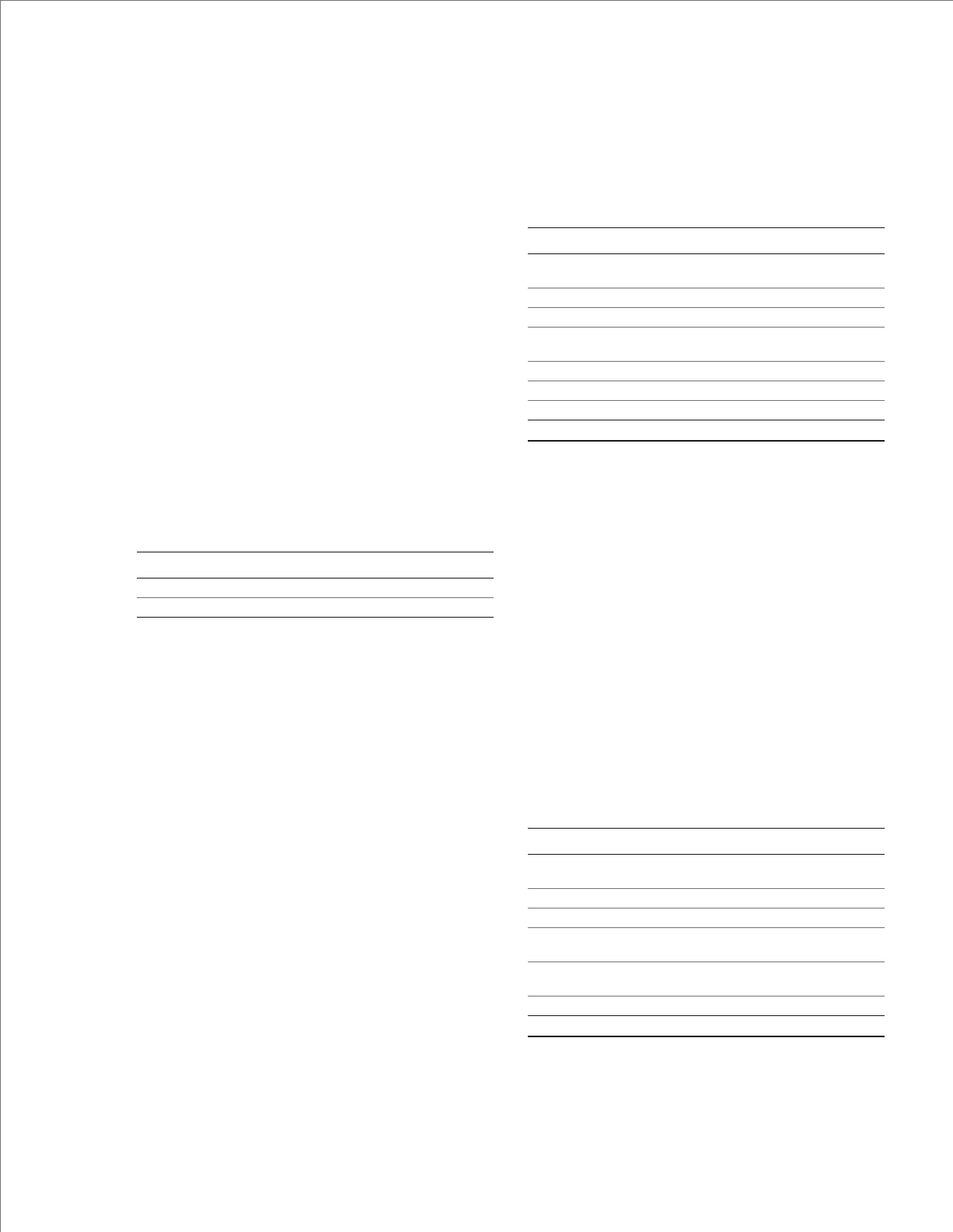

SELLING, GENERAL AND ADMINISTRATIVE

($ in millions)

Yr.-to-Yr.

For the year ended December 31: 2009 2008* Change

Selling, general and

administrative — base $18,056 $19,967 (9.6)%

Advertising and promotional expense 1,252 1,259 (0.6)

Workforce reductions 474 737 (35.7)

Amortization expense —

acquired intangibles 285 306 (6.9)

Retirement-related expense 322 326 (1.2)

Stock-based compensation 417 484 (13.9)

Bad debt expense 147 306 (52.0)

Total $20,952 $23,386 (10.4)%

* Reclassified to conform with 2009 presentation.

Total Selling, general and administrative (SG&A) expense decreased

10.4 percent (8 percent adjusted for currency) in 2009 versus

2008. Overall, the decrease was driven by reductions in opera-

tional expense (down 9 points) as the company continues to

focus on disciplined expense management, while investing

for future growth. Currency impacts also drove a year-to-year

decline (down 3 points), partially offset by acquisition-related

spending (up 1 point). Workforce reductions expense decreased

$264 million, primarily due to actions taken in the fourth quarter

of 2008, reflecting workforce actions in Japan ($120 million) and

other ongoing skills rebalancing that is a regular element of the

company’s business model. Bad debt expense decreased $159

million primarily driven by reductions in specific reserve require-

ments and lower accounts receivable balances in 2009 versus

2008. The company’s accounts receivable provision coverage is

2.0 percent, flat from a year ago.

OTHER (INCOME) AND EXPENSE

($ in millions)

Yr.-to-Yr.

For the year ended December 31: 2009 2008* Change

Foreign currency transaction

(gains)/losses $ (1) $ 328 NM

Gains on derivative instruments (12) (26) (53.4)%

Interest income (94) (343) (72.6)

Net losses/(gains) from securities

and investment assets 112 (52) NM

Net realized gains from certain

real estate activities (5) (26) (82.6)

Other (352) (179) 96.8

Total $(351) $(298) 17.7%

* Reclassified to conform with 2009 presentation.

NM—Not meaningful

32