IBM 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

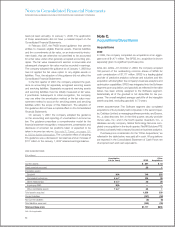

Debt and Marketable Equity Securities

The following table summarizes the company’s debt and market-

able equity securities all of which are considered available-for-sale

and re cord ed at fair value in the Consolidated Statement of Finan-

cial Position.

($ in millions)

Fair Value

At December 31: 2009 2008

Cash and cash equivalents:*

Time deposits and certificates of deposit $4,324 $ 4,805

Commercial paper 2,099 3,194

Money market funds 2,780 1,950

Other securities 74 60

Total $9,277 $10,009

Debt securities—current:**

Commercial paper $1,491 $ 166

Securities of U.S. Federal government

and its agencies 300 —

Total $1,791 $ 166

Debt securities—noncurrent:***

Other securities $ 9 $ 6

Total $ 9 $ 6

Non-equity method alliance investments*** $ 374 $ 165

* Included within cash and cash equivalents in the Consolidated Statement of

Financial Position.

** Reported as marketable securities within the Consolidated Statement of

Financial Position.

*** Included within investments and sundry assets in the Consolidated Statement

of Financial Position. See note I, “Investments and Sundry Assets,” on page 89.

Gross unrealized gains (before taxes) on debt securities were

less than $1 million and $1 million at December 31, 2009 and

2008, respectively. Gross unrealized gains (before taxes) on

marketable equity securities were $201 million and $31 million

at December 31, 2009 and 2008, respectively. Gross unrealized

losses (before taxes) on debt securities were less than $1 mil-

lion at December 31, 2009 and 2008. Gross unrealized losses

(before taxes) on marketable equity securities were $10 million

and $27 million at December 31, 2009 and 2008, respectively.

Based on an evaluation of available evidence as of December

31, 2009, the company believes that unrealized losses on mar-

ketable equity securities are temporary and do not represent

a need for an other-than-temporary impairment. See note N,

“Equity Activity,” on pages 98 and 99 for net change in unreal-

ized gains and losses on debt and marketable equity securities.

Proceeds from sales of debt securities and marketable

equity securities were approximately $24 million and $787

million during 2009 and 2008, respectively. The gross realized

gains and losses (before taxes) on these sales totaled $3 million

and $40 million, respectively in 2009. The gross realized gains

and losses (before taxes) on these sales totaled $182 million and

$13 million, respectively, in 2008.

The contractual maturities of substantially all available-for-sale

debt securities are due in less than one year at December 31, 2009.

Note F.

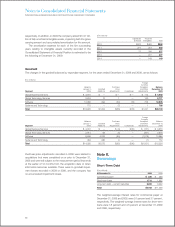

Inventories

($ in millions)

At December 31: 2009 2008

Finished goods $ 533 $ 524

Work in process and raw materials 1,960 2,176

Total $2,494 $2,701

Note G.

Financing Receivables

($ in millions)

At December 31: 2009 2008

Current:

Net investment in sales-type and

direct financing leases $ 4,105 $ 4,226

Commercial financing receivables 5,604 5,781

Client loan receivables 4,475 4,861

Installment payment receivables 730 608

Total $14,914 $15,477

Noncurrent:

Net investment in sales-type and

direct financing leases $ 5,331 $ 5,938

Commercial financing receivables 58 94

Client loan receivables 4,759 4,718

Installment payment receivables 496 433

Total $10,644 $11,183

Net investment in sales-type and direct financing leases is for

leases that relate principally to the company’s systems products

and are for terms ranging generally from two to six years. Net

investment in sales-type and direct financing leases includes

unguaranteed residual values of $849 million and $916 million

at December 31, 2009 and 2008, respectively, and is reflected

net of unearned income of $905 million and $1,049 million and

of allowance for doubtful accounts receivable of $159 million

and $217 million at those dates, respectively. Scheduled maturi-

ties of minimum lease payments outstanding at December 31,

2009, expressed as a percentage of the total, are approximately:

2010, 49 percent; 2011, 27 percent; 2012, 15 percent; 2013, 6

percent; and 2014 and beyond, 2 percent.

Commercial financing receivables relate primarily to inventory

and accounts receivable financing for dealers and remarketers

of IBM and non-IBM products. Payment terms for inventory and

accounts receivable financing generally range from 30 to 90 days.

Client loan receivables are loans that are provided by Global

Financing primarily to clients to finance the purchase of soft-

ware and services. Separate contractual relationships on these

88