IBM 2009 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

respectively. In addition, in 2009 the company retired $1,147 mil-

lion of fully amortized intangible assets, impacting both the gross

carrying amount and accumulated amortization for this amount.

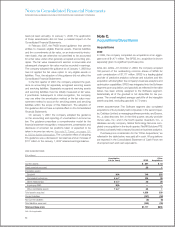

The amortization expense for each of the five succeeding

years relating to intangible assets currently recorded in the

Consolidated Statement of Financial Position is estimated to be

the following at December 31, 2009:

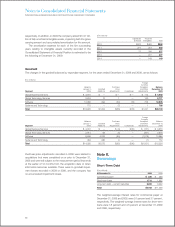

Goodwill

The changes in the goodwill balances by reportable segment, for the years ended December 31, 2009 and 2008, are as follows:

($ in millions)

Foreign

Currency

Balance Purchase Translation Balance

January 1, Goodwill Price and Other December 31,

Segment 2009 Additions Adjustments Divestitures Adjustments 2009

Global Business Services $ 3,870 $ — $ — $ — $ 172 $ 4,042

Global Technology Services 2,616 10 1 — 150 2,777

Software 10,966 994 (50) (13) 708 12,605

Systems and Technology 772 — (7) — 1 766

Total $18,226 $1,004 $(56) $(13) $1,031 $20,190

Foreign

Currency

Balance Purchase Translation Balance

January 1, Goodwill Price and Other December 31,

Segment 2008 Additions Adjustments Divestitures Adjustments 2008

Global Business Services $ 4,041 $ — $ (4) $(16) $ (151) $ 3,870

Global Technology Services 2,914 68 (5) — (361) 2,616

Software 6,846 5,225 (85) — (1,018) 10,966

Systems and Technology 484 280 9 — (1) 772

Total $14,285 $5,573 $(85) $(16) $(1,531) $18,226

Purchase price adjustments recorded in 2009 were related to

acquisitions that were completed on or prior to December 31,

2008 and were still subject to the measurement period that ends

at the earlier of 12 months from the acquisition date or when

information becomes available. There were no goodwill impair-

ment losses recorded in 2009 or 2008, and the company has

no accumulated impairment losses.

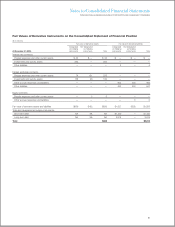

Note K.

Borrowings

Short-Term Debt

($ in millions)

At December 31: 2009 2008

Commercial paper $ 235 $ 468

Short-term loans 1,711 1,827

Long-term debt — current maturities 2,222 8,942

Total $4,168 $11,236

The weighted-average interest rates for commercial paper at

December 31, 2009 and 2008, were 0.1 percent and 3.1 percent,

respectively. The weighted-average interest rates for short-term

loans were 1.8 percent and 4.5 percent at December 31, 2009

and 2008, respectively.

($ in millions)

Capitalized Acquired

Software Intangibles Total

2010 $570 $422 $992

2011 277 373 650

2012 72 306 377

2013 — 277 277

2014 — 149 149

90