IBM 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

enable stronger regulatory and corporate compliance and improve

overall information technology performance. Serbian Business

Systems establishes the company’s maintenance and technical

support services business in Serbia.

Global Business Services completed one acquisition in the

fourth quarter: IT Gruppen AS, which will add to the company’s

presence in the retail and media sectors.

Systems and Technology completed one acquisition in the

fourth quarter: XIV, Ltd., a privately held company focused on

storage systems technology.

Purchase price consideration was paid in cash. These

acquisitions are reported in the Consolidated Statement of Cash

Flows net of acquired cash and cash equivalents.

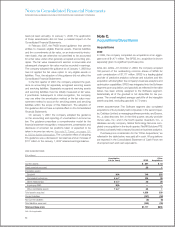

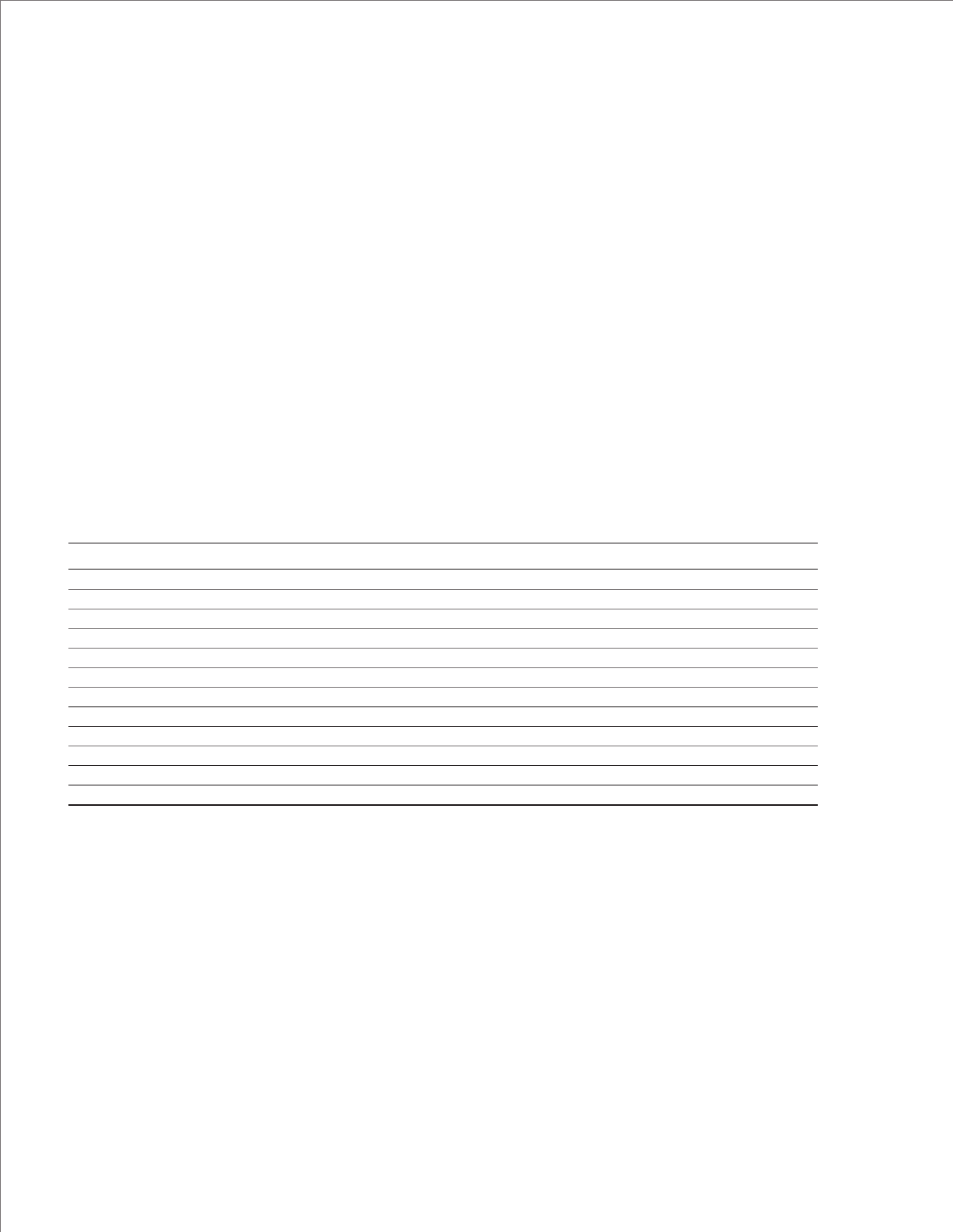

The table below reflects the purchase price related to these

acquisitions and the resulting purchase price allocations as of

Dec ember 31, 2007.

The acquisitions were accounted for as purchase transac-

tions, and accordingly, the assets and liabilities of the acquired

entities were recorded at their estimated fair values at the date

of acquisition. The primary items that generated the goodwill

are the value of the synergies between the acquired companies

and IBM and the acquired assembled workforce, neither of

which qualify as an amortizable intangible asset. Substantially

all of the goodwill is not deductible for tax purposes. The overall

weighted-average life of the identified amortizable intangible

assets acquired is 5.4 years. With the exception of goodwill,

these identified intangible assets will be amortized over their

useful lives. Goodwill of $999 million was assigned to the

Software ($639 million), Global Business Services ($14 million),

Global Technology Services ($76 million) and Systems and

Technology ($269 million) segments.

2007 ACQUISITIONS

($ in millions)

Amortization

Life (in Years) Acquisitions

Current assets $ 184

Fixed assets/noncurrent 31

Intangible assets:

Goodwill N/A 999

Completed technology 3 to 7 93

Client relationships 3 to 7 91

Other 2 to 5 17

Total assets acquired 1,415

Current liabilities (136)

Noncurrent liabilities (135)

Total liabilities assumed (271)

Total purchase price $1,144

N/A—Not applicable

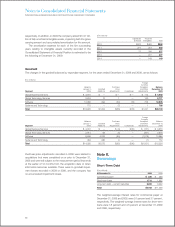

Divestitures

2009

On October 26, 2009, the company announced that it had

signed an agreement with Dassault Systemes (DS) under which

DS would acquire the company’s activities associated with sales

and support of DS’s product lifecycle management (PLM) soft-

ware solutions, including customer contracts and related assets.

This transaction is subject to customary closing conditions and

is expected to close in the first quarter of 2010. The company

expects to record a gain when this transaction is completed.

On October 1, 2009, the company completed the divestiture

of its UniData and UniVerse software products and related tools

to Rocket Software, a privately held global software develop-

ment firm. The company recognized a gain on the transaction in

the fourth quarter.

On March 16, 2009, the company completed the sale of cer-

tain processes, resources, assets and third-party contracts related

to its core logistics operations to Geodis. The company received

proceeds of $365 million and recognized a net gain of $298

million on the transaction in the first quarter of 2009. The gain

was net of the fair value of certain contractual terms, certain

transaction costs and related real estate charges. As part of this

transaction, the company outsourced its logistics operations to

Geodis which enables the company to leverage industry-leading

skills and scale and improve the productivity of the company’s

supply chain.

2007

In January 2007, the company announced an agreement with

Ricoh Company Limited (Ricoh), a publicly traded company,

to form a joint venture company based on the Printing System

Division (a division of the Systems and Technology segment).

85