IBM 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

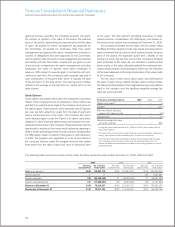

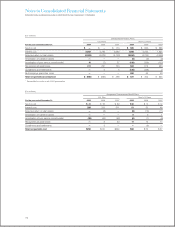

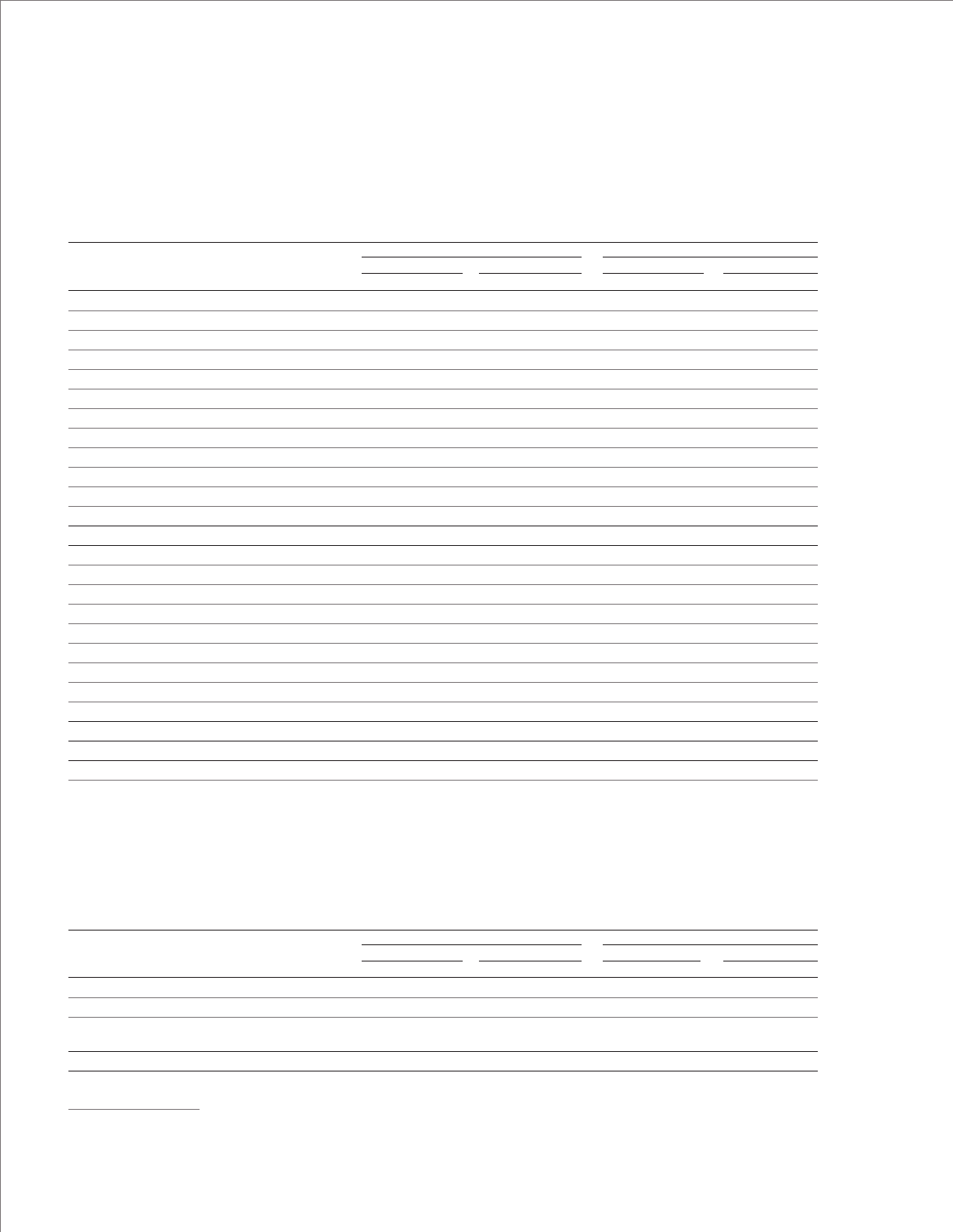

The following table presents the changes in benefit obligations and plan assets of the company’s retirement-related benefit plans.

($ in millions)

Defined Benefit Pension Plans Nonpension Postretirement Benefit Plans

U.S. Plans Non-U.S. Plans* U.S. Plan Non-U.S. Plans

2009 2008 2009 2008 2009 2008 2009 2008

Change in benefit obligation:

Benefit obligation at January 1 $48,756 $47,673 $39,171 $ 42,291 $ 5,224 $ 5,472 $ 608 $ 769

Service cost — — 585 660 41 55 10 10

Interest cost 2,682 2,756 1,898 2,042 289 312 51 53

Plan participants’ contributions — — 58 63 228 216 — —

Acquisitions/divestitures, net — — (58) (6) — — (2) (1)

Actuarial losses/(gains) 155 1,183 506 (64) (65) (191) 14 (12)

Benefits paid from trust (3,144) (2,999) (1,855) (1,814) (646) (656) (6) (31)

Direct benefit payments (94) (81) (464) (486) (25) (24) (23) (21)

Foreign exchange impact — — 1,920 (3,357) — — 111 (146)

Medicare subsidy — — — — 52 37 — —

Plan amendments/curtailments/settlements — 224 (454) (157) — 3 4 (13)

Benefit obligation at December 31 $48,354 $48,756 $41,308 $ 39,171 $ 5,100 $ 5,224 $ 767 $ 608

Change in plan assets:

Fair value of plan assets at January 1 $45,918 $57,191 $29,164 $ 41,696 $ 113 $ 504 $ 79 $ 121

Actual return on plan assets 4,496 (8,274) 4,030 (7,678) (1) 4 8 10

Employer contributions — — 1,195 858 338 45 1 10

Acquisitions/divestitures, net — — (29) 16 — — — —

Plan participants’ contributions — — 58 63 228 216 — —

Benefits paid from trust (3,144) (2,999) (1,855) (1,814) (646) (656) (6) (31)

Foreign exchange impact — — 1,710 (3,978) — — 23 (30)

Plan amendments/curtailments/settlements — — 33 2 — — (1) —

Fair value of plan assets at December 31 $47,269 $45,918 $34,305 $ 29,164 $ 33 $ 113 $ 104 $ 79

Funded status at December 31 $ (1,085) $ (2,838) $ (7,003) $(10,007) $(5,067) $(5,111) $(663) $(529)

Accumulated benefit obligation** $48,354 $48,756 $40,339 $ 37,759 N/A N/A N/A N/A

* Excludes a defined benefit pension plan in Brazil due to restrictions on the use of plan assets imposed by governmental regulations.

** Represents the benefit obligation assuming no future participant compensation increases.

N/A—Not applicable

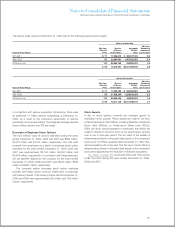

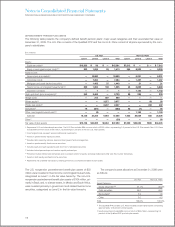

The following table presents the net funded status recognized in the Consolidated Statement of Financial Position.

($ in millions)

Defined Benefit Pension Plans Nonpension Postretirement Benefit Plans

U.S. Plans Non-U.S. Plans* U.S. Plan Non-U.S. Plans

At December 31: 2009 2008 2009 2008 2009 2008 2009 2008

Prepaid pension assets $ 359 $ — $ 2,641 $ 1,598 $ — $ — $ 1 $ 3

Current liabilities—Compensation and benefits (91) (86) (326) (283) (425) (255) (24) (9)

Noncurrent liabilities—Retirement and

nonpension postretirement benefit obligations (1,353) (2,752) (9,318) (11,322) (4,642) (4,856) (640) (523)

Funded status — net $(1,085) $(2,838) $(7,003) $(10,007) $(5,067) $(5,111) $(663) $(529)

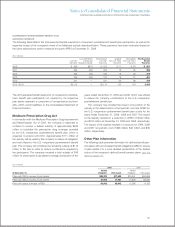

The table on page 114 presents the pre-tax net loss and prior service costs/(credits) and transition (assets)/liabilities recognized in

other comprehensive income/(loss) and the changes in pre-tax net loss, prior service costs/(credits) and transition (assets)/liabilities

recognized in accumulated other comprehensive income/(loss) for the retirement-related benefit plans.

113