IBM 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other (income) and expense was income of $351 million in

2009, an increase in income of $53 million year to year. The

increase was driven by several key factors: the $298 million gain,

reflected in Other, from the core logistics operations divestiture;

increased foreign currency transaction gains of $329 million;

offset by less interest income of $249 million due to lower rates;

less gains from securities transactions of $162 million due to

Lenovo equity sales in 2008; and a 2009 loss provision related to

a joint venture investment of $119 million, also reflected in Other.

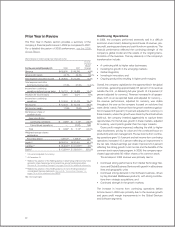

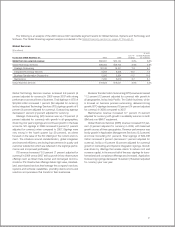

RESEARCH, DEVELOPMENT AND ENGINEERING

($ in millions)

Yr.-to-Yr.

For the year ended December 31: 2009 2008 Change

Research, development

and engineering

Total $5,820 $6,337 (8.2)%

The company continues to invest in research and development,

focusing its investments on high-value, high-growth opportunities.

Total Research, development and engineering (RD&E) expense

decreased 8.2 percent in 2009 versus 2008; adjusted for cur-

rency, expense decreased 6 percent in 2009. The decrease in

spending, adjusted for currency, was driven by continued process

efficiencies and reductions in discretionary spending, partially off-

set by the impact of acquisitions. RD&E investments represented

6.1 percent of total revenue in 2009, flat compared to 2008.

INTELLECTUAL PROPERTY AND CUSTOM DEVELOPMENT INCOME

($ in millions)

Yr.-to-Yr.

For the year ended December 31: 2009 2008 Change

Sales and other transfers

of intellectual property $ 228 $ 138 65.5%

Licensing/royalty-based fees 370 514 (28.0)

Custom development income 579 501 15.5

Total $1,177 $1,153 2.1%

The timing and amount of sales and other transfers of IP may

vary significantly from period to period depending upon timing

of divestitures, industry consolidation, economic conditions and

the timing of new patents and know-how development. There

were no significant individual IP transactions in 2009 or 2008.

INTEREST EXPENSE

($ in millions)

Yr.-to-Yr.

For the year ended December 31: 2009 2008 Change

Interest expense

Total $402 $673 (40.3)%

The decrease in interest expense was primarily due to lower debt

balances in 2009 versus 2008. Total debt at December 31, 2009

was $26.1 billion; a decline of $7.8 billion of primarily non-Global

Financing debt. Interest expense is presented in cost of financ-

ing in the Consolidated State ment of Earnings if the related

external borrowings are to support the Global Financing external

business. Overall interest expense for 2009 was $1,109 million,

a decrease of $353 million versus 2008.

Stock-Based Compensation

Total pre-tax stock-based compensation cost of $558 million

decreased $101 million compared to 2008. The decrease was

principally the result of a reduction in the level of stock option

grants ($159 million), offset by an increase related to restricted

and performance-based share units ($58 million). The year-to-

year change was reflected in the following categories: reductions

in cost ($22 million), RD&E expense ($12 million), and SG&A

expense ($67 million).

See note T, “Stock-Based Compensation,” on pages 105 to

109 for additional information on stock-based incentive awards.

Retirement-Related Benefits

The following table presents the total pre-tax cost for all retirement-

related plans. These amounts are included in the Consolidated

Statement of Earnings within the category (e.g., cost, SG&A,

RD&E) relating to the job function of the plan participants.

($ in millions)

Yr.-to-Yr.

For the year ended December 31: 2009 2008* Change

Defined benefit and contribution

pension plans cost $1,065 $1,076 (1.1)%

Nonpension postretirement plans costs 350 363 (3.6)

Total $1,415 $1,439 (1.7)%

* Reclassified to conform with 2009 presentation.

33