IBM 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

Receivable losses are charged against the allowance when

management believes the uncollectibility of the receivable is con-

firmed. Subsequent recoveries, if any, are credited to the allowance.

Certain receivables for which the company recorded specific

reserves may also be placed on non-accrual status. Non-accrual

assets are those receivables (impaired loans or non-performing

leases) with specific reserves and other accounts for which it

is likely that the company will be unable to collect all amounts

due according to original terms of the lease or loan agreement.

Income recognition is discontinued on these receivables. Cash

collections are first applied as a reduction to principal out-

standing. Any cash received in excess of principal payments

outstanding is recognized as interest income. Receivables may

be removed from non-accrual status, if appropriate, based upon

changes in client circumstances.

Estimated Residual Values of Lease Assets

The recorded residual values of the company’s lease assets are

estimated at the inception of the lease to be the expected fair

value of the assets at the end of the lease term. The company

periodically reassesses the realizable value of its lease residual

values. Any anticipated increases in specific future residual values

are not recognized before realization through remarketing efforts.

Anticipated decreases in specific future residual values that are

considered to be other-than-temporary are recognized immedi-

ately upon identification and are recorded as an adjustment to

the residual-value estimate. For sales-type and direct financing

leases, this reduction lowers the recorded net investment and is

recognized as a loss charged to financing income in the period

in which the estimate is changed, as well as an adjustment to

unearned income to reduce future-period financing income.

Common Stock

Common stock refers to the $.20 par value per share capital

stock as designated in the company’s Certificate of Incorporation.

Treasury stock is accounted for using the cost method. When

treasury stock is reissued, the value is computed and recorded

using a weighted-average basis.

Earnings Per Share of Common Stock

Basic earnings per share of common stock is computed by

dividing net income by the weighted-average number of common

shares outstanding for the period. Diluted earnings per share of

common stock is computed on the basis of the weighted-aver-

age number of shares of common stock plus the effect of dilutive

potential common shares outstanding during the period using

the treasury stock method. Dilutive potential common shares

include outstanding stock options, stock awards and convertible

notes. See note R, “Earnings Per Share of Common Stock,” on

page 104 for additional information.

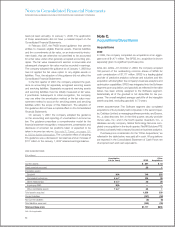

Note B.

Accounting Changes

New Standards to be Implemented

In January 2010, the Financial Accounting Standards Board

(FASB) issued additional disclosure requirements for fair value

measurements. According to the guidance, the fair value hierar-

chy disclosures are to be further disaggregated by class of assets

and liabilities. A class is often a subset of assets or liabilities within

a line item in the statement of financial position. In addition, signif-

icant transfers between Levels 1 and 2 of the fair value hierarchy

will be required to be disclosed. These additional requirements are

effective January 1, 2010 for quarterly and annual reporting. These

amendments will not have an impact on the consolidated finan-

cial results as this guidance relates only to additional disclosures.

In addition, the guidance requires more detailed disclosures of the

changes in Level 3 instruments. These changes will be effective

January 1, 2011 and are not expected to have a material impact

on the Consolidated Financial Statements.

In October 2009, the FASB issued amended revenue rec-

ognition guidance for arrangements with multiple deliverables.

The new guidance eliminates the residual method of revenue

recognition and allows the use of management’s best estimate

of selling price for individual elements of an arrangement when

vendor-specific objective evidence (VSOE), vendor objective

evidence (VOE) or third-party evidence (TPE) is unavailable. In

accordance with the guidance, the company has elected to early

adopt its provisions as of January 1, 2010 on a prospective basis

for all new or materially modified arrangements entered into on or

after that date. The company does not expect a material impact

on the Consolidated Financial Statements.

In October 2009, the FASB issued guidance which amends

the scope of existing software revenue recognition account-

ing. Tangible products containing software components and

non-software components that function together to deliver the

product’s essential functionality would be scoped out of the

accounting guidance on software and accounted for based on

other appropriate revenue recognition guidance. This guidance

must be adopted in the same period that the company adopts

the amended accounting for arrangements with multiple deliv-

erables described in the preceding paragraph. Therefore, the

company will also early adopt this guidance as of January 1,

2010 on a prospective basis for all new or materially modified

arrangements entered into on or after that date. The com-

pany does not expect a material impact on the Consolidated

Financial Statements.

In June 2009, the FASB issued amendments to the account-

ing rules for variable interest entities (VIEs) and for transfers of

financial assets. The new guidance for VIEs eliminates the quan-

titative approach previously required for determining the primary

beneficiary of a variable interest entity and requires ongoing

qualitative reassessments of whether an enterprise is the primary

beneficiary. In addition, qualifying special purpose entities (QSPEs)

79