IBM 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

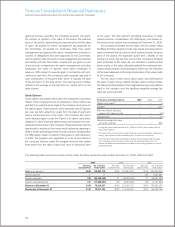

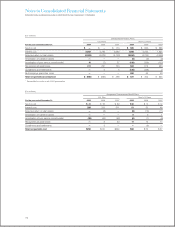

The following table presents a summary of the total projected benefit obligation (PBO) for defined benefit plans, accumulated postre-

tirement benefit obligation (APBO) for nonpension postretirement benefit plans (benefit obligations), fair value of plan assets and the

associated funded status recorded in the Consolidated Statement of Financial Position.

($ in millions)

Benefit Obligations Fair Value of Plan Assets Funded Status*

At December 31: 2009 2008 2009 2008 2009 2008

U.S. Plans:

Overfunded plans:

Qualified PPP $46,910 $ — $47,269 $ — $ 359 $ —

Underfunded plans:

Qualified PPP $ — $47,297 $ — $45,918 $ — $ (1,379)

Excess PPP 1,195 1,224 — — (1,195) (1,224)

Retention Plan 249 235 — — (249) (235)

Nonpension postretirement benefit plan 5,100 5,224 33 113 (5,067) (5,111)

Total underfunded U.S. plans $ 6,545 $53,980 $ 33 $46,031 $ (6,512) $ (7,949)

Non-U.S. Plans:

Overfunded plans:

Qualified defined benefit pension plans $14,032 $12,586 $16,673 $14,183 $ 2,641 $ 1,598

Nonpension postretirement benefit plans 7 12 8 14 1 3

Total overfunded non-U.S. plans $14,039 $12,598 $16,681 $14,197 $ 2,642 $ 1,601

Underfunded plans:

Qualified defined benefit pension plans $21,521 $21,179 $17,633 $14,980 $ (3,888) $ (6,199)

Nonqualified defined benefit pension plans 5,755 5,406 — — (5,755) (5,406)

Nonpension postretirement benefit plans 760 596 96 65 (664) (532)

Total underfunded non-U.S. plans $28,036 $27,182 $17,729 $15,045 $(10,307) $(12,137)

Total overfunded plans $60,949 $12,598 $63,950 $14,197 $ 3,001 $ 1,601

Total underfunded plans $34,581 $81,162 $17,762 $61,076 $(16,819) $(20,086)

* Funded status is recognized in the Consolidated Statement of Financial Position as follows: Asset amounts as prepaid pension assets; (Liability) amounts as compensa-

tion and benefits (current liability) and retirement and nonpension postretirement benefit obligations (noncurrent liability).

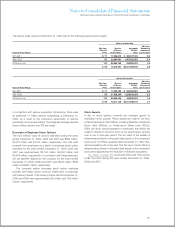

At December 31, 2009, the company’s qualified defined benefit

pension plans worldwide were 99 percent funded compared to the

benefit obligations, with the U.S. qualified PPP 101 percent funded.

Overall, including nonqualifed plans, the company’s defined ben-

efit pension plans were 91 percent funded, an improvement of 6

points from the year-end 2008 position.

Defined Benefit Pension and Nonpension

Postretirement Benefit Plan Financial Information

The tables on pages 112 to 114 represent financial information

for the company’s retirement-related benefit plans. Defined ben-

efit pension plans in the U.S. Plans consist of the Qualified PPP,

the Excess PPP and the Retention Plan. Defined benefit pen-

sion plans in the non-U.S. Plans consist of all plans sponsored

by the company’s subsidiaries. The nonpension postretirement

benefit plan in the U.S. Plan represents the U.S. Non pension

Postretirement Benefit Plan. Nonpension postretirement benefit

plans in the non-U.S. Plans consist of all plans sponsored by the

company’s subsidiaries.

The tables on page 112 present the components of net peri-

odic (income)/cost of the company’s retirement-related benefit

plans recognized in Consoli dated Statement of Earnings.

111