IBM 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

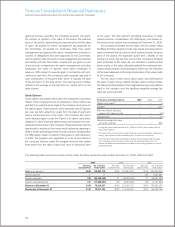

repurchase. The initial purchase price was subject to adjustment

based on the volume weighted-average price of IBM common

stock over a settlement period of three months for each of the

banks. The adjustment also reflected certain other amounts

including the banks’ carrying costs, compensation for ordinary

dividends declared by the company during the settlement period

and interest benefits for receiving the $12.5 billion payment in

advance of the anticipated purchases by each bank of shares in

the open market during the respective settlement periods. The

adjustment amount could be settled in cash, registered shares

or unregistered shares at IIG’s option. Under the ASR agreements,

IIG had a separate settlement with each of the three banks. The

first settlement occurred on September 6, 2007, resulting in a

settlement payment to the bank of $151.8 million. The second

settlement occurred on December 5, 2007, resulting in a settle-

ment payment to the bank of $253.1 million. The third settlement

occurred on March 4, 2008, resulting in a settlement payment to

the company of $54.2 million. The adjusted average price paid per

share during the ASR was $108.13, resulting in a total purchase

price of $12,581 million. The $351 million difference was settled

in cash. The settlement amounts were paid in cash at the election

of IIG in accordance with the provisions of the ASR agreements

and were recorded as adjustments to equity in the Consolidated

Statement of Financial Position on the settlement dates.

The company issued 6,408,265 treasury shares in 2009,

5,882,800 treasury shares in 2008 and 9,282,055 treasury shares

in 2007, as a result of exercises of stock options by employees of

certain recently acquired businesses and by non-U.S. employees.

At December 31, 2009, $6,113 million of Board common stock

repurchase authorization was still available. The company plans

to purchase shares on the open market or in private transactions

from time to time, depending on market conditions. In connection

with the issuance of stock as part of the company’s stock-based

compensation plans, 1,550,846 common shares at a cost of

$161 million, 1,505,107 common shares at a cost of $166 million

and 1,282,131 common shares at a cost of $134 million in 2009,

2008 and 2007, respectively, were remitted by employees to the

company in order to satisfy minimum statutory tax withholding

requirements. These amounts are included in the treasury stock

balance in the Consolidated Statement of Financial Position and

the Consolidated Statement of Changes in Equity.

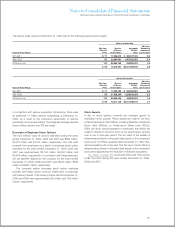

for certain asbestos remediation AROs. These conditional AROs

are primarily related to the encapsulated structural fireproof-

ing that is not subject to abatement unless the buildings are

demolished and non-encapsulated asbestos that the company

would remediate only if it performed major renovations of certain

existing buildings. Because these conditional obligations have

indeterminate settlement dates, the company could not develop a

reasonable estimate of their fair values. The company will continue

to assess its ability to estimate fair values at each future reporting

date. The related liability will be recognized once sufficient addi-

tional information becomes available. The total amounts accrued

for ARO liabilities, including amounts classified as current in the

Consolidated Statement of Financial Position were $126 million

and $127 million at December 31, 2009 and 2008, respectively.

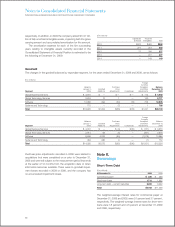

Note N.

Equity Activity

The authorized capital stock of IBM consists of 4,687,500,000

shares of common stock with a $.20 per share par value, of which

1,305,337,423 shares were outstanding at December 31, 2009

and 150,000,000 shares of preferred stock with a $.01 per share

par value, none of which were outstanding at December 31, 2009.

Stock Repurchases

The Board of Directors authorizes the company to repurchase IBM

common stock. The company repurchased 68,650,727 common

shares at a cost of $7,534 million, 89,890,347 common shares at a

cost of $10,563 million and 178,385,436 common shares at a cost

of $18,783 million in 2009, 2008 and 2007, respectively. These

amounts reflect transactions executed through December 31 of

each year. Actual cash disbursements for repurchased shares

may differ due to varying settlement dates for these transactions.

Included in the 2007 repurchases highlighted above, in May

2007, IBM International Group (IIG), a wholly owned foreign

sub sidiary of the company, repurchased 118.8 million shares of

common stock for $12.5 billion under accelerated share repur-

chase (ASR) agreements with three banks.

Pursuant to the ASR agreements, executed on May 25, 2007,

IIG paid an initial purchase price of $105.18 per share for the

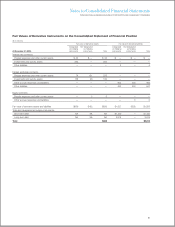

Accumulated Other Comprehensive Income/(Loss) (net of tax)

($ in millions)

Net Unrealized Net Change Net Unrealized Accumulated

Gains/(Losses) Foreign Currency Retirement- Gains/(Losses) Other

on Cash Flow Translation related on Marketable Comprehensive

Hedge Derivatives Adjustments* Benefit Plans Securities Income/(Loss)

December 31, 2007 $(227) $ 3,655 $ (7,168) $ 325 $ (3,414)

Change for period 301 (3,552) (14,856) (324) (18,431)

December 31, 2008 74 103 (22,025) 2 (21,845)

Change for period (556) 1,732 1,727 111 3,015

December 31, 2009 $(481) $ 1,836 $(20,297) $ 113 $(18,830)

* Foreign currency translation adjustments are presented gross except for any associated hedges which are presented net of tax.

98