IBM 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

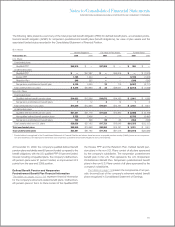

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

The settlements and reductions to the unrecognized tax

benefits for tax positions of prior years are primarily attributable to

the conclusion of the company’s various U.S., state and non-U.S.

income tax examinations and various non-U.S. matters including

impacts due to lapses in statutes of limitation.

The liability at December 31, 2009 of $4,790 million can be

reduced by $577 million of offsetting tax benefits associated with

the correlative effects of potential transfer pricing adjustments,

state income taxes and timing adjustments. The net amount of

$4,213 million, if recognized, would favorably affect the com-

pany’s effective tax rate. The net amounts at December 31,

2008 and December 31, 2007 were $3,366 million and $2,598

million, respectively.

Interest and penalties related to income tax liabilities are

included in income tax expense. During the year ended December

31, 2009, the company recognized $193 million in interest and

penalties; in 2008, the company recognized $96 million in inter-

est and penalties and in 2007, the company recognized $85

million in interest and penalties. The company has $479 million

for the payment of interest and penalties accrued at December

31, 2009 and had $286 million accrued at December 31, 2008.

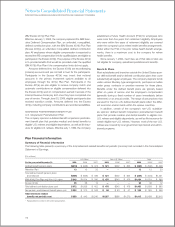

Within the next 12 months, the company believes it is reason-

ably possible that the total amount of unrecognized tax benefits

associated with certain positions may be significantly reduced.

The potential decrease in the amount of unrecognized tax ben-

efits is primarily associated with the possible resolution of the

company’s U.S. income tax audit for 2006 and 2007, as well as

various non-U.S. audits. Specific positions that may be resolved,

and that may significantly reduce the related amount of unrecog-

nized tax benefits, include transfer pricing matters, tax incentives

and credits as well as various other foreign tax matters including

foreign tax loss utilization. The company estimates that the unrec-

ognized tax benefits at December 31, 2009 could be reduced by

approximately $1,100 million.

With limited exception, the company is no longer subject to

U.S. federal, state and local or non-U.S. income tax audits by

taxing authorities for years through 2003. The years subsequent

to 2003 contain matters that could be subject to differing inter-

pretations of applicable tax laws and regulations as it relates to

the amount and/or timing of income, deductions and tax credits.

Although the outcome of tax audits is always uncertain, the

company believes that adequate amounts of tax and interest

have been provided for any adjustments that are expected to

result for these years.

During the fourth quarter of 2008, the U.S. Internal Revenue

Service (IRS) concluded its examination of the company’s income

tax returns for 2004 and 2005 and issued a final Revenue Agent’s

Report (RAR). The company has agreed with all of the adjust-

ments contained in the RAR, with the exception of a proposed

adjustment, with a pre-tax amount in excess of $2 billion, relating

to valuation matters associated with the intercompany transfer

of certain intellectual property in 2005 and computational issues

related to certain tax credits. The company disagrees with the

IRS position on these specific matters and in March 2009 filed a

protest with the IRS Appeals Office.

The audit of the company’s 2006 and 2007 U.S. income tax

returns commenced in the first quarter of 2009. The company

anticipates that this audit will be completed by the end of 2010.

The company has not provided deferred taxes on $26.0

billion of undistributed earnings of non-U.S. subsidiaries at

December 31, 2009, as it is the company’s policy to indefinitely

reinvest these earnings in non-U.S. operations. However, the

company periodically repatriates a portion of these earnings to

the extent that it does not incur an additional U.S. tax liability.

Quantification of the deferred tax liability, if any, associated with

indefinitely reinvested earnings is not practicable.

For additional information on the company’s effective tax

rate refer to the “Looking Forward” section of the Management

Discussion on pages 47 to 49.

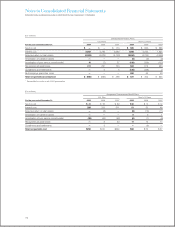

Note Q.

Research, Development

and Engineering

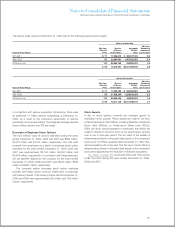

RD&E expense was $5,820 million in 2009, $6,337 million in

2008 and $6,153 million in 2007.

The company incurred expense of $5,523 million in 2009,

$6,015 million in 2008 and $5,754 million in 2007 for scien-

tific research and the application of scientific advances to the

development of new and improved products and their uses, as

well as services and their application. Within these amounts,

software-related expense was $2,991 million, $3,359 million and

$3,037 million in 2009, 2008 and 2007, respectively. In addition,

included in the expense was a charge of $24 million in 2008 for

acquired IPR&D.

Expense for product-related engineering was $297 million,

$322 million and $399 million in 2009, 2008 and 2007, respectively.

103