IBM 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overall retirement-related benefit costs decreased $24 million

versus 2008. Total plan costs decreased $142 millon year-to-

year, driven by lower defined contribution plans cost of $160

million compared to 2008. This decrease was offset by higher

costs for mandatory pension insolvency insurance coverage.

During the year ended December 31, 2009, the company paid

$140 million for mandatory pension insolvency insurance cover-

age in certain non-U.S. countries, an increase year to year of

$117 million driven primarily by premiums paid in Germany. While

not related to the IBM Plans, all companies with plans in Germany

and several other countries are subject to these charges.

Retirement-related plan costs decreased approximately $16

million in cost, $4 million in SG&A expense and $3 million in

RD&E expense.

See note U, “Retirement-Related Benefits,” on pages 109

through 121 for additional information on these plans and the

factors driving the year-to-year change in total cost.

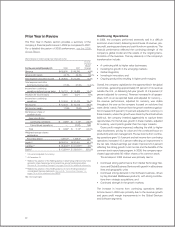

Acquired Intangible Asset Amortization

The company has been investing in targeted acquisitions to

increase its capabilities in higher value businesses. The following

table presents the total acquired intangible asset amortization

included in the Consol idated Statement of Earnings. See note

J, “Intangible Assets Including Goodwill,” on pages 89 and 90

for additional information.

($ in millions)

Yr.-to-Yr.

For the year ended December 31: 2009 2008 Change

Cost:

Software (Sales) $160 $173 (7.5)%

Global Technology Services (Services) 33 32 2.2

Systems and Technology (Sales) 11 8 27.0

Selling, general and

administrative expense 285 306 (6.9)

Total $489 $520 (6.0)%

Income Taxes

The effective tax rate for 2009 was 26.0 percent, compared

with 26.2 percent in 2008. The 0.2 point decrease was primarily

driven by a more favorable geographic mix of pre-tax income,

the absence of the 2008 tax cost impacts associated with the

intercompany transfer of certain intellectual property and the

agreements reached regarding the completion of the U.S. federal

income tax examination for the years 2004 and 2005, includ-

ing the associated income tax reserve redeterminations. These

benefits were offset by a decrease in 2009 in the utilization of

foreign tax credits.

Earnings Per Share

Basic earnings per share is computed on the basis of the weighted-

average number of shares of common stock outstanding during

the period. Diluted earnings per share is computed on the basis

of the weighted-average number of shares of common stock

outstanding plus the effect of dilutive potential common shares

outstanding during the period using the treasury stock method.

Dilutive potential common shares include outstanding stock

options, share awards and convertible notes.

Yr.-to-Yr.

For the year ended December 31: 2009 2008 Change

Earnings per share of common stock:

Assuming dilution $10.01 $ 8.89* 12.6%

Basic $10.12 $ 9.02* 12.2%

Weighted-average shares

outstanding (in millions):

Assuming dilution 1,341.4 1,387.8* (3.3)%

Basic 1,327.2 1,369.4* (3.1)%

* Reflects the adoption of the FASB guidance in determining whether instruments

granted in share-based payment transactions are participating securities. See

note B, “Accounting Changes,” on pages 79 to 82 for additional information.

Actual shares outstanding at December 31, 2009 and December

31, 2008 were 1,305.3 million and 1,339.1 million, respectively.

The average number of common shares outstanding assuming

dilution was 46.4 million shares lower in 2009 versus 2008. The

decrease was primarily the result of the common stock repur-

chase program. See note N, “Equity Activity,” on pages 98 and

99 for additional information regarding common stock activities.

Also see note R, “Earnings Per Share of Common Stock,” on

page 104.

Financial Position

Dynamics

At December 31, 2009, the company’s balance sheet and liquidity

position remain strong. Cash on hand at year end was $12,183

million. Total debt of $26,099 million decreased $7,826 million

from prior year-end levels, primarily as a result of the repayment

of debt issued in support of the 2007 accelerated share repur-

chase program. The commercial paper balance at December

31, 2009 was $235 million, down $233 million from December

31, 2008. In 2009, the company generated $20,773 million in

cash from operations, an increase of $1,961 million compared

to 2008. The company has consistently generated strong cash

flow from operations and continues to have access to additional

sources of liquidity through the capital markets and its $10 billion

global credit facility.

34