IBM 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

The company initially created a wholly owned subsidiary,

InfoPrint Solutions Company, LLC (InfoPrint), by contributing spe-

cific assets and liabilities from its printer business. The Printing

Systems Division generated approximately $1 billion of revenue

in 2006. The InfoPrint portfolio includes solutions for production

printing for enterprises and commercial printers as well as solu-

tions for office workgroup environments and industrial segments.

On June 1, 2007 (closing date), the company divested 51 per-

cent of its interest in InfoPrint to Ricoh. The company will divest

its remaining 49 percent ownership to Ricoh quarterly over the

next three years from the closing date. At December 31, 2009,

the company’s ownership in InfoPrint was 8.0 percent.

The total consideration the company agreed to on January

24, 2007 (the date the definitive agreement was signed) was

$725 million which was paid in cash to the company on the clos-

ing date. The cash received was consideration for the initial 51

percent acquisition of InfoPrint by Ricoh as well as a prepayment

for the remaining 49 percent to be acquired and certain royalties

and services to be provided by the company to InfoPrint. Final

consideration for this transaction will be determined at the end

of the three-year period based upon the participation in the

profits and losses recorded by the equity partners. The com-

pany concluded that InfoPrint met the requirements of a variable

interest entity, the company is not the primary beneficiary of the

entity and that deconsolidation of the applicable net assets was

appropriate. The company’s investment in InfoPrint is accounted

for under the equity method of accounting.

The company will provide maintenance services for one year,

certain hardware products for three years and other information

technology and business process services to InfoPrint for up to

five years. The company assessed the fair value of these arrange-

ments, and, as a result, deferred $274 million of the proceeds.

This amount will be recorded as revenue, primarily in the com-

pany’s services segments, as services are provided to InfoPrint.

The royalty agreements are related to the use of certain of

the company’s trademarks for up to 10 years. The company

assessed the fair value of these royalty agreements, and, as a

result, deferred $116 million of the proceeds. This amount will

be recognized as intellectual property and custom development

income as it is earned in subsequent periods.

Net assets contributed, transaction-related expenses and

provi sions were $90 million, resulting in an expected total pre-tax

gain of $245 million, of which $81 million was recorded in other

(income) and expense in the Consolidated Statement of Earnings

in the second quarter of 2007.

The deferred pre-tax gain of $164 million at the closing date

was primarily related to: (1) the transfer of the company’s remain-

ing 49 percent interest in InfoPrint to Ricoh, and, (2) the transfer of

certain maintenance services employees to InfoPrint. The com-

pany will recognize this amount over a three-year period as the

remaining ownership interest is divested and the employees are

transferred. The pre-tax gain will be recorded in other (income)

and expense in the Consolidated Statement of Earnings.

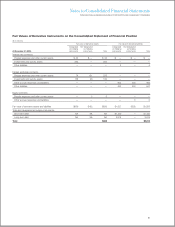

Note D.

Fair Value

Financial Assets and Financial Liabilities Measured at Fair Value on a Recurring Basis

The following table presents the company’s financial assets and financial liabilities that are measured at fair value on a recurring basis

at December 31, 2009 and 2008.

($ in millions)

At December 31, 2009: Level 1 Level 2 Level 3 Netting(1) Total

Assets:

Cash and cash equivalents $2,780 $6,497 $ — $ — $ 9,277

Marketable securities — 1,791 — — 1,791

Derivative assets(2) — 838 — (573) 265

Investments and sundry assets 369 14 — — 383

Total assets $3,149 $9,140 $ — $(573) $11,716

Liabilities:

Derivative liabilities(3) $ — $1,555 $ — $(573) $ 982

Total liabilities $ — $1,555 $ — $(573) $ 982

(1) Represents netting of derivative exposures covered by a qualifying master netting agreement.

(2)

The gross balances of derivative assets contained within prepaid expenses and other current assets, and investments and sundry assets in the Consolidated Statement

of Financial Position at December 31, 2009 are $273 million and $565 million, respectively.

(3) The gross balances of derivative liabilities contained within other accrued expenses and liabilities, and other liabilities in the Consolidated Statement of Financial Position

at December 31, 2009 are $906 million and $649 million, respectively.

86