IBM 2009 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

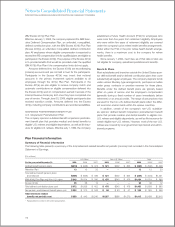

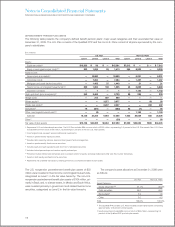

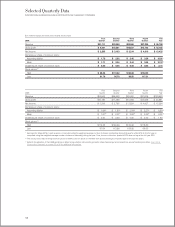

The following table presents the reconciliation of the beginning and ending balances of Level 3 assets for the year ended December

31, 2009 for the U.S. Plan:

($ in millions)

Equity Mortgage Fixed

Commingled/ And Income Private

Mutual Asset-Backed Commingled/ Hedge Private Real

Funds Securities Mutual Funds Funds Equity Estate Total

Balance at January 1 $ — $47 $180 $513 $3,169 $2,698 $6,607

Return on assets held at end of year 1 11 11 80 575 (634) 44

Return on assets sold during the year — 1 — 2 14 (98) (81)

Purchases, sales and settlements, net 25 (7) — (8) 118 281 408

Transfers, net — (14) — — — — (14)

Balance at December 31 $26 $37 $192 $587 $3,877 $2,247 $6,964

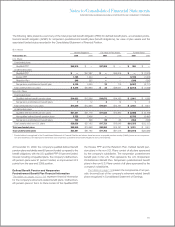

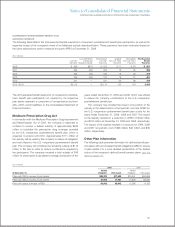

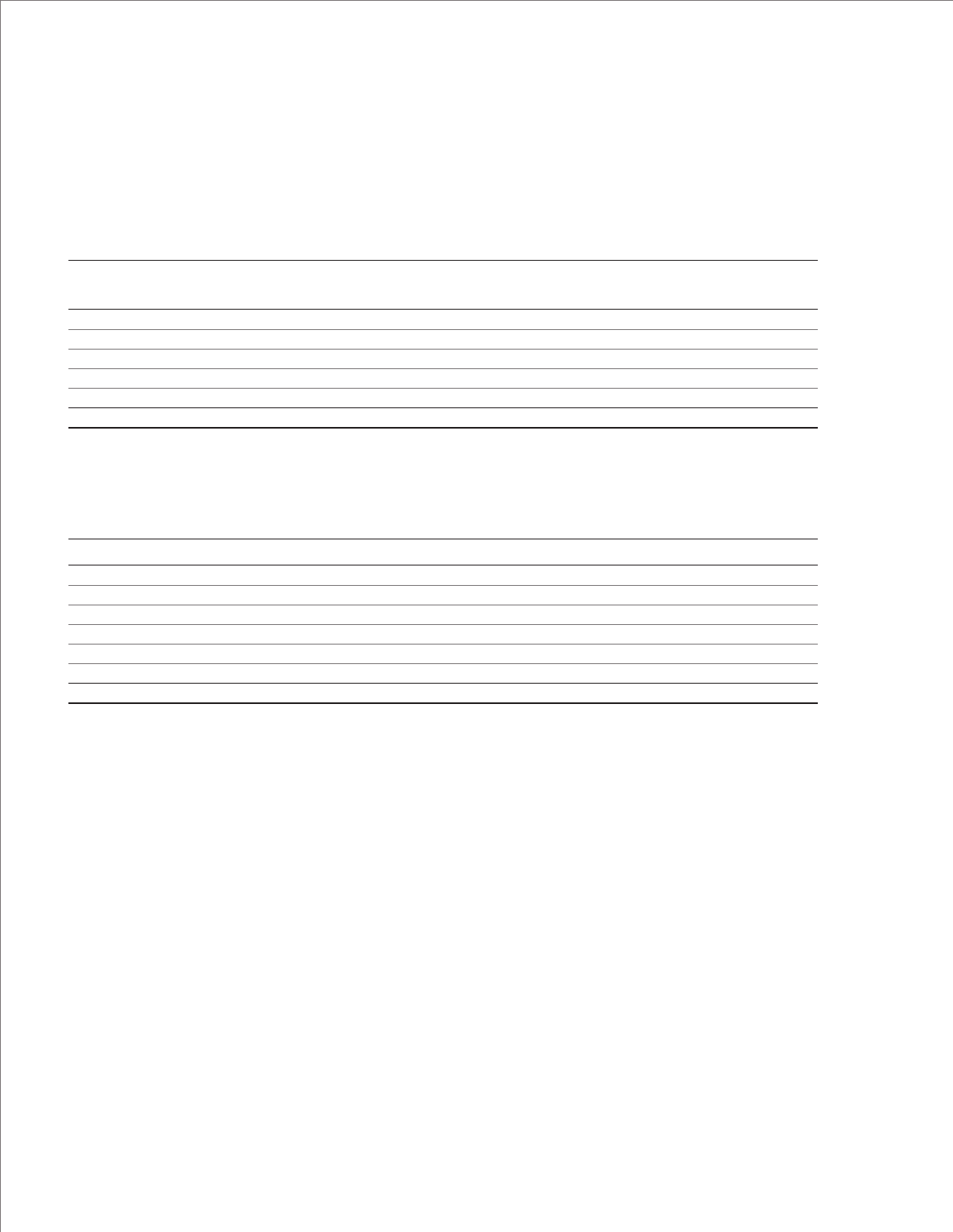

The following table presents the reconciliation of the beginning and ending balances of Level 3 assets for the year ended December

31, 2009 for the non-U.S. Plans:

($ in millions)

Private Private

Equity Real Estate Total

Balance at January 1 $ 64 $429 $494

Return on assets held at end of year (10) (10) (19)

Return on assets sold during the year — — 1

Purchases, sales and settlements, net 32 27 59

Transfers, net — — —

Foreign exchange impact 6 46 51

Balance at December 31 $ 93 $492 $585

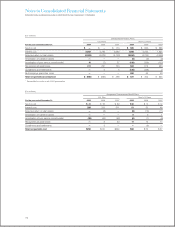

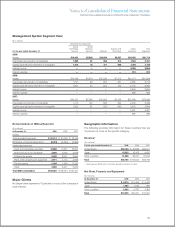

VALUATION TECHNIQUES

The following is a description of the valuation techniques used

to measure plan assets at fair value. There were no changes in

valuation techniques during 2009 and 2008.

Equity securities are valued at the closing price reported on

the stock exchange on which the individual securities are traded.

IBM common stock is valued at the closing price reported on the

New York Stock Exchange. Equity commingled/mutual funds

are typically valued using the net asset value (NAV) provided by

the administrator of the fund and reviewed by the company. The

NAV is based on the value of the underlying assets owned by

the fund, minus liabilities and divided by the number of shares or

units outstanding. These assets are classified as Level 1, Level 2

or Level 3 depending on availability of quoted market prices.

The fair value of fixed income securities is typically estimated

using pricing models, quoted prices of securities with similar

characteristics or discounted cash flows and are generally clas-

sified as Level 2. If available, they are valued using the closing

price reported on the major market on which the individual

securities are traded.

Cash includes money market accounts that are valued at

their cost plus interest on a daily basis, which approximates fair

value. Short-term investments represent securities with original

maturities of one year or less. These assets are classified as Level

1 or Level 2.

Private equity and private real estate partnership valuations

require significant judgment due to the absence of quoted mar-

ket prices, the inherent lack of liquidity and the long-term nature

of such assets. These assets are initially valued at cost and are

reviewed periodically utilizing available and relevant market data

to determine if the carrying value of these assets should be

adjusted. These investments are classified as Level 3. The valu-

ation methodology is applied consistently from period to period.

119