IBM 2009 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

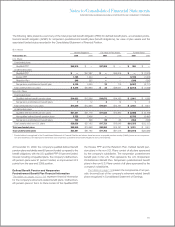

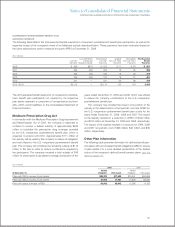

NONPENSION POSTRETIREMENT BENEFIT PLAN

EXPECTED PAYMENTS

The following table reflects the total expected benefit payments to nonpension postretirement benefit plan participants, as well as the

expected receipt of the company’s share of the Medicare subsidy described below. These payments have been estimated based on

the same assumptions used to measure the plan’s APBO at December 31, 2009.

($ in millions)

Less: IBM Share Net Expected Qualified Nonqualified Total Expected

U.S. Plan of Expected U.S. Plan Non-U.S. Plans Non-U.S. Plans Benefit

Payments Medicare Subsidy Payments Payments Payments Payments

2010 $ 499 $(27) $ 472 $ 11 $ 24 $ 507

2011 492 (28) 464 15 25 503

2012 458 (28) 430 16 26 472

2013 440 (28) 412 18 27 457

2014 431 — 431 20 28 479

2015

–

2019 $2,113 — $2,113 135 154 2,402

The 2010 expected benefit payments to nonpension postretire-

ment benefit plan participants not covered by the respective

plan assets represent a component of compensation and ben-

efits, within current liabilities, in the Consolidated Statement of

Financial Position.

Medicare Prescription Drug Act

In connection with the Medicare Prescription Drug Improvement

and Modernization Act of 2003, the company is expected to

continue to receive a federal subsidy of approximately $229

million to subsidize the prescription drug coverage provided

by the U.S. nonpension postretirement benefit plan, which is

expected to extend until 2013. Approx imately $111 million of

the subsidy will be used by the company to reduce its obligation

and cost related to the U.S. nonpension postretirement benefit

plan. The company will contribute the remaining subsidy of $118

million to the plan in order to reduce contributions required by

the participants. The company received a total subsidy of $45

million for prescription drug-related coverage during each of the

years ended December 31, 2009 and 2008, which was utilized

to reduce the company contributions to the U.S. nonpension

postretirement benefit plan.

The company has included the impact of its portion of the

subsidy in the determination of net periodic cost and APBO for

the U.S. nonpension postretirement benefit plan at and for the

years ended December 31, 2009, 2008 and 2007. The impact

of the subsidy resulted in a reduction in APBO of $100 million

and $127 million at December 31, 2009 and 2008, respectively.

The impact of the subsidy resulted in a reduction in 2009, 2008

and 2007 net periodic cost of $28 million, $40 million and $36

million, respectively.

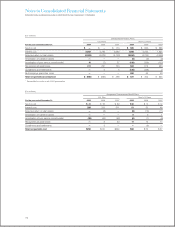

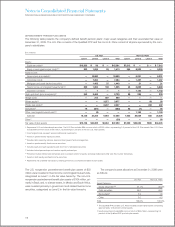

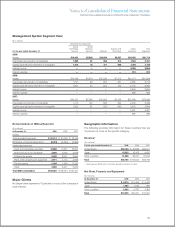

Other Plan Information

The following table presents information for defined benefit pen-

sion plans with accumulated benefit obligations (ABO) in excess

of plan assets. For a more detailed presentation of the funded

status of the company’s defined benefit pension plans, see the

table on page 113.

($ in millions)

2009 2008

Benefit Benefit

At December 31: Obligation Plan Assets Obligation Plan Assets

Plans with PBO in excess of plan assets $28,720 $17,633 $75,341 $60,898

Plans with ABO in excess of plan assets 27,996 17,561 73,939 60,630

Plans with assets in excess of PBO 60,942 63,942 12,586 14,183

121