IBM 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

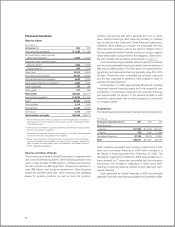

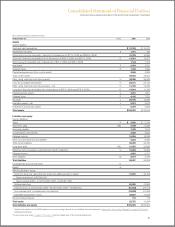

Financial Condition

Balance Sheet

($ in millions)

At December 31: 2009 2008

Cash and cash equivalents $ 1,285 $ 1,269

Net investment in sales-type and

direct financing leases 9,482 10,203

Equipment under operating leases:

External clients(a) 1,863 2,139

Internal clients(b)(c) 994 1,709

Client loans 10,413 10,615

Total client financing assets 22,752 24,667

Commercial financing receivables 5,662 5,875

Intercompany financing receivables(b)(c) 3,660 2,957

Other receivables 370 396

Other assets 877 956

Total assets $34,605 $36,119

Intercompany payables(b) $ 5,879 $ 5,391

Debt(d) 22,383 24,360

Other liabilities 3,174 2,875

Total liabilities 31,435 32,626

Total equity 3,170 3,493

Total liabilities and equity $34,605 $36,119

(a) Includes intercompany mark-up, priced on an arms-length basis, on products

purchased from the company’s product divisions, which is eliminated in IBM’s

consolidated results.

(b) Entire amount eliminated for purposes of IBM’s consolidated results and there-

fore does not appear on page 65.

(c) These assets, along with all other financing assets in this table, are leveraged at

the value in the table using Global Financing debt.

(d) Global Financing debt is comprised of intercompany loans and external debt.

A portion of Global Financing debt is in support of the company’s internal busi-

ness, or related to intercompany mark-up embedded in the Global Financing

assets. See table on page 60.

Sources and Uses of Funds

The primary use of funds in Global Financing is to originate client

and commercial financing assets. Client financing assets for end

users consist primarily of IBM systems, software and services,

but also include non-IBM equipment, software and services to

meet IBM clients’ total solutions requirements. Client financing

assets are primarily sales-type, direct financing and operating

leases for systems products, as well as loans for systems,

software and services with terms generally from two to seven

years. Global Financing’s client loans are primarily for software

and services and are unsecured. These loans are subjected to

additional credit analysis to evaluate the associated risk and,

when deemed necessary, actions are taken to mitigate risks in

the loan agreements which include covenants to protect against

credit deterioration during the life of the obligation. Client financ-

ing also includes internal activity as described on page 24.

Commercial financing receivables arise primarily from inventory

and accounts receivable financing for dealers and remarketers of

IBM and non-IBM products. Payment terms for inventory financ-

ing and accounts receivable financing generally range from 30 to

90 days. These short-term receivables are primarily unsecured

and are also subjected to additional credit analysis in order to

evaluate the associated risk.

At December 31, 2009, approximately 98 percent of Global

Financing’s external financing assets are in the segment’s core

competency of technology equipment and solutions financing,

and approximately 59 percent of the external portfolio is with

investment grade clients with no direct exposure to consumers

or mortgage assets.

Originations

The following are total external and internal financing originations.

($ in millions)

For the year ended December 31: 2009 2008 2007

Client financing:

External $11,760 $14,790 $14,171

Internal 755 1,039 1,040

Commercial financing 27,126 32,078 30,541

Total $39,641 $47,907 $45,752

Cash collections exceeded new financing originations for both

client and commercial financing in 2009 which resulted in a

net decline in financing assets from December 31, 2008. The

decrease in originations in 2009 from 2008 was primarily due to

lower demand for IT equipment associated with the economic

environment. The increase in originations in 2008 versus 2007

was due to improving external volumes in both client and com-

mercial financing.

Cash generated by Global Financing in 2009 was primarily

deployed to pay the intercompany payables and dividends to IBM.

58