IBM 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

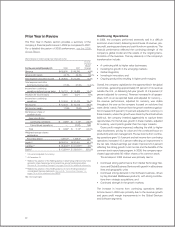

Income Taxes

The effective tax rate for 2008 was 26.2 percent, compared

with 28.1 percent in 2007. The 1.9 point decrease was primarily

driven by the 2008 net increase in the utilization of foreign and

state tax credits (2.9 points), the benefit associated with the

second quarter 2008 agreement reached with the U.S. Internal

Revenue Service (IRS) regarding claims for certain tax incentives

(1.7 points) and the benefit related to certain issues associated

with newly published U.S. tax regulations (1.2 points). These

benefits were partially offset by several items including the net

impact related to the completion of the U.S. federal income tax

examination for the years 2004 and 2005 including the asso-

ciated income tax reserve redeterminations (0.5 points), the

second quarter 2008 tax cost associated with the intercompany

transfer of certain intellectual property (2.8 points) and lower

capital loss utilization in 2008 (0.7 points). The remaining items

were individually insignificant.

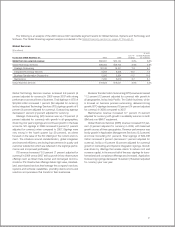

Financial Position

Total assets decreased $10,907 million ($5,854 million adjusted

for currency) primarily due to decreases in cash and cash equiv-

alents ($2,250 million), prepaid pension assets ($15,816 million),

short-term marketable securities ($989 million) and total financ-

ing receivables ($1,233 million). These decreases were partially

offset by increases in long-term deferred taxes ($5,757 million),

goodwill ($3,941 million) and intangible assets ($771 million).

Total liabilities increased $4,123 million ($5,301 million

adjusted for currency) driven primarily by increases in retirement

and nonpension postretirement benefit obligations ($5,871 mil-

lion) and total deferred income ($547 million), partially offset by

decreases in total debt ($1,349 million) and accounts payable

($1,041 million).

Total equity of $13,584 million decreased $15,030 million

versus 2007. Net income of $12,334 million was offset by the

effects of pension remeasurements and other retirement-related

items ($14,856 million), common/treasury stock activity ($6,323

million), dividends ($2,585 million) and equity translation adjust-

ments ($3,552 million).

The company generated $18,812 million in cash flow pro-

vided by operating activities, an increase of $2,718 million,

compared to 2007, primarily driven by increased net income

($1,916 million). Net cash used in investing activities of $9,285

million was $4,611 million higher than 2007, primarily due to

increased spending for acquisitions ($5,304 million). Net cash

used in financing activities of $11,834 million increased $7,095

million primarily due to debt transactions ($14,556 million), par-

tially offset by lower common stock repurchases ($8,249 million)

in 2008 versus 2007.

Discontinued Operations

On December 31, 2002, the company sold its HDD business to

Hitachi for approximately $2 billion. The final cash payment of

$399 million was received on December 30, 2005.

In 2007, the company reported a net loss of less than $1 mil-

lion, net of tax. There was no activity in 2008.

Other Information

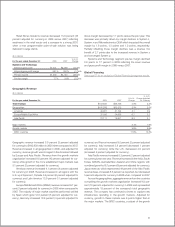

Looking Forward

Looking forward, the company enters 2010 in excellent opera-

tional and financial position. Since the last recession in 2002,

the company has consistently generated strong profit and cash

growth. In that timeframe (2003

–

2009), the company has added

$12 billion to its pre-tax income base; pre-tax income margin

has expanded more than 2.5 times; earnings per diluted share

is up 4 times, and cumulatively, the company has generated

approximately $115 billion in cash flow from operating activities.

This financial performance is the result of the transformation of

the business that started at the beginning of the decade. Its

driven by a combination of shifting the company’s business mix,

improving leverage through productivity and investing to capture

growth opportunities.

The company has remixed its business to move into higher

value areas—exiting commoditizing businesses, while acquiring

108 companies since 2000 for a total of approximately $22 billion

in net cash. These portfolio actions have contributed to a signifi-

cant change in the company’s business profile. In 2000, Global

Services segment pre-tax income was $4.5 billion; in 2009, it

was over $8 billion. The Software growth is even more dynamic.

In 2000, Software segment pre-tax income was $2.8 billion; in

2009, it also was over $8 billion. In 2009, over 90 percent of

segment pre-tax income came from Software, Global Services

and Global Financing, with Software and Global Services each

contributing 42 percent of segment pre-tax income. The portfolio

generates high profitability and the company will continue to remix

to higher value through organic investments and acquisitions.

The company has had an ongoing focus on driving operating

leverage through productivity. The company has leveraged its

scale and global presence to improve processes and productiv-

ity in a number of areas, including support functions and service

delivery. In 2009, the company yielded $3.7 billion of cost and

expense savings from the structural actions it has taken, driving

gross margin improvement and reductions in operational expense.

These actions have reduced the fixed cost base and improved

the operational balance point. Going forward, this will provide an

advantage as the spending environment improves—with solid

operating leverage off of the company’s leaner cost base.

47