IBM 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Events that could temporarily change the historical cash flow

dynamics discussed above include significant changes in oper-

ating results, material changes in geographic sources of cash,

unexpected adverse impacts from litigation or future pension

funding requirements during periods of severe downturn in the

capital markets. Whether any litigation has such an adverse

impact will depend on a number of variables, which are more com-

pletely described in note O, “Contingencies and Commitments”

on pages 99 and 100. With respect to pension funding, in 2009,

the company contributed $1,252 million to its non-U.S. defined

benefit plans, versus $917 million in 2008. As highlighted in the

Contractual Obligations table on page 51, the company expects

to make legally mandated pension plan contributions to certain

non-U.S. plans of approximately $3.6 billion in the next five years.

The 2010 contributions are currently expected to be approxi-

mately $0.8 billion. Financial market performance in 2010 could

increase the legally mandated minimum contributions in certain

non-U.S. countries that require more frequent remeasurement

of the funded status. The company is not quantifying any fur-

ther impact from pension funding because it is not possible to

predict future movements in the capital markets or pension plan

funding regulations.

The Pension Protection Act of 2006 was enacted into law in

2006, and, among other things, increases the funding require-

ments for certain U.S. defined benefit plans beginning after

December 31, 2007. No mandatory contribution is required for

the U.S. defined benefit plan in 2010 as of December 31, 2009.

capital expenditures. As discussed on page 24, a key objective

of the Global Financing business is to generate strong returns on

equity. Increasing receivables is the basis for growth in a financing

business. Accordingly, management considers Global Financing

receivables as a profit-generating investment, not as working

capital that should be minimized for efficiency. After considering

Global Financing receivables as an investment, the remaining net

operational cash flow less net capital expenditures is viewed by

the company as free cash flow.

From the perspective of how management views cash flow, in

2009, free cash flow was $15.1 billion, an increase of $0.8 billion

compared to 2008. This cash performance was driven primarily

by the growth in net income of $1.1 billion, lower capital spending

of $0.8 billion and higher cash from sales cycle working capital

($1.2 billion), partially offset by higher retirement-related funding

($0.9 billion) and workforce rebalancing payments ($0.6 billion).

Over the past five years, the company generated over $61

billion in free cash flow. During that period, the company invested

$13.8 billion in strategic acquisitions and returned over $63 bil-

lion to shareholders through dividends and share repurchases.

The amount of prospective returns to shareholders in the form

of dividends and share repurchases will vary based upon several

factors including each year’s operating results, capital expendi-

ture requirements, research and development investments and

acquisitions, as well as the factors discussed below.

The company’s Board of Directors meets quarterly to consider

the dividend payment. The company expects to fund dividend

payments through cash from operations. In the second quarter

of 2009, the Board of Directors increased the company’s quar-

terly common stock dividend from $0.50 to $0.55 per share.

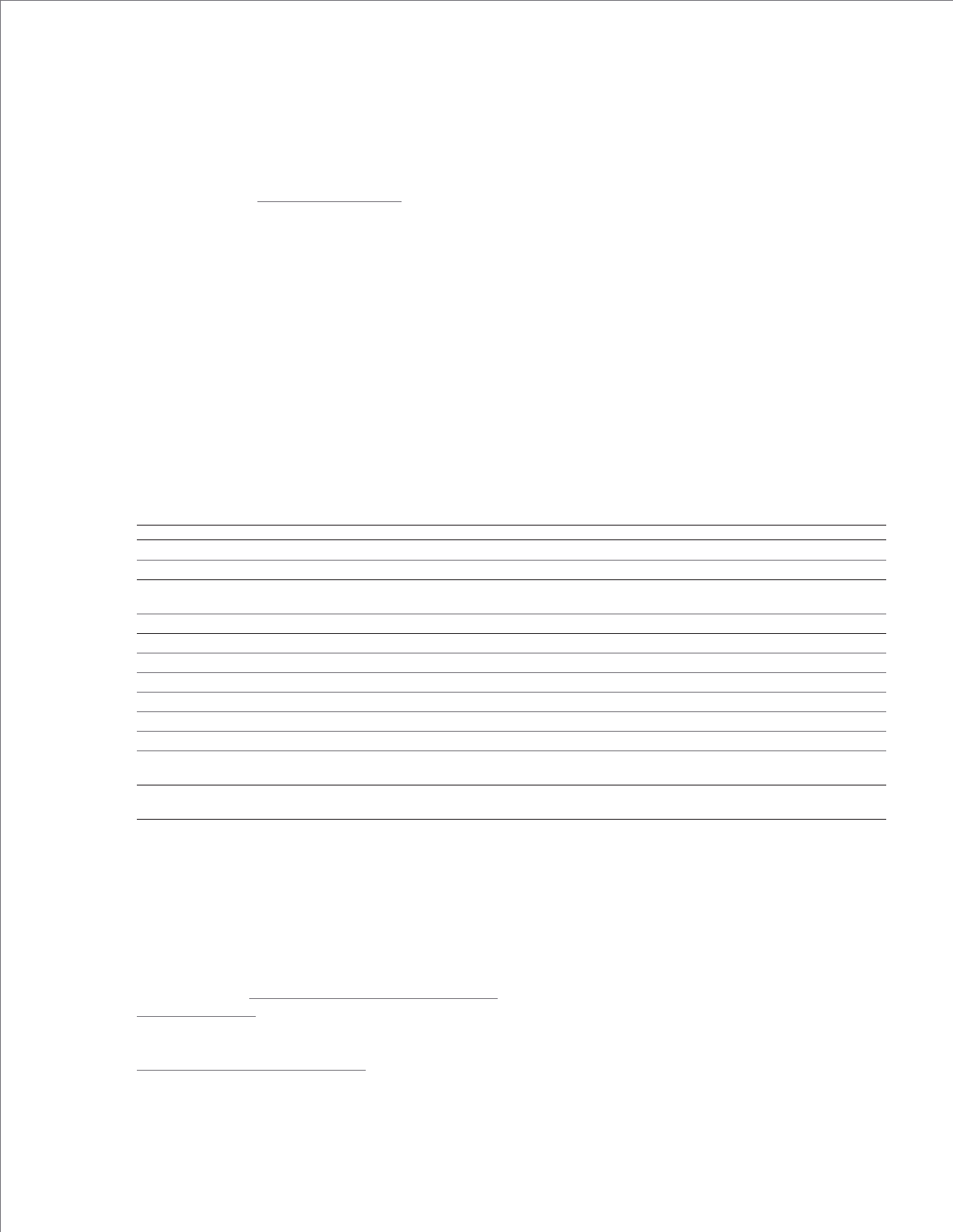

The table below represents the way in which management

reviews cash flow as described above.

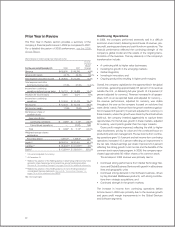

($ in billions)

For the year ended December 31: 2009 2008 2007 2006 2005

Net cash from operating activities per GAAP (Continuing Operations) $20.8 $ 18.8 $16.1 $15.0 $14.9

Less: Global Financing receivables (1.9) (0.0) (1.3) (0.3) 1.8

Net cash from operating activities (Continuing Operations),

excluding Global Financing receivables 18.9 18.8 17.4 15.3 13.1

Capital expenditures, net (3.7) (4.5) (5.0) (4.7) (3.5)

Free cash flow (excluding Global Financing receivables) 15.1 14.3 12.4 10.5 9.6

Acquisitions (1.2) (6.3) (1.0) (3.8) (1.5)

Divestitures 0.4 0.1 0.3 — 0.9

Share repurchase (7.4) (10.6) (18.8) (8.1) (7.7)

Dividends (2.9) (2.6) (2.1) (1.7) (1.2)

Non-Global Financing debt (4.7) (3.2) 10.9 (1.1) 1.2

Other (includes Global Financing receivables

and Global Financing debt) 1.7 5.0 3.8 1.1 1.9

Change in cash, cash equivalents

and short-term marketable securities $ 1.1 $ (3.2) $ 5.5 $ (3.0) $ 3.1

50