IBM 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

between IBM and PSI and recorded in SG&A expense. See

note O, “Contingencies and Commitments,” on pages 99 to

101 for additional information regarding this litigation. Also, the

company recorded a $24 million in-process research and devel-

opment (IPR&D) charge related to this acquisition in the second

quarter. The acquisition of Transitive Corporation (Transitive)

was completed in the fourth quarter. Transitive’s cross-platform

technology will allow clients to consolidate their Linux-based

applications onto the IBM systems that make the most sense

for their business needs.

Purchase price consideration for the “Other Acquisitions”

was paid all in cash. All acquisitions are reported in the Consol-

idated Statement of Cash Flows net of acquired cash and cash

equivalents.

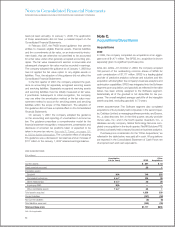

2008 ACQUISITIONS

($ in millions)

Amortization Other

Life (in Years) Cognos Telelogic Acquisitions

Current assets $ 504 $ 242 $ 185

Fixed assets/noncurrent 126 7 75

Intangible assets:

Goodwill N/A 4,207 690 676

Completed technology 3 to 7 534 108 94

Client relationships 3 to 7 512 127 39

In-process R&D N/A — — 24

Other 3 to 7 78 15 19

Total assets acquired 5,960 1,189 1,112

Current liabilities (798) (141) (233)

Noncurrent liabilities (141) (163) (14)

Total liabilities assumed (939) (304) (247)

Settlement of prexisting litigation — — 24

Total purchase price $5,021 $ 885 $ 889

N/A—Not applicable

The table above reflects the purchase price related to these

acquisitions and the resulting purchase price allocations as of

Decem ber 31, 2008.

The acquisitions were accounted for as purchase transac-

tions, and accordingly, the assets and liabilities of the acquired

entities were recorded at their estimated fair values at the date

of acquisition. The primary items that generated the goodwill

are the value of the synergies between the acquired companies

and IBM and the acquired assembled workforce, neither of

which qualify as an amortizable intangible asset. For the “Other

Acquisitions,” the overall weighted-average life of the identified

amortizable intangible assets acquired is 4.3 years. With the

exception of goodwill, these identified intangible assets will

be amortized on a straight-line basis over their useful lives.

Goodwill of $676 million has been assigned to the Software

($328 million), Global Technology Services ($68 million) and

Systems and Technology ($280 million) segments. Substantially,

all of the goodwill related to “Other Acquisitions” is not deduct-

ible for tax purposes.

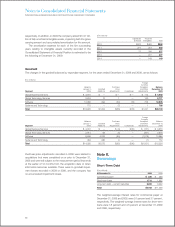

2007

In 2007, the company completed 12 acquisitions at an aggre-

gate cost of $1,144 million.

The Software segment completed six acquisitions: in the first

quarter, Consul Risk Management International BV and Vallent

Cor por ation, both privately held companies. Four acquisitions

were completed in the third quarter: Watchfire Corporation,

WebDialogs Inc. and Princeton Softech Inc., all privately held

companies, and DataMirror Corporation, a publicly held com-

pany. Each acquisition further complemented and enhanced the

software product portfolio.

Global Technology Services completed four acquisitions: in

the first quarter, Softek Storage Solutions Corporation (Softek)

and DM Information Systems, Ltd. (DMIS), both privately held

companies. Two acquisitions were completed in the fourth

quarter: Novus Consulting Group, Inc. and Serbian Business

Systems, both privately held companies. Softek augments the

company’s unified data mobility offerings and worldwide delivery

expertise for managing data in storage array, host and virtual-

ized IT environments. DMIS will enhance and complement the

Technology Service offerings. Novus CG, a storage solution

company, will provide improved access to business information,

84