IBM 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

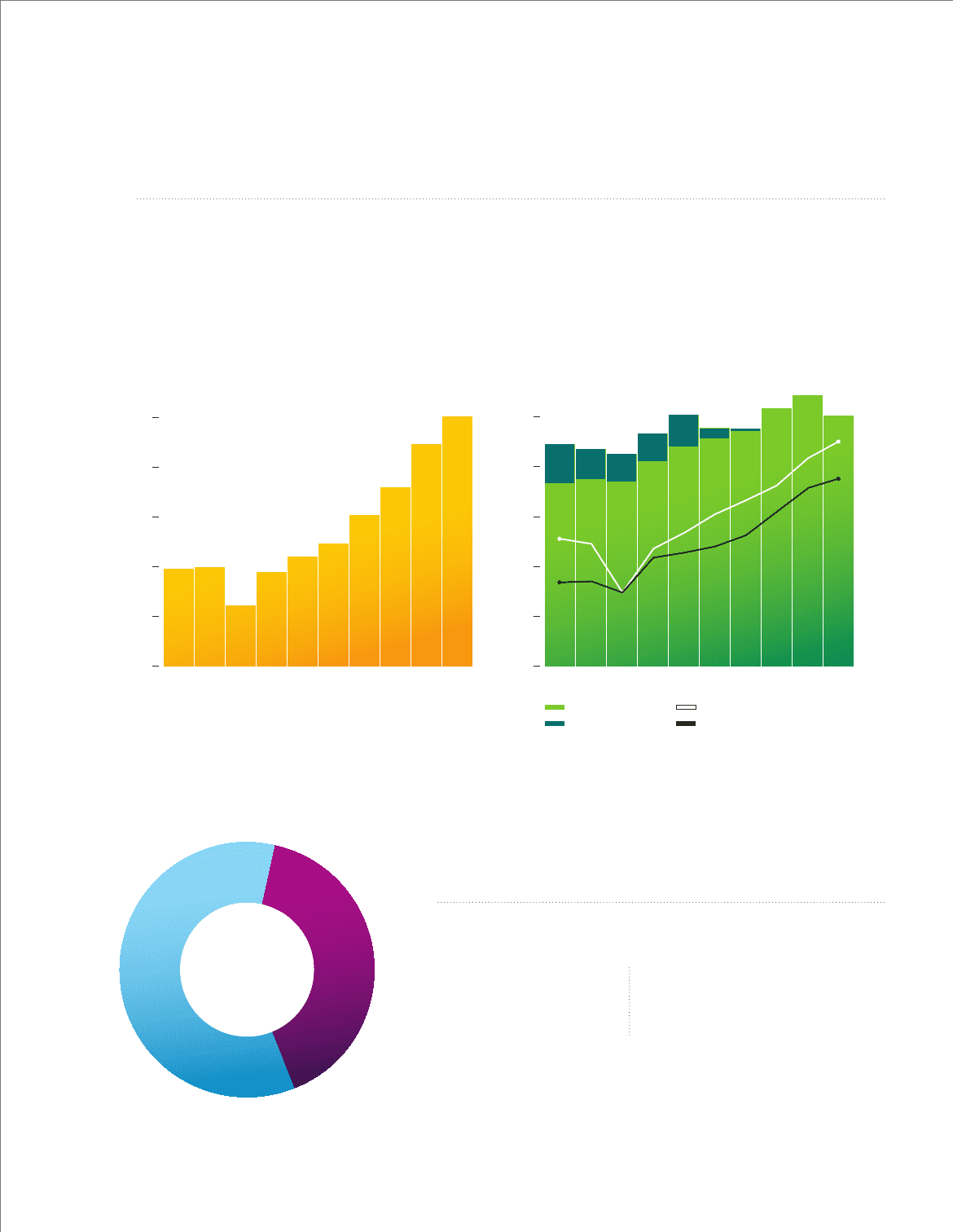

Pre-tax Income

Free Cash Flow

Revenue

Divested Revenue

Note: 2005

–

2008 EPS reects the adoption of amendments

to ASC 260, “Earnings Per Share”

Financial Performance History

($ in billions)

Earnings Per Share

$

161

billion

As a result, IBM today is a

higher-performing enterprise.4

We have achieved record earnings per share …

Diluted earnings per share in 2009 were $10.01, marking

seven consecutive years of double-digit growth. Pre-tax

earnings from continuing operations were $18.1 billion, an

increase of 9 percent.

… and record cash performance.

In 2009 our free cash flow, excluding the year-to-year change

in Global Financing receivables, was $15.1 billion—an increase

of $800 million from 2008.

Our business model is more aligned with our clients’ needs and generates better financial results.

09080706050403020100

85 83 81

89

96

91 91

99

104

96

$18.1

$15.1

0

4

8

12

16

$20

We have therefore been able to invest

in future sources of growth and provide

record return to shareholders . . .

Primary Uses of Cash

From 2000 to 2009

$65 billion

Reinvested

Acquisitions & Capital Expenditures

$96 billion

Returned to Shareholders

Share Repurchases & Dividends

. . . while continuing to invest in R&D—more

than $56 billion from 2000 to 2009.

5

3.88

2.43

09080706050403020100

3.94 3.76

4.39

4.91

6.05

7.15

8.89

10.01

0

2

4

6

8

$10

12