IBM 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

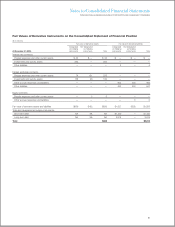

($ in millions)

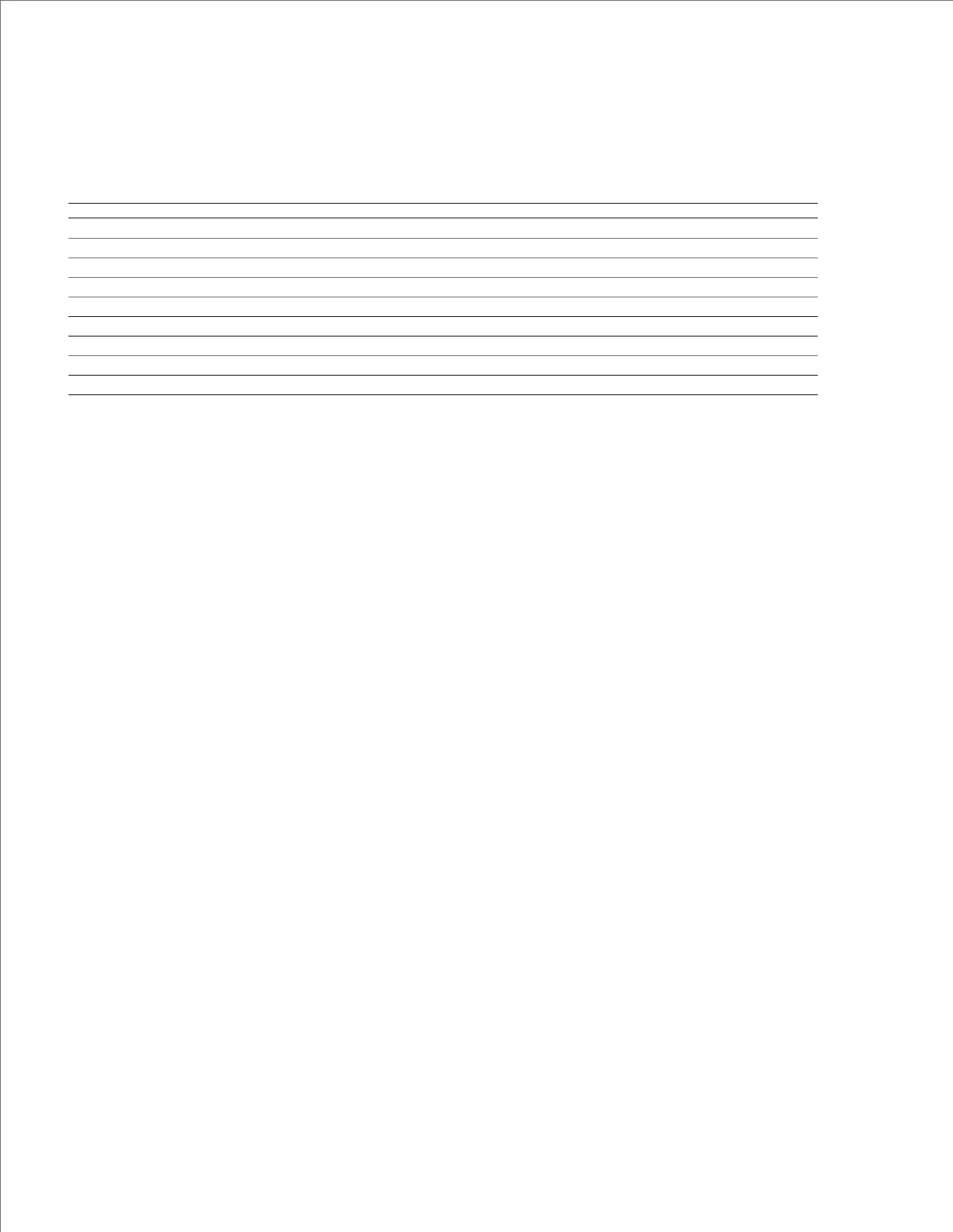

At December 31, 2008: Level 1 Level 2 Level 3 Netting(1) Total

Assets:

Cash and cash equivalents $1,950 $ 8,059 $ — $ — $10,009

Marketable securities — 166 — — 166

Derivative assets(2) 56 1,834 — (875) 1,015

Investments and sundry assets 165 6 — — 171

Total assets $2,171 $10,065 $ — $(875) $11,361

Liabilities:

Derivative liabilities(3) $ — $ 2,116 $ — $(875) $ 1,241

Total liabilities $ — $ 2,116 $ — $(875) $ 1,241

(1) Represents netting of derivative exposures covered by a qualifying master netting agreement.

(2)

The gross balances of derivative assets contained within prepaid expenses and other current assets, and investments and sundry assets in the Consolidated Statement

of Financial Position at December 31, 2008 are $773 million and $1,117 million, respectively.

(3) The gross balances of derivative liabilities contained within other accrued expenses and liabilities, and other liabilities in the Consolidated Statement of Financial Position

at December 31, 2008 are $1,414 million and $702 million, respectively.

Items Measured at Fair Value on

a Nonrecurring Basis

In the fourth quarter of 2008, the company recorded an other-

than-temporary impairment of $81 million for an equity method

investment. The resulting investment which was classified as

Level 3 in the fair value hierarchy was valued using a discounted

cash flow model. The valuation inputs included an estimate of

future cash flows, expectations about possible variations in the

amount and timing of cash flows and a discount rate based on

the risk-adjusted cost of capital. Potential results were assigned

probabilities that resulted in a weighted average or most-likely

discounted cash flow fair value as of December 31, 2008. The

fair value of the investment after impairment was $7 million at

December 31, 2008. During 2009, the balance of this invest-

ment was further reduced by an additional impairment of $5

million and other adjustments primarily related to dividends. The

balance of this investment was zero at December 31, 2009.

Note E.

Financial Instruments

(Excluding Derivatives)

Fair Value of Financial Instruments

Cash and cash equivalents, debt and marketable equity securi-

ties and derivative financial instruments are recognized and

measured at fair value in the company’s financial statements.

Notes and other accounts receivable and other investments are

financial assets with carrying values that approximate fair value.

Accounts payable, other accrued expenses and short-term debt

are financial liabilities with carrying values that approximate fair

value. In the absence of quoted prices in active markets, consid-

erable judgment is required in developing estimates of fair value.

Estimates are not necessarily indicative of the amounts the com-

pany could realize in a current market transaction. The following

methods and assumptions are used to estimate fair values:

Loans and Long-term Receivables

Estimates of fair value are based on discounted future cash

flows using current interest rates offered for similar loans to cli-

ents with similar credit ratings for the same remaining maturities.

Long-term Debt

Fair value of publicly traded long-term debt is based on quoted

market prices for the identical liability when traded as an asset

in an active market. For other long-term debt for which a

quoted market price is not available, an expected present value

technique that uses rates currently available to the company

for debt with similar terms and remaining maturies is used to

estimate fair value. The carrying amount of long-term debt is

$21,932 million and $22,689 million and the estimated fair value

is $23,748 million and $23,351 million at December 31, 2009

and 2008, respectively.

87