IBM 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

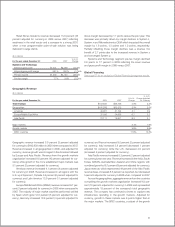

Consistent with accounting standards, the company remea-

sures the funded status of its retirement and postretirement

plans at December 31. The funded status is measured as the

difference between the fair value of the plan assets and the ben-

efit obligation and is recognized in the Consolidated Statement

of Financial Position. At December 31, 2009, primarily as a result

of improved returns on plan assets, the overall net underfunded

position decreased $4,667 million from December 31, 2008, to

a net underfunded position of $13,818 million. This change is

primarily reflected in prepaid pension assets and retirement and

nonpension postretirement benefit obligations which increased

$1,401 million and decreased $3,500 million, respectively, from

year-end 2008 levels. Due to the improvement in the equity

markets in 2009, the return on the U.S. Personal Pension Plan

assets was 11 percent, compared to a negative 15 percent in

2008. The company’s asset return in the non-U.S. plans was

approximately 14 percent compared to a negative 21 percent in

2008. At December 31, 2009, the company’s qualified defined

benefit plans worldwide were 99 percent funded with the U.S.

qualified Personal Pension Plan 101 percent funded.

In addition, total equity increased $9,170 million, net of tax,

primarily as a result of an improvement in retained earnings of

$10,546 million driven by current year net income, partially offset

by net stock transactions which declined $4,390 million primarily

due to common stock repurchases.

The assets and debt associated with the Global Financing

business are a significant part of the company’s financial posi-

tion. The financial position amounts appearing on page 65

are the consolidated amounts including Global Financing. The

amounts appearing in the separate Global Financing section

on pages 57 through 61 are supplementary data presented to

facilitate an understanding of the Global Financing business.

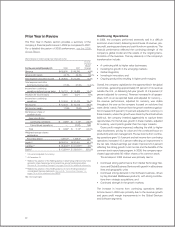

Working Capital

($ in millions)

At December 31: 2009 2008

Current assets $48,935 $49,004

Current liabilities 36,002 42,435

Working capital $12,933 $ 6,568

Current ratio 1.36 1.15

Working capital increased $6,365 million compared to the prior

year primarily as a result of a net decrease in current liabilities.

The key drivers are described below:

Current assets decreased $68 million due to:

• An increase of $1,066 million in cash and cash equivalents

and marketable securities (see Cash Flow analysis below

and on page 36); partially offset by;

• A decrease of $1,541 million in short-term receivables, offset

by a currency benefit of $779 million, driven by short-term

financing receivables due to lower volumes;

• A decrease of $353 million in prepaid expenses and other

current assets primarily resulting from:

– a decrease of $500 million in derivative assets as a result of

changes in foreign currency rates primarily driven by instru-

ments in cash flow hedging relationships; partially offset by;

– an increase of approximately $236 million in services pre-

paid and deferred transition costs; and

– a currency benefit of $135 million.

Current liabilities decreased $6,433 million as a result of:

• A decrease in short-term debt of $7,068 million primarily

driven by:

– $12,123 million in payments; partially offset by;

– reclasses of $2,282 million from long-term to short-term

debt to reflect maturity dates; and

– $3,502 million in new debt issuances.

• A decrease of $1,357 million in other accrued expenses and

liabilities primarily due to:

– a decrease of $508 million in derivative liabilities as a result

of changes in foreign currency rates primarily for certain

economic hedges;

– a decrease of $349 million in workforce reduction accru-

als; and

– a decrease of $218 million in deferred tax liabilities; partially

offset by;

• An increase of $1,083 million in taxes payable as a result of

a reclass from noncurrent liabilities related to uncertain tax

benefits and higher pre-tax income;

• An increase of $606 million in deferred income mainly driven

by a currency impact of approximately $329 million; and

• An increase of $423 million in accounts payable including a

currency impact of $131 million.

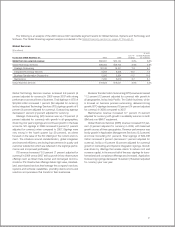

Cash Flow

The company’s cash flow from operating, investing and financ-

ing activities, as reflected in the Consolidated Statement of Cash

Flows on page 66, is summarized in the following table. These

amounts include the cash flows associated with the Global

Financing business.

35